by Ben Claremon | Principal and Research Analyst

In recent letters we have pretty thoroughly discussed the ongoing industrywide move toward passive investment management strategies—and away from active management. But when we saw this thoughtful piece from Charles Brandes (a fellow Southern Californian), we could not resist the chance to reiterate our thoughts. We don’t know if there is a bubble in passive investing. And we can’t know for sure about the long-term impacts of the move to passive, especially as it relates to abrupt stock market declines. What is certain is that when we see investor behaviors like the ones described by Brandes, we make sure to inject an extra amount of conservatism into our investment process.

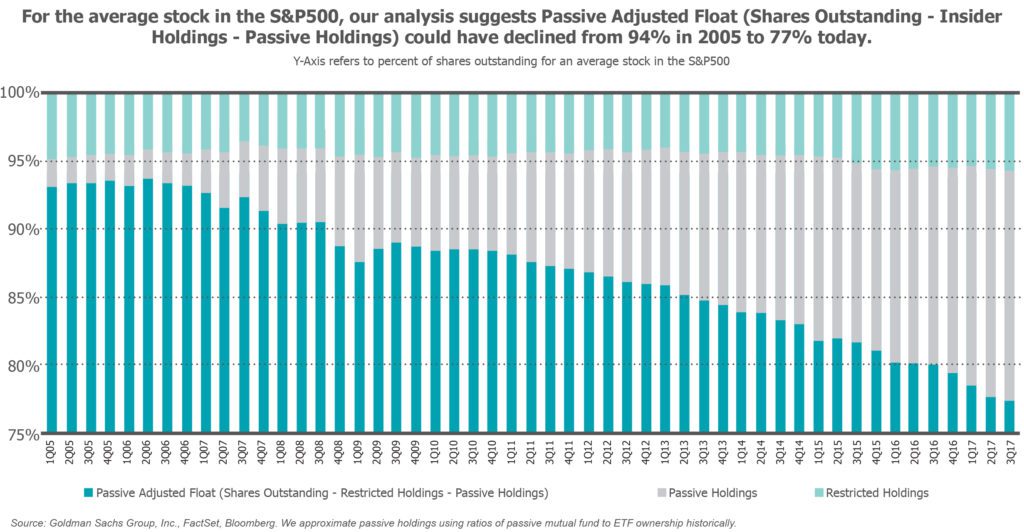

On a similar note, the Wall Street Journal recently had an interesting piece about how the growth in passive strategies has effectively limited the available float of the stocks in the S&P 500 (see chart below).

Suffice to say that investment managers are navigating some unique and uncharted waters.