By Jeffrey Bronchick, CFA | Principal, Portfolio Manager

Colfax Corporation (Ticker: CFX) is a diversified industrial company whose present day life is cursed by the “next Danaher” label due to the presence of one Mitchell P. Rales, co-founder of both Danaher and Colfax.

We have studied Colfax for years, and while we get its “Danaher Business System” (DBS) model, we have simply never been in love with the business mix, which is decidedly un-Danaher in terms of end markets, margins, and returns. Nonetheless, the price in the fourth quarter of 2015 created a margin of safety and we were owners…and nearly doubled our money in an impressively short (for us) period of time. At $40, one must either truly be a believer in the “System” or anticipate a massive cyclical rebound in some areas that seem hard to see happening. We are no longer owners.

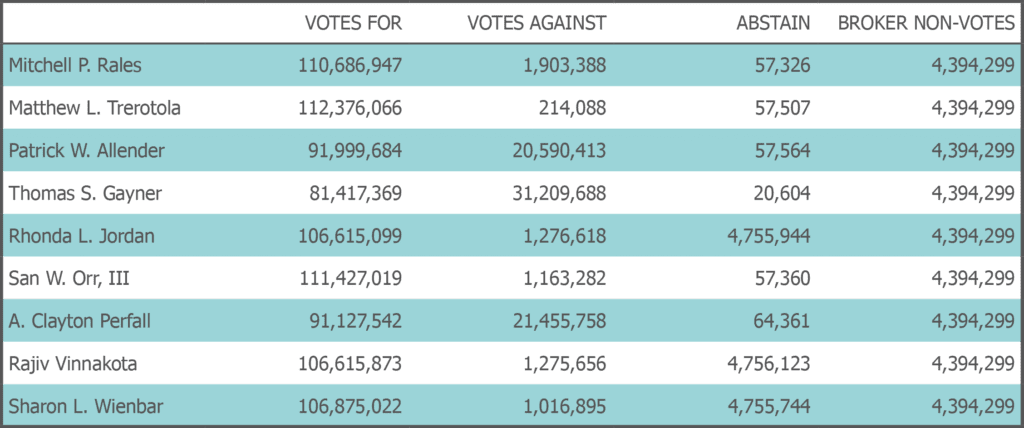

But we “hand-check” the company quarterly, which is where we came up with the following jewel. Thirty plus years ago, Thomas S. Gayner was a stockbroker who used to pitch the then-tiny Markel Insurance on bond ideas. He eventually went in-house to Markel to run their investments. Markel Corporation (Ticker: MKL) is now a $13 billion dollar global company, partly built on the back of owners with integrity and a terrific investment record by the aforementioned Gayner. He is now Co-CEO. I met him and his wife 30-ish years ago at an insurance conference and you simply cannot find a more decent and highly qualified business and investment person with which to associate. So how in heck did he receive a 27% NO vote on his re-election to the Colfax Board?

Answer: The disaster entitled “Outsourced Corporate Governance” in the form of Institutional Shareholder Services (ISS) and Glass, Lewis & Co. Those who are raking in money in passively managed funds do not differentiate between companies’ values and people, and thus outsource their votes to outside firms. These firms—who have at various times recommended AGAINST re-electing Warren Buffett to the Boards of several of his holdings—are concerned that Mr. Gayner is “overboarded” and thus a NO vote is a simple box check for those who aren’t paying attention. Gayner sits on Markel, the two split companies that were Washington Post, Colfax, and the Davis Funds. Okay, give up the Davis Funds. But who would turn down a chance to work the Raleses? Graham and the Buffett crew?

I am more worried about this election trend than Russian issues.

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.