by Eugene Robin | Research Analyst

The magnitude of the recent price decline caught many of “us” off guard and caused many (including Cove Street) to re-think our notion of what constitutes a sustainable oil price. Here, we analyze the somewhat complex question of “is $40 oil sustainable?”

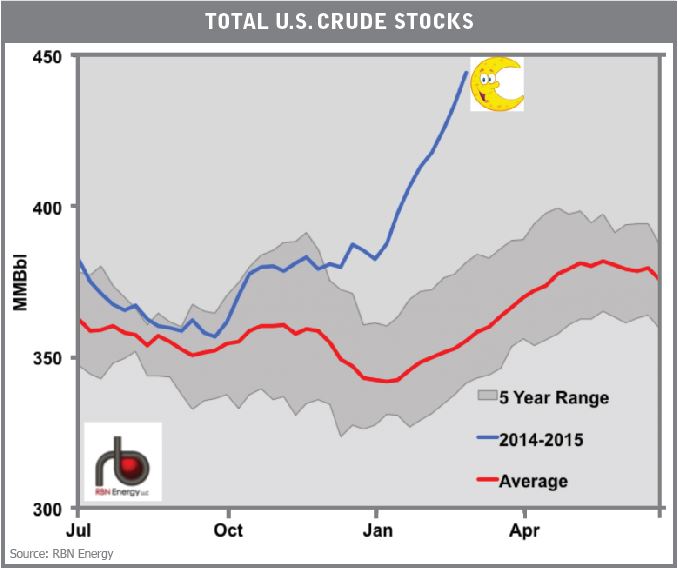

Currently, with storage in the U.S. looking like it’s about to hit escape velocity (see below), short term price pressures will continue as long as the supply overhang exists. While refiners will feast on the lower cost oil, nothing will change this dynamic until either one (or both) of two things happen: supply is decreased through less drilling, meaning we see actual production declines, or demand increases to absorb excess supply.

In the medium term (1-2 years), oil can stay in the current $40-50 range due to both supply not correcting and to demand stalling around the world. An interesting fact to mention is that while rig counts and capital budgets have been slashed by 50% and 20-60%, respectively, the overall year over year change in oil production for the U.S. and the world is still forecasted to be positive. This is due to the fact that not all rigs are created equally, with many of the dropped rigs performing what is known in the oil patch as delineation drilling (where exploration companies drill wells to hold acreage or to discover how far a certain oil formation extends). The remaining rigs are drilling more efficiently, producing more wells per rig, and thus companies can produce more oil with less invested capital. Many small operators, who are the marginal producers in the U.S. business, have slashed budgets but will still grow oil output. Our very own bloody warrior Approach Resources is cutting its capital outlay from $400 million to $160 million, yet production is expected to increase 10-14% this coming year. Approach is not alone. Only the majors are going to experience anything close to flat or declining production with many other smaller independents growing in the face of these very low oil prices. Given this, we find it difficult to argue against those that believe that a v-shaped recovery of oil prices is impractical.

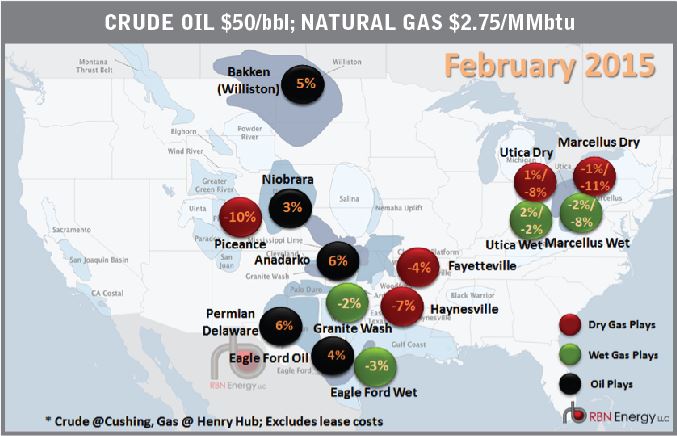

However, if you look out longer term, thinking in five year increments, it is inconceivable that $40 oil stays around for much longer than a few years, barring a massive global depression. Several reasons exist to still be optimistic about higher oil prices over a longer time horizon. First, because oil is nothing more than a commodity, its price should approximate the marginal cost of extraction for the marginal barrel. With the U.S. shale plays acting as the swing producer over the past year, we look to the fundamental economics of shale drilling to understand the marginal cost issue. If you were to look by basin (thanks to our friends at RBN Energy), you would see that current energy prices are having a hugely negative impact on returns on capital:

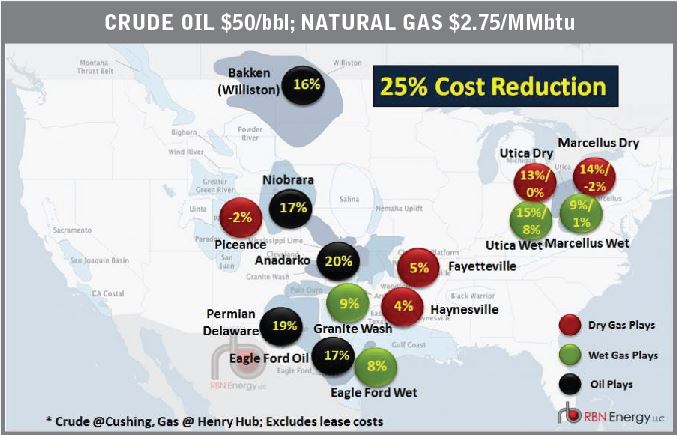

No one is profitable anywhere besides a few places in Texas or Oklahoma that can eke out returns far lower than the cost of capital of the operators. Of course one of the issues in this analysis is that just as the oil and gas prices are dynamic, so are the input costs. Again, our friends at RBN provide us with a rough approximation of what happens with a 25% reduction in well costs (producers have the range of reductions as 15-30% for 2015):

All of a sudden, it appears that 4 of the major oil basins in the country (Permian, Bakken, Eagle Ford, and Anadarko) are now exceptionally profitable and can generate high IRRs. However, we caution that these are averages that exclude company specific metrics such as operating cost structure or debt burden. In reality, there will be many marginal producers who are over-leveraged or who do not have the proper operating infrastructure in place to attain this average return. Another issue with this analysis is that it uses pre-tax calculations and thus avoids IRR calculations on an after-tax basis. The good news for oil prices is that, even with these potential returns, the overall growth of production will flatten out and might even decline in 2017 due to curtailment on the part of marginal producers in the best basins as well as curtailment by “liquids rich” or “combo” plays that have oil percentages less than 40%.

What all of this implies is that oil drilling will continue in the U.S. until the funding runs dry and returns dip below 10% on a pre-tax basis. This augers for $40 oil as a long-term floor (since adjusting the above map for $40 would show no one above a 10% IRR), even taking into account the large service cost reductions already in the works. So if $40 is unsustainable, then where are prices “normalized?” That is the billion dollar question and while we have no way of knowing the right answer we can only surmise that the previous concept of $80 oil as the “normal marginal cost” of production has, thanks to cost reductions and efficiencies, given way to $60 oil as the new “normal marginal cost” going forward. We caution anyone that believes in “New Normals” or some version thereof, since normality is just a function of time and with small service providers in the oil field space is likely to disappear over the next year. We would like to point to the inevitable price inflation in the oil field service space after the reckoning is over.

In the short term, over-capacity will drive prices lower than the current WTI price until the stored oil overhang disappears. In the medium term, a combination of over-leveraged small independents running into financial problems, larger independents choosing to grow moderately or to drill within their cash flows, and majors curtailing some of their bigger ambitions all point to an eventual flattening of US production growth. In the long-term, barring a disintermediation of oil by some new energy source within the next three years, we see no reason to believe that these prices are sustainable with longer-term marginal economics winning out eventually and pushing oil back towards $80.

We continue to hold a small handful of producers that don’t have a survivability issue, and we are leaning into what we affectionately call “widget” companies that happen to have some energy exposure.

“To buy when others are despondently selling and sell when others are greedily buying requires the greatest fortitude and pays the greatest reward.” — Sir John Templeton

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.