by Eugene Robin | Research Analyst

The title of this blog post borrows a line from an Agent Orange song that I loved listening to when I was growing up. I think it encapsulates the argument currently taking place between the environmentalists in this country and the oil and gas industry, and specifically the gas shale drillers. The two sides have barked at each other for over a year, throwing accusations, writing articles, supporting “independent” research and lobbying politicians to get their way. As is often the case, there is no absolute truth here, just shades of grey. Most recently, an exchange between Rolling Stone and Chesapeake Energy (a Cove Street holding) piqued my interest enough that I wanted to draft up my own response to Jeff Goodell’s piece.

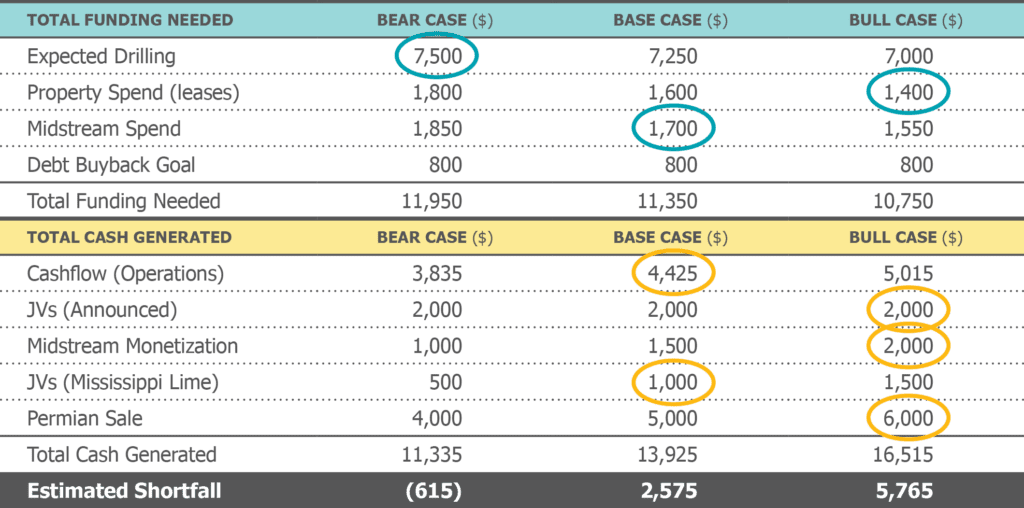

One particular issue I have with Goodell’s analysis is the lack of comprehension of economics and math in particular. He issues an attack on Chesapeake (Ticker: CHK) by comparing it to both a Ponzi scheme and to Enron, the poster child for American corporate fraud. But let’s really look at the facts for a moment. The assertion that Chesapeake is overleveraged and teetering on the verge of some impending insolvency is wishful thinking by Goodell. Chesapeake is currently planning to drill out $7-7.5 billion worth of new wells for 2012, with roughly 10 percent of this drilling going to HBP (held by production) mandatory drilling. A crucial factor to watch is the new lease acquisition spend, which CHK has guided to be around $1.4 billion. Overall, I have their funding situation illustrated in the chart below (circled values were CHK guided values):

The bear case in the above chart is quite pessimistic in terms of their operating cash flows. It assumes a drop of realized gas prices to $2.92 as well as no incremental price uplift from any liquids drilling that the company is pursuing. With the bear case cash shortfall coming in at roughly $600 million, we feel that the risks of CHK not meeting its production and debt reduction plans are de minimis. While it is undoubtedly true that CHK is a gas-leveraged shale driller, what many people seemed to have overlooked over the past six quarters is that CEO Aubrey McClendon and his crew have been steering their ship towards oil and natural gas liquids. By our calculations, Chesapeake sits on some of the finest acreage in the prolific Eagle Ford oil window as well as the newly touted Mississippian Lime and Anadarko Basin plays. The returns on average wells in these plays are in the mid to high 20’s when using $4 gas and $80 oil assumptions. This gives us more confidence that CHK’s drilling plan for 2012 is not value degrading and thus the $6 billion or so spent on new drills will be accretive to the company’s net asset value.

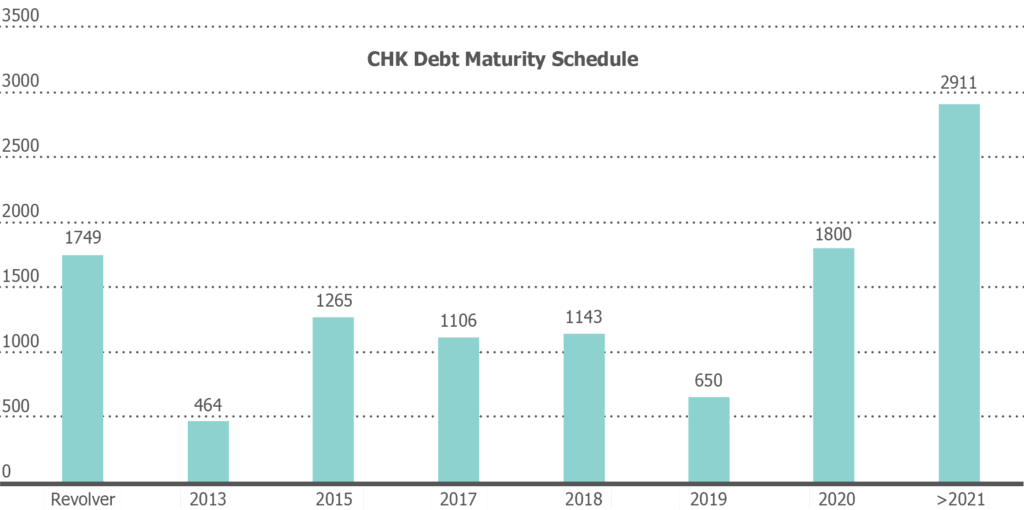

Additionally, our research suggests that the high debt burden faced by CHK is not an immediate threat. It is not the case that CHK has $11 billion of debt that is about to come crashing down on it. Instead, the company’s senior obligations are spaced out in the following manner:

Besides the total consolidated revolving credit facility, which has over $3 billion of available credit on it, maturities are spaced out over the next seven years such that only an average of $661 million is due per year. This figure represents 11 percent of 2011 operating cash flows and only 15 percent of projected 2012 cash flows. The main issue is the revolver that stands $1.75 billion drawn but which can most likely be converted into longer-term debt by the company with new debt issuance. The lack of any real discussion as to the finances of the company indicates that Goodell never bothered to do any rudimentary math before arriving at his conclusion that CHK was representative of another overleveraged corporate disaster.

Goodell’s other inflammatory point, that CHK is running a Ponzi scheme, is again unsupported by any credible evidence. If McClendon is truly operating a Ponzi whereby he bids up land prices in order to sell to the next sucker in line, then he has done a magnificent job convincing the top oil and gas producers in the ENTIRE world to follow along. The Exxons, Chevrons, Totals, and BPs of the world have rushed into shale with large purchases. These companies usually take twenty-plus year approaches to their corporate strategies, which is in itself a testament to what the industry’s cream of the crop actually thinks about the potential for secure domestic resources coming from shale drilling. Goodell is asking us to assume that if CHK is a Ponzi then the most sophisticated energy producers in the world apparently do no geological testing, 3-D mapping or core sampling before they decide to make acquisitions worth BILLIONS of dollars. I find this hard to conceive.

Lastly, I’d like to comment on the idea that CHK is creating low gas prices through uneconomic drilling and that this in some way represents the definite future for gas in general. First, CHK—unlike most of its large brethren—decided to cut pure gas drilling to a minimum (HBP) and concentrate on liquids for 2012. Second, CHK will actually shut in about 1 Bcf of production, unlike any other major company (Devon, Exxon, Southwestern, etc.). Third, 85 percent of CAPEX spend for CHK is going to liquids-rich drilling, showing that CHK is willing to change its mix to better manage future capital allocation decisions. Fourth, and what people seem to miss, is the fact that low gas prices will fix low gas prices. The longer gas remains at $3 and under, the more likely it is that industry will switch manufacturing over to gas power and the more likely it is that liquefied natural gas will become a viable alternative to diesel for the large trucking fleets. This conversion isn’t going to happen over night but if the author and other bearish analysts are right about gas prices, then the long-term prospects for gas demand are excellent, and companies like CHK will be in perfect position to reap the rewards. Furthermore, the debacle of 2008/2009 was predicated on the fact that E&P companies were drilling with $14 gas in mind, while in today’s gas price environment, most are struggling to justify wells that need $3.50+ gas for IRR breakeven. Barring blatant fraud, the downside for CHK is boredom.

While I can talk about the economics and math of CHK, what I cannot really discuss to any great detail is the environmental arguments for and against drilling. I encourage those of you who are both for and against fracking to watch the controversial anti-fracking documentary called “Gasland.” This movie provides the best anti-fracking argument from an environmental standpoint. Additionally, to counter the assertions made in the film, an energy-funded group has put out a “Debunking Gasland” piece that is worth reading. Of course, there is a counter to the counter, as this healthy debate shows no signs of slowing down.

I’ll offer one more article worth reading: Wall Street Journal’s “Faulty Wells, Not Fracking, Blamed For Water Pollution.” What all of these pieces show us is that there is no single “truth” or smoking gun-like evidence overwhelmingly supporting either side. But, what is really not up for debate is that state authorities are moving to more closely regulate shale drilling. The impact of extra regulation will be the same for the oil and gas industry as it is for other industries that undergo regulation—costs will rise and marginal players will be eliminated. Yet, CHK is one of the top five lowest cost producers in the country. Therefore any increase in drilling costs will accrue to them and the other majors. As marginal supply decreases through either independent exploration and production companies going out of business or gas drilling at current gas prices becoming a negative cash flow investment, prices for the commodity will begin to rise again. Make no mistake about it, every $1/Mcf increase in gas price equates to roughly $3-$4 billion in NAV value for CHK. (Imagine what CHK would be worth if natural gas ever got back to $14/Mcf.) Successful value investing is predicated on the price one pays and even after taking into consideration the bear case we believe that the current risk-reward trade-off associated with CHK shares is asymmetrically skewed to the upside.

Solar and wind might be the energies of tomorrow but the leap to get to that magical future will have to be bridged with the fossil fuels of today. So pick your poison: oil from nefarious OPEC states, dirty coal from Appalachia, or natural gas from hydraulic fracturing.

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.