(Translation: Another Weasel-like Deal Where Public Shareholders are Sold-Out.)

The topic for today is the deal announcement on May 31st that the OM Group (Ticker: OMG) decided to sell itself to the private equity firm Apollo Group for $34 a share. We own approximately 1.5% of the shares outstanding at an average cost of roughly $28 purchased within the last year, so the transaction beats a sharp stick in the eye…but not by much. Here is what we find offensive:

1 — The basic premise of any sale of a public company should be: is the upfront premium reasonably equal to or does it exceed the present value of the operating plan? The answer here, as we will detail below, is grossly no.

2 — As we have noted many times in many places, there is an inherent conflict of interest when a management team leads a sale to a private equity firm. Joe Scaminace, the CEO, has had a ten year adventure which has resulted in nearly zero shareholder value creation. After a very recent activist campaign that barely lifted the stock from deserved lows, he and the Board decided to sell the company to Apollo the day before the new Board was to be elected. Arguably, the first action of the Board in our opinion would have been to replace the CEO, who has demonstrated a complete lack of capital allocation skills, limited ability to set a proper strategic direction and absolutely no operating ability.

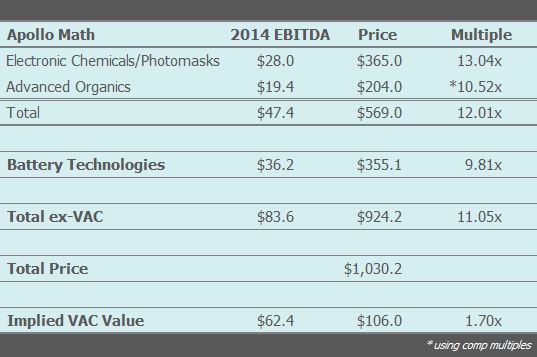

3 — We are using this schematic for valuation (Note: We are ignoring corporate costs because we feel they would likely almost all go away—see comments on the Platform deal “synergies” below—if this company were sold to one more strategic buyers.):

In other words, Apollo pays us $34 a share, and then sells off the electronic chemicals and organics business at what looks like a very healthy multiple to Platform Specialty Products—who then says there is $20mm in savings on top of the $28mm of trailing EBITDA that OM was earning. Ouch for us. We then use a 10.5x multiple for chemical business that is staying with OM and a 9.8x multiple for the very nice and niche Battery Technologies business. That leaves Apollo essentially paying 1.7x for the core VAC business and that is 1.7x times an EBITDA number that is 40% below what OM thought they were paying for when they bought VAC in 2011. Conclusion? Apollo has one of the best PE teams in the chemical space and this is at least the 4th deal I have seen them do over 20 years that screams “Please let me work there.”

The other obvious conclusion is that this is a lousy deal for shareholders. The present value of a new CEO running this company properly and getting the benefit of a better European economy sometime in the next three years exceeds a $34 number by 30% in our estimation.

4 — I cannot remember a recent deal with a public company where there was NOT a conference call for shareholders to understand the motivation and math of the deal. This is called “hiding.” So the real story will not be available until after the go-shop expires and the proxy comes out. There are also no details on what is financially motivating our CEO in this transaction, but our guess is that this deal maximizes his self-interest.

5 — “But we have a go-shop clause, so if the company is worth more, we will see it.” Experience has shown that in most cases this a “phone it in” effort. Neither the investment banker nor management is highly motivated to do the work for a real auction once they have a deal in hand. Prove us wrong Mr. BNP Paribas and Deutsche Bank.

This deal is a poster child for the unwritten rule of the thumb for acquiring public companies: “Offer just above the number where you will legitimately be sued.” It works perfectly when shareholders have been suffering for years and are willing to take a scrap to be done with it. Nice work Apollo.

We are reviewing our options internally.

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.