“Value” has a number of different components all tied at the hip. Internally, we simplify by mentally handicapping companies as either “Buffets or Grahams” based upon a research driven, albeit always subjective assessment of the business model. A history of consistently solid returns on invested capital, and reasonably consistent growth to drive through those goalposts(a sporting term formerly used by a pre-Covid society) sits heavily on the Buffett side of the scale while deeply discounted valuation for less than visually pristine corporate goods holds the scale of the Graham side. Invariably, market messes like the one in which we reside today create opportunities on both sides of the scale. Never been attempted before Federal Reserve activity to support non-investment grade debt is another angle to throw in the mix. So which “side” should be favored in today’s world? Partner and PM of CSC Small Cap Plus strategy has an opinion.

There is not a lot that we can say that hasn’t already been said about the impact of the virus on our daily lives and on the financial markets. We recognize that these are trying times, from both a personal and an investment perspective. So, we will try to keep this discussion (relatively) short.

It is our stated goal to outperform in down markets and keep pace in up markets. We believe that our conservative positioning, the quality of companies we invest in, and the strategy of limiting the number of over-levered companies, typically sets us up well for market downturns. As we had discussed at length in prior letters, the compounders we ideally wanted to own were quite expensive and we were having trouble putting money to work in the right combinations of Business, Value and People. Plus, we were anticipating eventually having a more attractive environment in which to invest.

Well, here we are! One could argue that our elevated cash levels positioned us well for what we saw in Q1. We certainly would have thought that the cash would be a huge help in a rapidly falling market. Annoyingly, it has not been as large a cushion on the downside as we would have hoped or anticipated. When correlations go to one (meaning everything goes down at the same time), asset managers are getting redemptions, and liquidity dries up, stocks can fall to levels that no longer have any connection to intrinsic value. Currently, the market is lurching from headline to headline, mainly because the near-term and long-term impacts of COVID-19 are so hard to handicap. But, despite the mark-to-market declines we have seen in some of our stocks, we do not see much, if any, permanent impairment in our portfolio. To the contrary, given some of the updates we have been receiving, it would appear to us that our companies are managing through this uniquely tough period really well. (At least so far.)

What in the world is wrong with value stocks?

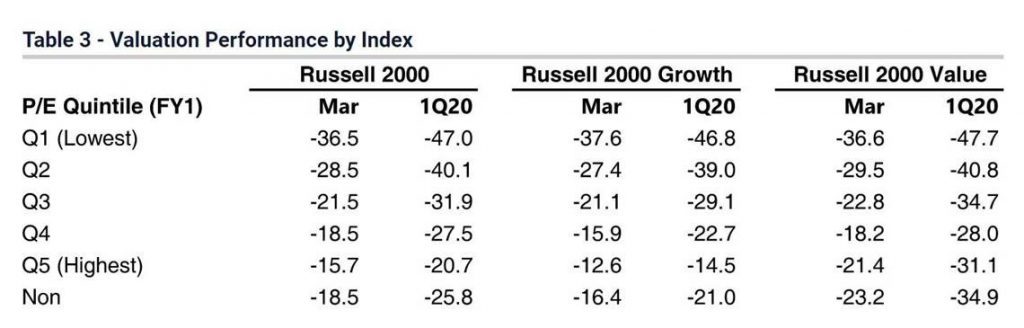

(Source: Jefferies)

The father of value of investing, Ben Graham, once said that the stock market is a voting machine in the short-run but a weighing machine in the long-run. What that means is that prices can, at times, become completely unhinged from intrinsic value in the short-run. But, over time, they should recover to better reflect the value of the franchise and the associated cash flows. This is another way of saying that we thought our largest positions were cheap before all of this started and given that a number of them are down a lot, now they are REALLY cheap. As the above chart indicates, it was the least expensive stocks within the Russell 2000 that were down the most in Q1 and in March specifically. Being undervalued to start with literally didn’t matter at all. We find it hard to believe that the most expensive stocks will continue to outperform whether the market is going up or down. History is on our side—just think back to the early 2000s to see how much value stocks outperformed. But, of course, when you run concentrated portfolios with a 3-to-5-year investment timeframe, the voting machine can cause a great deal of short-term pain. However, as long as you have been careful in your security selection, it is precisely at times like these that the best investments are made.

We certainly don’t want to go on record predicting when the market is going to turn or when the scourge of the virus will no longer be a daily topic of discussion. But, we are currently finding good businesses that are still undervalued even if you basically write off 2020 and part—if not all—of 2021. Given how difficult it is to forecast the next 2 weeks—let alone the next year—our general approach is to assume that our companies don’t get back to 2019 levels of revenue and profitability until 2022 or 2023. Even with those assumptions, we are seeing companies trading at valuations that have not been touched since 2008-09. Accordingly, while we are not going to call the bottom here, we will say that current valuations may set this period up to be the best time to invest since the Financial Crisis.

Mean reversion and choosing the proper elevator

Please recall that we believe deeply in concentration and in building index-agnostic portfolios. We are therefore not focused on what the benchmark owns or how its constituents are weighted. Instead, we have identified 25-ish securities that we believe are 1) materially undervalued; 2) well-positioned to weather the current storm; 3) likely to be stronger coming out of this as smaller or venture-capital-backed competitors are not able to keep pace; and 4) are getting more valuable each and every day. To get there, we have made some sales of businesses that have Graham-ish elements and have consciously upgraded to more Buffett-like companies.

We also still have plenty of cash to put to work. We promise that what we are not going to do is put that cash into levered cyclicals in the hope that they won’t go bankrupt. That is a great way to make a lot of money if you are right—or lose everything if you are wrong. We are conservative investors who focus first and foremost on not losing money. We simply see our current portfolio companies as coiled springs that could bounce back substantially as the smoke starts to clear. Concentration has hurt a little on the way down. But, if we are right in our assumptions about the companies in our portfolio, our willingness to focus on our best ideas—and buy more on the way down—is likely to be very helpful on the elevator ride back up. And assuming we still live in a world where mean reversion is a relevant concept, the past underperformance of all things small and value-oriented (large and growth continued their winning streak vs. small and value again in Q1) may cause the ride back up to be as violent as was the ride down.

Optimistic but patient

Going forward, on the macro front, we have a single hope. We hope that everyone—from landlords to lenders to bosses—simply takes a breath. Rent and interest will eventually be paid. Business will eventually pick up again. We just need everyone to hunker down for the next few months and avoid putting too many companies out of business, kicking out too many homeowners and renters, and firing too many employees. It is clear that this is going to be a painful period for a lot of individuals and businesses. But, this too shall pass and the U.S. economy will rebound much faster if people are willing to defer getting paid for a while and to keep employees on the payroll just a little longer. Easier said than done, but hopefully the recent stimulus bill and the Fed can cushion the blow a little bit.

In the meantime, we will continue to focus on individual companies as we look for world-class franchises and unique assets that are now on sale. We will put the cash to work and we promise to do that judiciously, being very mindful of balance sheet leverage, liquidity issues, and industry/end market concentrations. Our goal is to be fully invested and we firmly believe that those who are willing to step in during periods of rampant uncertainty will be handsomely rewarded.

– Ben Claremon

Principal, Portfolio Manager

Information provided on this site is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product. Advice may only be provided by Cove Street Capital’s (“CSC”) advisory persons after entering into an advisory agreement and provided CSC with all requested background and account information.

From time to time on our website we may offer direct access or ‘links’ to other Internet websites. These sites contain information that has been created, published, maintained or otherwise posted by institutions or organizations independent of Cove Street Capital LLC. CSC does not endorse, approve, certify or control these websites and does not assume responsibility for the accuracy, completeness or timeliness of the information located there. Visitors to these websites should not use or rely on the information contained therein until consulting with an independent finance professional. CSC does not necessarily endorse or recommend any products or services described by these websites.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. You should not assume that any of the securities discussed, if any, are or will be profitable, or that references we make will be profitable.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our ADV Part 2A. A copy of CSC’s current written disclosure statement discussing the Company’s business operations, services, and fees is available on our website and also upon written request.