Of the myriad of reasons proffered daily as to why we are the verge of stock market doom, a “decline in share repurchase” has come up a lot. We would note the following:

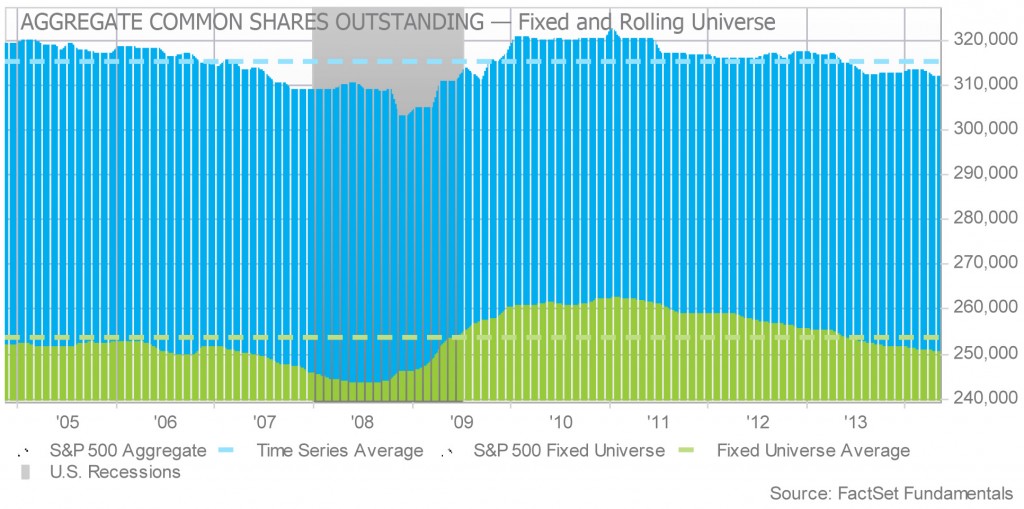

As the below chart suggests, shares outstanding for most of the S&P 500 as a whole have not changed in a decade. Material share repurchase that actually reduces shares outstanding is not the majority rule. If it has been the prop for the market going up, it will not be the reason for a decline.

So where do all these hundreds of billions of dollars of share repurchase go as a whole? It is a correct statement that many Boards and management simply don’t understand the corporate finance behind effective share repurchase and use it to disguise the very high cost of dilution to shareholders from aggressive compensation programs. See the chart again.

Boards and management are like many investors — they buy at the top when they are “confident” and freeze at the bottom when things are “uncertain.” Sad but true and very difficult in practice to change. It is tough to say en masse that share repurchase “signals” anything anymore as it has become so widely used as a PR prop.

What an intelligent share repurchase plan does is buy small pieces of a business below a reasonable estimate of intrinsic value. When pursued like this, there is no debate — how can you argue with its logic? As a secondary effect, how can you argue with using free cashflow to return cash to shareholders and enable those who stay to own more and more of a worthwhile business on a tax free basis?

After 30 years of talking to CEO’s, I am not sure I can count on one hand CEO’s that have told me they are NOT going to make a worthwhile corporate investment in order to buy stock. What I have seen hundreds of times is management pursue out and out silliness to the tune of hundreds of billions of dollars in wasted and inopportune spending on corporate acquisitions, capital spending at the top of cycles, R+D wasting ventures, and other grand scheme, consultant-driven ideas that get hatched in apparently very fertile boardrooms. THAT is the bigger destroyer of value — NOT intelligent share repurchase.