by Dean Pagonis | Research Analyst

Intelligent investors can always come up with a slew of reasons for why the market is under/overvalued. We are always at the precipice of disaster or at the beginning of a never-ending bull market of higher highs. Although in every era the economy and stock market have their own unique challenges, the origins of the present situation are truly different. The astronomical increase in central bank balance sheets and corresponding near-zero or negative interest rates, in conjunction with the rise of passive investing, has created a series of distortions that are unprecedented. What seems not to be terribly different is the likely outcome—the “value replenishment” scenario. The following is a non-exhaustive list of the distortions we are presently observing.

- Insider selling. High levels of insider selling relative to buying. Despite the constant insistence on stock buybacks at any price, public company executives and board members are themselves significantly less bullish when their own wallet is at risk. Please reference our prior article.

- FANG. Stock market gains in the last few years have been disproportionately driven by a few highly successful technology companies commonly known as FANG (Facebook, Amazon, Netflix, Google). Every bull market has the functional equivalent, be it railroads in the 19th century or the Nifty Fifty of the 70s.

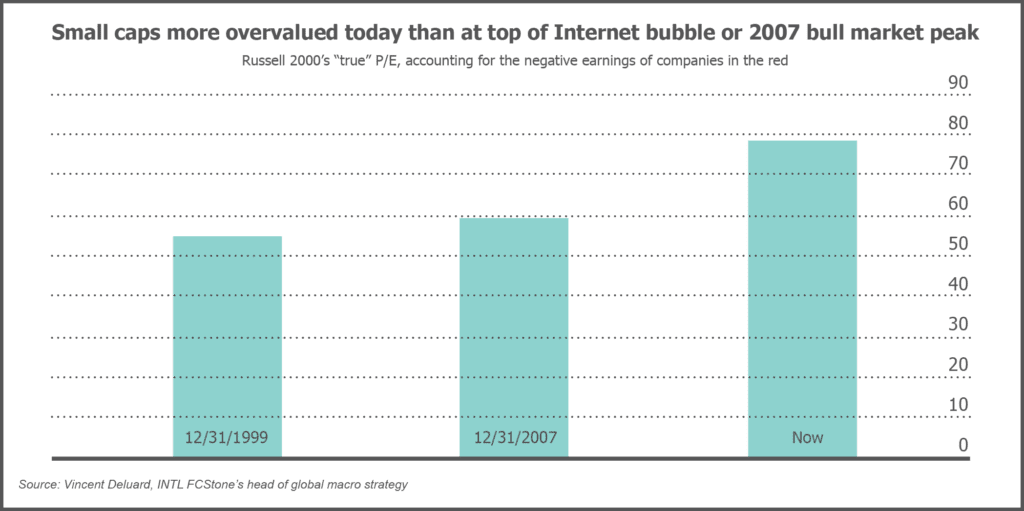

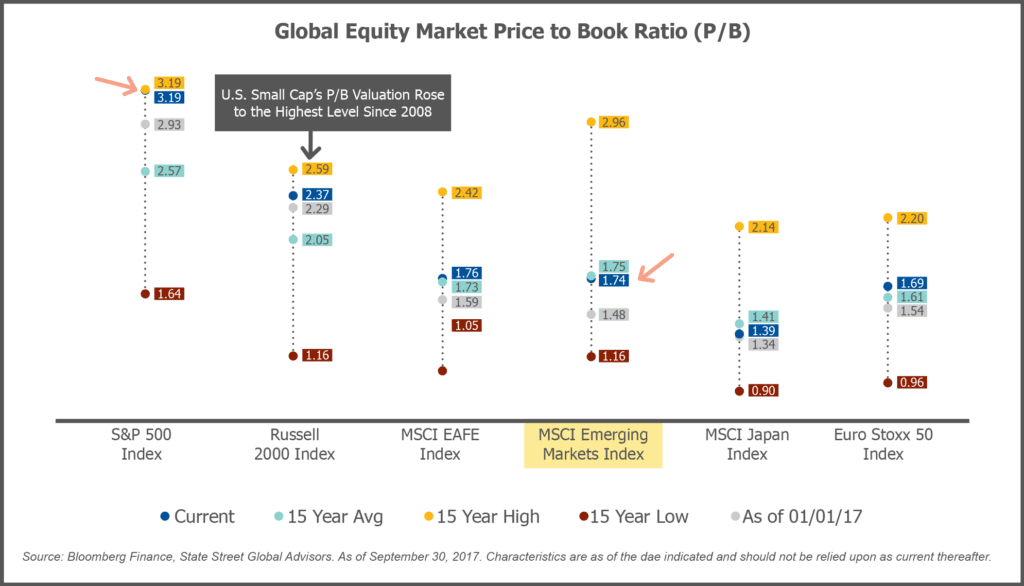

- Valuation. Companies with little or no earnings are trading at ever-higher valuations. Although we are nowhere near the craziness experienced in the late nineties and early 2000s, the Russell 2000® (one of the two indexes to which we are most commonly compared) currently trades at approximately 27X earnings, a 15 year high. Furthermore, as of the start of 2017 approximately 25% of the Russell 2000® companies have negative earnings. When these unprofitable companies are included within the index, the actual average earnings multiple is almost 80x.

- Funding nonprofit for profits. The market currently has a willingness to fund what we have termed “nonprofit for profit” public companies. The three most egregious examples being Netflix, Tesla, and Uber. All three companies operate close to or below zero operating margins. Equity investors that back these firms predicate their investment on the basis of growing revenues and profits that will be realized in the always not too distant future that never comes. Although low interest rates certainly play a major part in investor’s willingness to fund these companies, there are countless other historical analogs with the dotcom bubble being the most recent.

- VCs run amuck. There are a host of venture-backed startups that are “disrupting” industries from mattresses to food delivery. In some cases the VCs are simply enamored with the founder’s story and forego even the most basic due diligence—Theranos and the Honest Companies being two of most publicized examples. In many cases, the underlying economics of the business models simply do not work. For a great example, read this article on MoviePass, a company that will pay for you to watch unlimited movies at the Cinema for $10/month. The average cost of a movie in the U.S. is approximately $9 (good luck finding that price in Los Angeles). I will leave it to the reader to find the fatal flaw in the model.

- Alternatives bubbles. Tulips, the South Sea bubble, and now crypto currencies. Each era has its own version of “alternative” that is the subject of speculative mania. The common underlying themes for these alternative investments is an underlying investment premise which may be sound at some difficult to ascertain valuation, but which is blown out of proportion by the speculative masses.

- Record high corporate profits. Corporate profits as a % of GDP are at record levels.

- China. The Chinese government both restricts and directs the flow of a massive pool of capital. Chinese overcapacity in a large number of basic industries and the government’s prerogative to maintain rapid rates of GDP growth have resulted in unsustainably high levels of fixed asset investment. Capital controls that force domestic Chinese investors to invest at extremely low rates of return have caused Chinese firms to engage in foreign takeovers at seemingly irrational valuations. Different variants, the most recent of which is Japan in the 80s, have existed at different points in the last century, but none at China’s scale.

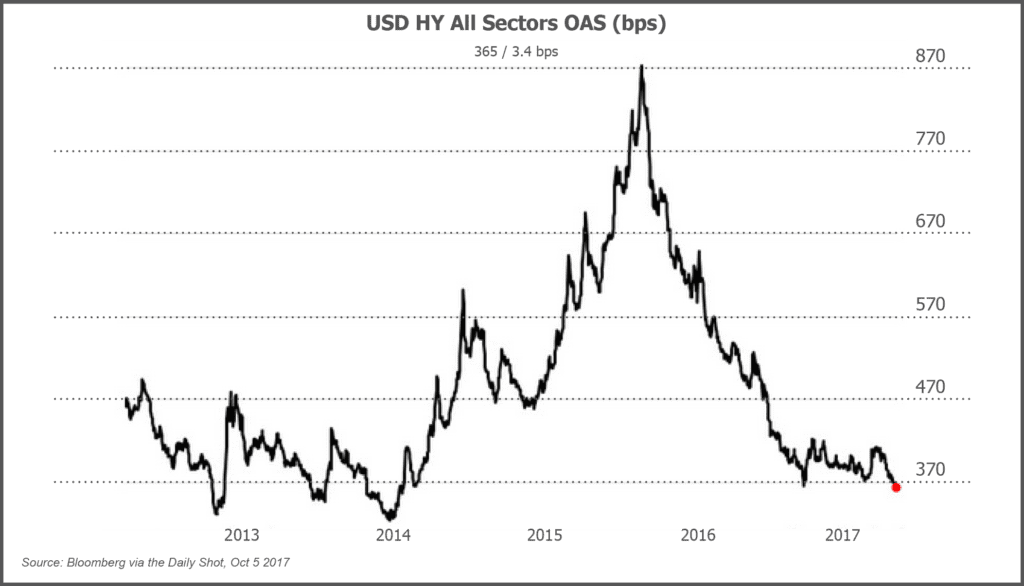

- Corporate leverage and spread collapses. American firms are taking on increasing amounts of debt primarily to fund stock buybacks. Acquisitions are being funded at higher rates of leverage and with weaker covenants. As a result, spreads on high yield or “junk bonds” have collapsed.

- Emerging market debt issuances at absurd rates. Recent oversubscribed debt issuances by Argentina, Ukraine, and Tajikistan demonstrate the mad scramble for yield irrespective of risk that is occurring throughout the globe. Argentina has defaulted 8 times in the past century (most recently in 2001), Ukraine is in the middle of a civil war, and Tajikistan’s 10-yr debt is priced at a whopping 0.125% above its current rate of inflation.

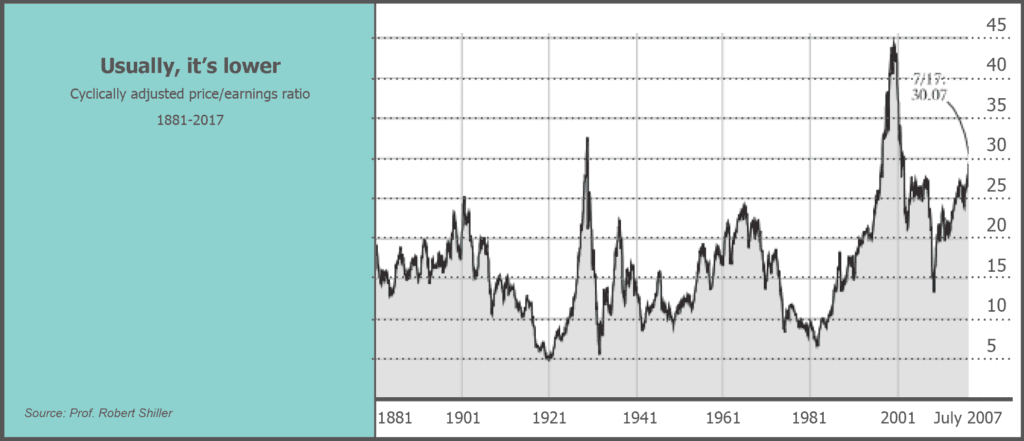

- 2nd or 3rd highest valuations ever.Measured on virtually any standard financial valuation metric (Enterprise value to EBITDA, Price to earnings, Price to book etc.) markets are at their second or third highest valuations ever. The two higher periods are ominously 1929 and 2001.

- Negative rates. In man’s 3,000 plus year monetary history we have never had negative interest rates…until now. At present several major EU countries and Japan have negative interest rates. Our economic systems, financial models, and central banks were not designed to handle negative interest rates. The presence of negative rates is creating a slew of distortions from zombie companies that survive on unbelievably cheap debt to mortgages in Denmark where the mortgagors are literally being paid to borrow money.

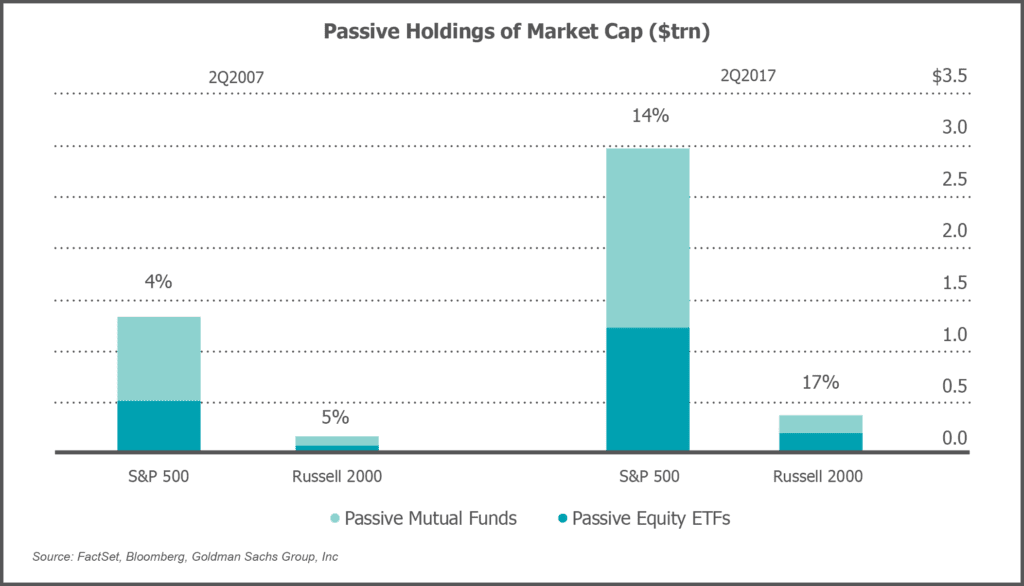

- Rise of passive funds. Although passive funds have existed for decades, their importance in the stock market has increased dramatically in the last few years. Since 2007, passive funds have increased their average holdings as a percentage of S&P 500 market cap from 4% to 14% and in the Russell 2000® from 5% to 17%. Passive funds buy on a formulaic basis irrespective of qualitative and in many cases quantitative attributes. They are the definition of “dumb money”. When inflows are positive as they have been since the great recession and the stock market is rising, passive funds act almost like a self-reinforcing loop. The passive funds buy an index, which in turn increases the price of the constituent index companies, irrespective of valuation, thereby supporting ever higher prices/valuations. As is evident in their increasing share of market capitalization, the marginal buyer of a stock in many cases are the passive funds. According to JP Morgan, 10% or less of equity trading today is from active investors. (Grant’s Interest Rate Observer. July 20017. Seven Singularities.) The major question that then follows is what happens when the passive funds have significant outflows at a time when prices are falling. The other alternative source of liquidity, active investors, are not value blind and are less willing to provide liquidity at any price than the passive funds themselves.

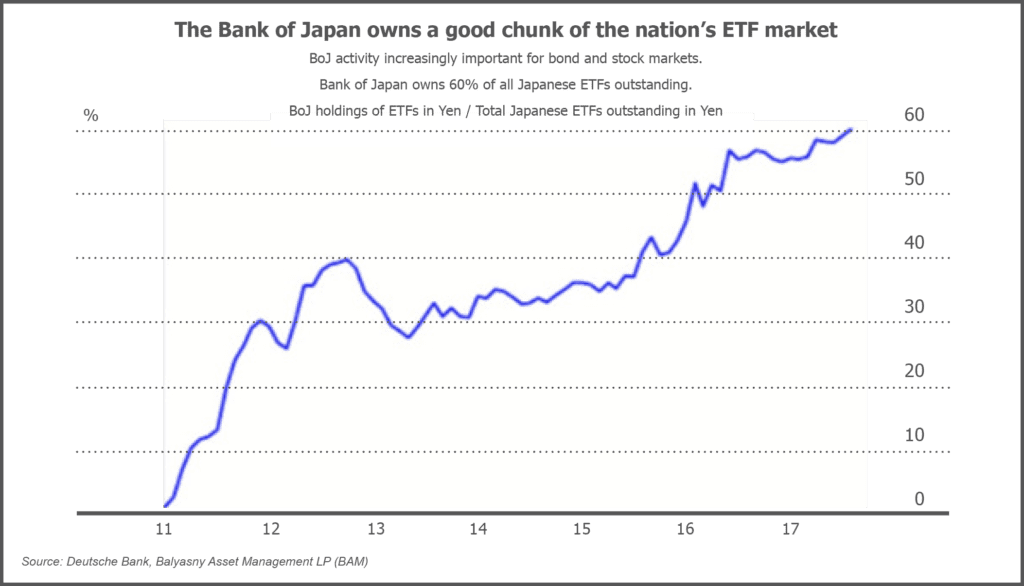

- Central bank balance sheets. The European Central Bank, Japanese Central Bank, and the Federal Reserve currently hold $14 Trillion on their balance sheets. Like negative interest rates, there has never been a historical situation where the world’s three largest central banks hold such massive balance sheets. The presence of central banks as non-fundamental buyers has distorted markets from mortgage backed securities to U.S. equities. In some cases price discovery exists only as a shadow of its former self as the central bank is now the majority of the market. For example, the Japanese Central Bank now owns 60% of the Japanese exchange traded fund (ETF) market. Eventually the central banks have to unwind their balance sheets and produce market dislocations that again we have never witnessed before. There has simply never been a seller in any asset class of this size.

- Central bank forex holdings. The Swiss National Bank holds $720B in forex reserves in order to keep the Franc from rising against the Euro and Dollar. The SNB has been using the funds to purchase equity holdings and other asset classes outside of Switzerland. Much like their larger central bank cousins, the SNB will have to liquidate their holdings at some point resulting in yet another non-fundamental actor selling.

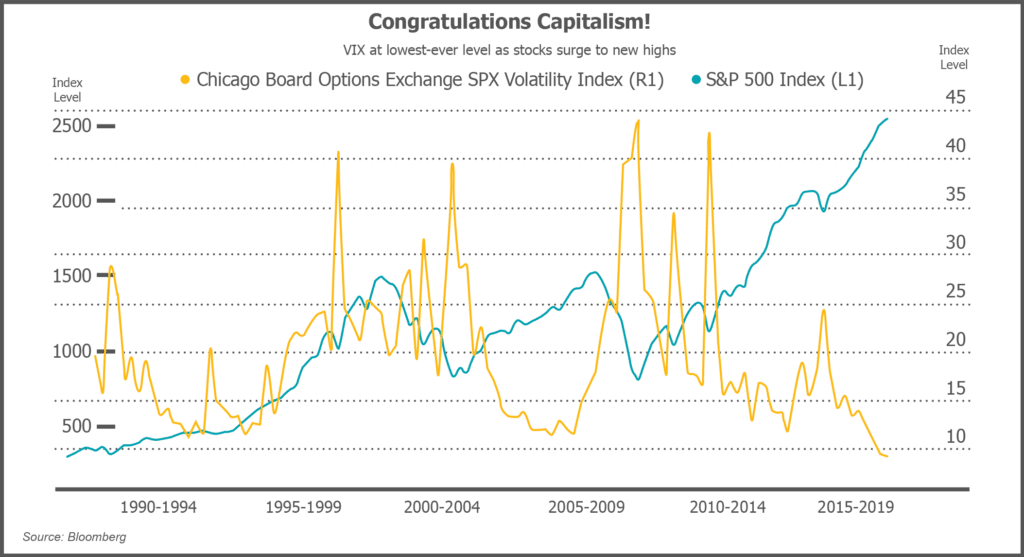

- Record low volatility. In the midst of the conditions outlined herein, we somehow have record low levels of volatility. The increase in passive funds, low volatility ETFs, and central bank holdings have created a perfect storm that acts to minimize price movement.

- Run concentrated portfolios. In an environment with diminishing opportunities, it is critical that you appropriately weight your best ideas.

- Valuation still matters. A company can have a record high valuation that significantly deviates from its historical average if it is justified by a major change to the company’s underlying fundamentals. However, we will not underwrite a company at higher than historical standard deviation adjusted averages if it is not warranted by a change in the business. In a world of ever expanding multiples, we are more not less wary of using present multiples as the basis for our analysis.

- Avoid leverage, debt kills. We are cognizant of the multiplicative effect debt has on returns, but investors often forget that the multiplication works both ways. Companies in certain industries such as real estate or with highly recurring cash flows clearly have higher debt capacities, which we take into account, but whenever possible we try to avoid companies with high levels of debt to EBITDA.

- Ignore the index. We do not look at index weightings or a company’s index membership when constructing our portfolios. Rather we try to identify good businesses trading at fair prices or okay businesses trading at great prices.

- Sell Grahams, hold Buffetts. Buy competitively advantaged businesses. Better businesses that have sustainably high returns on capital that compound intrinsic value—all else being equal—will typically outperform weaker businesses during downturns.

- Management matters. One of the fatal flaws of passive investing is its reliance on purely quantitative metrics. Although we acknowledge the importance of the quantitative metrics, especially returns on invested capital, companies are fundamentally a collection of people. Management is therefore one of the key three tenants we focus on in addition to business and value.

— Download this post as a PDF —

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.