by Eugene Robin | Research Analyst

Let us start by saying that this is not an essay on whether or not a large pool of institutional asset allocators should consider an indexing strategy or not. What follows is an analysis of the question: If you are going to charge active management fees with the goal of outperforming relevant benchmarks over the longer run within reasonable risk parameters, what sort of preconditions are suggestive of a higher probability of success?

In search of the answer to that question, Martijn Cremers and Antti Petajisto—two researchers at the Yale School of Management—meticulously studied the relative performance of several different investment styles and found that the greatest opportunity for outperformance relative to an index is provided by managers who take differentiated positions (active management) from their respective indices. (Cremers and Petajisto, 2009) To divide managers among the different style groups, the authors used a measure called Active Share. Active Share is estimated by comparing the weight of stock X in the manager’s portfolio to stock X’s weight in the corresponding index, measured for each stock in the given index. These differences are then summed across all the constituents of the index and divided by 2 (see footnotes for calculation detail). High Active Share managers are those that have position weights for their holdings that are most unlike their corresponding index’s constituents’ weights. Additionally, high Active Share also gives an indication as to the concentration level of a given manager’s portfolio.

Indexers have low Active Share, while at the other extreme, a manager with a one-stock portfolio would have an Active Share of close to 100. To further refine their study, the authors included Tracking Error as another way to measure the degree of active management, with the observation that it was possible to have high Tracking Error without having high Active Share if your investment style was more macro-oriented and driven by “factor bets.” The authors found that from 1990 – 2009, “funds with the highest Active Share exhibit some skill and pick portfolios which outperform their benchmarks by 2-2.71 percent per year. After fees and transaction costs, this outperformance decreases to 1.49-1.59 percent per year. In contrast, funds with the lowest Active Share have poor benchmark-adjusted returns and alphas before expenses (between 0.06% and -0.66%) and do even worse after expenses, underperforming by -1.41% to -1.76% per year.” (Cremers and Petajisto, 2009)

From these results, what seems fairly obvious to us is that widely diversified portfolios that hug their respective indices are either the outcome of excessive amounts of money under management or a firm’s business decision to stay close to an index and take advantage of a whole host of behavioral finance flaws that enable fee paying mediocrity. Our point is that if “maximizing R² to an index” is the most important driver of a decision to park capital, then the client should index and save the fees. Instead, if a client decides that there are uniquely attractive asset classes and money managers who can add value, then the logical conclusion is that one should be aligned with preconditions that help tilt the probability of success higher.

Naturally, we think that moderately concentrated portfolios skewed toward smaller and value-oriented stocks with a high degree of position divergence from the respective index will have the greatest chance at success.

WHERE IS COVE STREET?

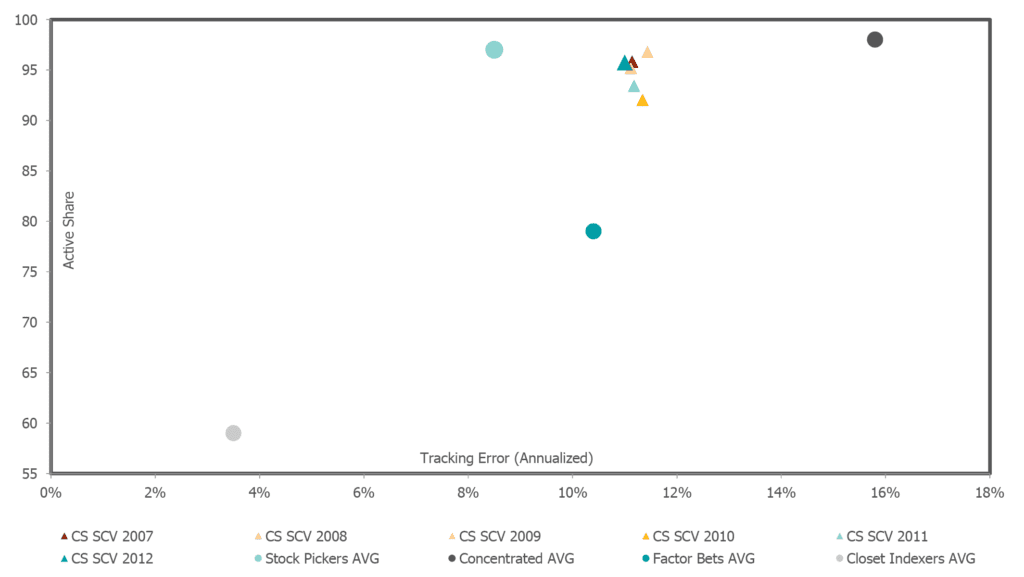

Given the strong correlation between high Active Share and subsequent outperformance, we decided it would be worthwhile to map out where Cove Street fits within the Active Share matrix. The results are presented in the graph below, shown as a time progression from 2007-2012:

Clearly, Cove Street’s Small Cap strategy has consistently exhibited a strong Active Share ranging from 92-96 and averaging 95 over the past five years (high Active Share was defined as greater than 60 by the authors). Additionally, our systematic risk exposure, as measured by tracking error, puts us nearly right between the diversified and the concentrated stock pickers, as one should expect given our penchant for carrying roughly 30 or more stocks at any given time. A follow-up study by Petajisto (2010) showed that extreme concentration detracts from returns by driving up Tracking Error, thus indicating that we could in fact be in a relative “sweet spot” in terms of our Active Share/systematic risk trade off as our results most closely track the Stock Picker category as defined by Petajisto.

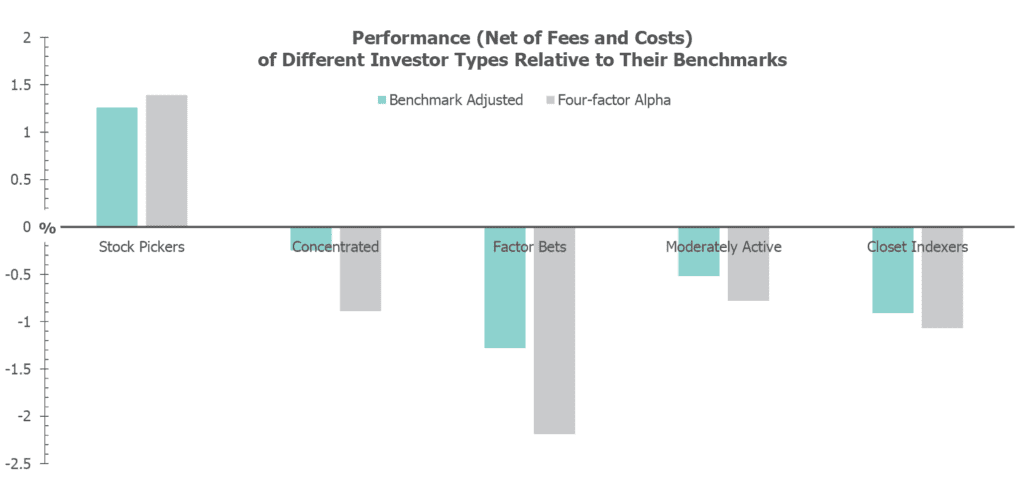

The importance of our results can be seen in the following chart, representing the conclusions Petajisto drew in his 2010 paper:

Overall, the Stock Picker category outperformed the relevant benchmark by 1.26% (1.39% when adjusting for Carhart’s four-factor model), net of fees.

WHY DOES THIS MATTER?

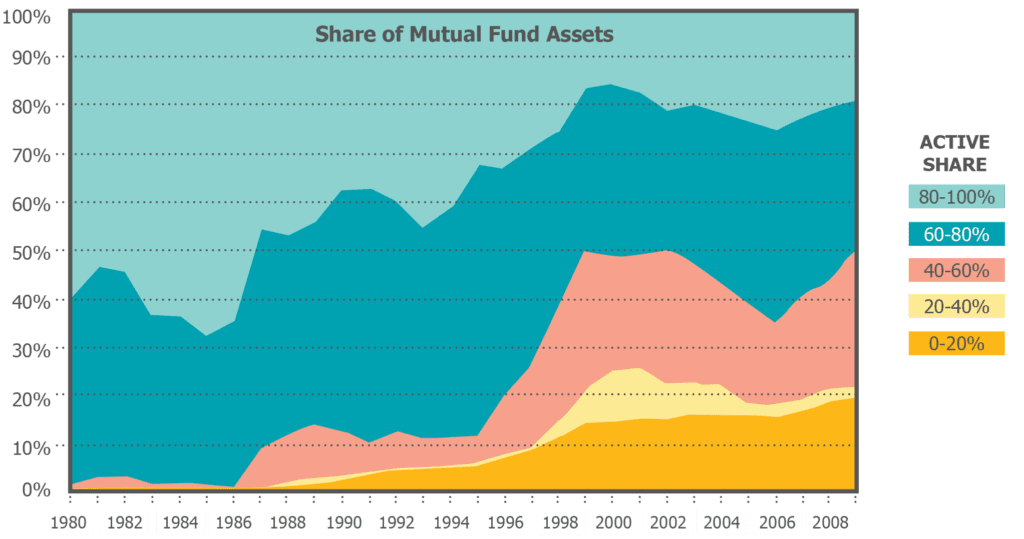

The idea that indexing can provide returns that beat most active managers is not in any way misplaced. In fact, that fact has been shown to be true by numerous papers that compare general active management and indexing. Yet, what these papers fail to point out is that not all active managers are created equal. Differences in the general strategy of active managers matter a great deal and account for the wide dispersion of returns seen by active managers. Unfortunately, as the below graph shows, the art of stock picking has become much less prevalent while (closet) indexing has become in vogue due to the marketing campaign by the ETF providers and their supporters in the efficient market academia:

The 2008 crash has driven many asset allocators to seek out ETFs and indexers while converting many formerly active managers to indexing as a way to stay competitive in the asset sourcing market. Yet, we remain steady in our focus and our belief that superior performance can be attained only by intelligent stock selection.

REFERENCES:

Cremers, Martijn and Petajisto, Antti. (March 31, 2009). “How Active is Your Fund Manager? A New Measure That Predicts Performance.” AFA 2007 Chicago Meetings Paper; EFA 2007 Ljubljana Meetings Paper; Yale ICF Working Paper No. 06-14.

Petajisto, Antti (December 15, 2010). “Active Share and Mutual Fund Performance.” CFA Institute Financial Analysts Journal.

EQUATIONS:

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.