by Dean Pagonis | Research Analyst

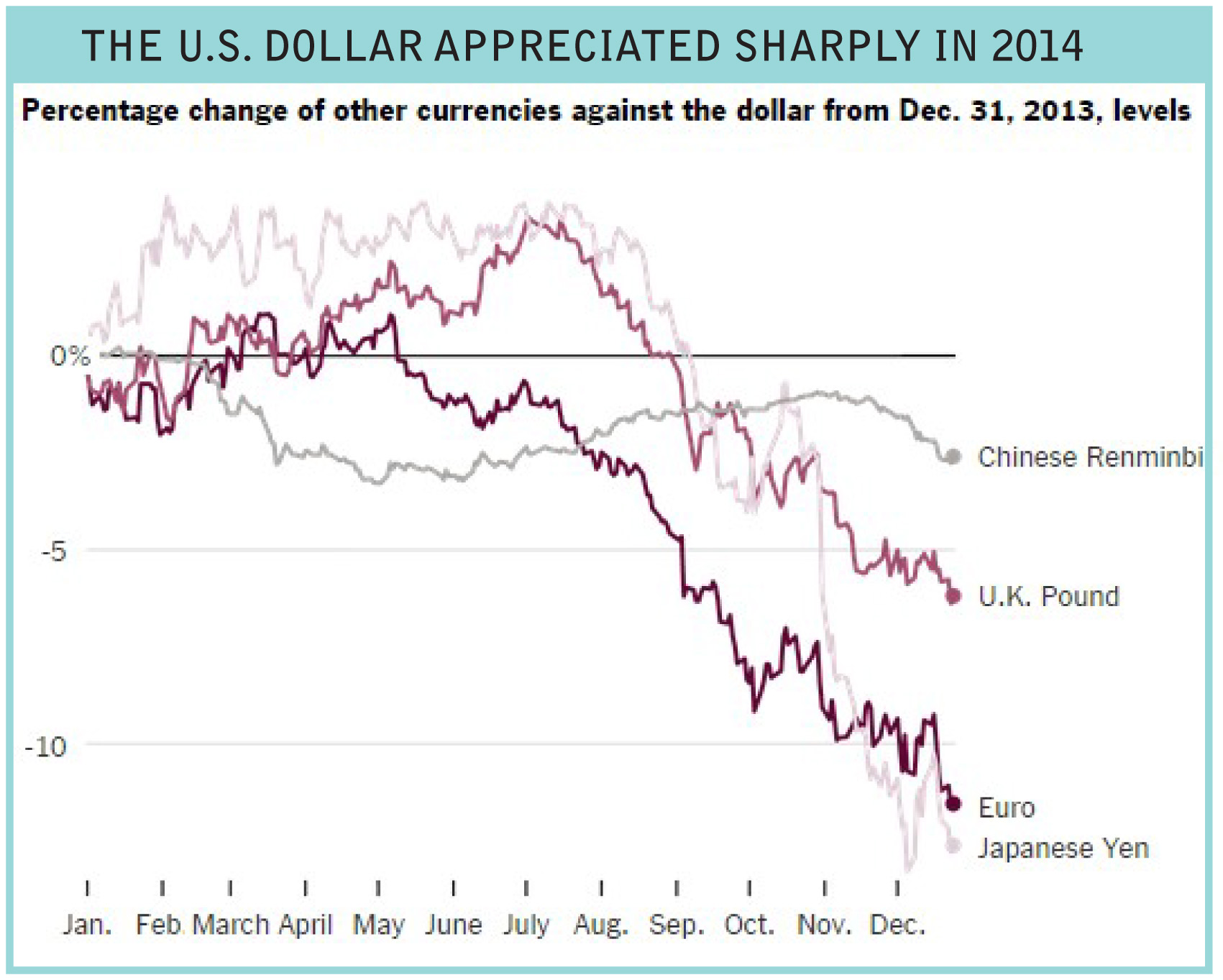

We think you might have noticed the dollar has been appreciating versus most currencies. (Have you heard the one about the Canadian Peso?)

Source: New York Times, 2015

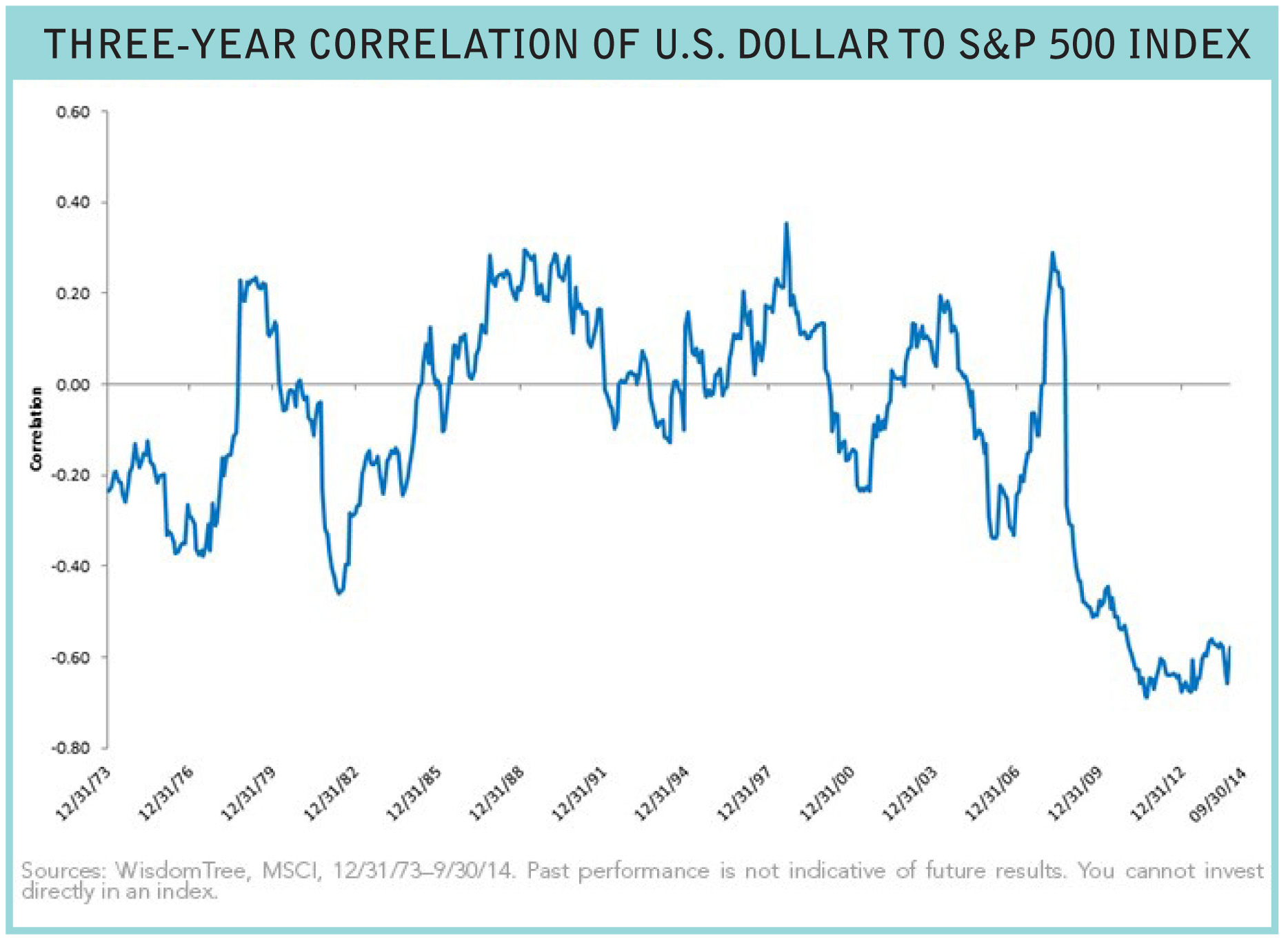

So yes, there is a negative translation effect for large, multi-national companies and yes, a product gets more expensive vis-à-vis foreign competitors, and yes, there will be problems for some foreign companies whose dollar denominated debt is getting larger by the moment. The overall effect is equity investors don’t like a strong dollar, but the correlation is mixed depending upon the environment.

Source: Wisdom Tree, 2014

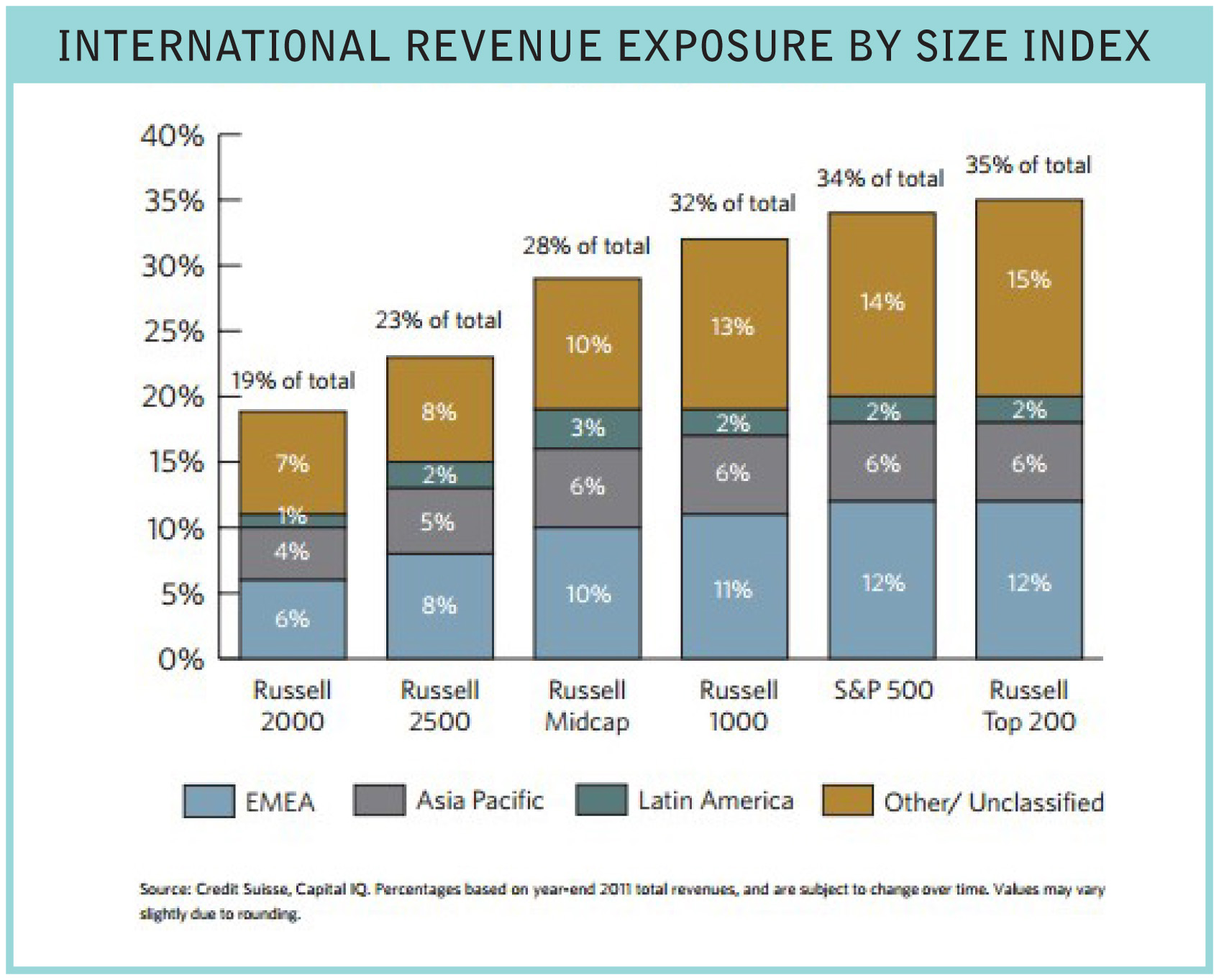

But not all is lost…particularly for small cap managers. While 34% of S&P 500 companies’ revenues are from foreign sales, it’s only 19% for the Russell 2000®. Small cap firms are therefore less exposed than their large cap peers to decreases in earnings from a strengthening dollar. After a relatively tough 2014, we will take it.

Source: Bank of New York Mellon, 2012

But the largest risk we see on the horizon for multinationals is not a strong dollar, but rather the fact that the majority of the world’s international markets are in recession or trending towards it. Although we are mindful of the effects currency produces, there is not a single company in which currency exposure ranks as the first or even second crucial variable in the determination of a company’s value.