What is the actual float of a company? How many shares are actually tradeable relative to the headline free float share count that major data providers such as Bloomberg and CapIQ publish? The answer in almost every case is that the “true” free float is considerably lower than the actual “headline” float. In order to determine free float, one must come up with a set of restrictions that exclude stock held by investors that are unlikely to buy or sell in the normal course of trading. In our estimation three shareholder types result in a true free float that is materially lower than headline float counts: Insider holdings including A/B shares, large 20%+ strategic investors, and passive investors.

Dissecting Float

Regulations restrict insiders from trading outside of pre-approved windows. Minimum ownership requirements and lockups also prevent insiders from freely transacting their shares. Some firms have dual voting otherwise known as A/B share structures. An A/B share structure means that an individual or group of people have disproportionate voting rights via a second or third class of shares. These shares are often not tradeable as they are frequently locked in trusts, subject to agreements, and lack a large enough secondary market for B shares. In other instances, the sale of stock by the “controlling party” below a threshold will result in a collapse of the A/B structure and a forfeiture of the disproportionate voting rights. Many industrial companies with a long history have internal pension funds, which are effectively near permanent stockholders that only liquidate occasionally to meet retiree payment obligations. The limited trading period and the extreme length of the average holding time of insiders provide a solid basis for excluding insider holdings from calculations of true float.

Strategic investor such as sovereign wealth funds, holding companies, and private equity firms are frequent buyers of large (20%+) or controlling stakes in public companies. The size of these investors’ stakes relative to the daily trading volumes present in the small cap universe means that they cannot easily trade out of their position without substantially moving the company’s stock price. As a result, these investors are forced to either sell their block to another large holder, conduct a secondary offering with the support of the company, or directly sell their stake to the company itself. It is usually rare for the strategic investors to sell directly into the market and therefore these investors’ stakes ought to be excluded from a true float calculation.

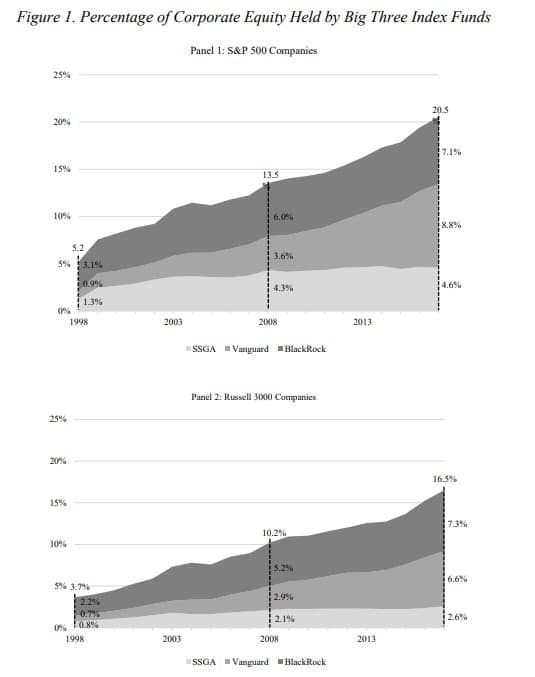

Indexation firms enable passive investing for all investors through their exchange traded funds (ETFs) wherein they buy and sell stock in direct proportion to the composition of the index they are tracking. Blackrock, Vanguard, and State Street are the three largest players in the ETF market. Unlike fundamental investors that are buying based on an approximation of a company’s value, passive investors will only increase or decrease a holding in response to fund inflows/outflows or a change in the underlying index. As passive investments have had positive inflows for many years, these players have witnessed increased ownership in virtually every publicly listed company. As of 2019, passive investors made up 17% of the Russell 3000’s float and 20% of the S&P 500. Although passives actively trade on the margins, their ownership tends to be stable unless a company is dropped from an index. Therefore passives should not be included as part of free float because of the underlying stability of their percentage ownership.

Source: http://www.law.harvard.edu/programs/olin_center/papers/pdf/Bebchuk_1004.pdf

Float Schmoat, Why Does It Matter

Why does it matter that true free float is way lower than actual free float? A smaller float expands the small cap universe into the midcap space, makes agile trading more important, further constrains large players from investing in small caps, and erodes the link between shareholders and the boards that are supposed to represent their interests.

Within our small cap strategies, including Classic Value ׀ Small Cap, our investable universe is limited to companies with market capitalizations of less than $3B. When true float is considered, our investable universe becomes significantly larger as companies with far higher “headline” floats are significantly smaller when a true float is calculated. Many companies that are considered mid cap companies are really small caps when one looks at their true float. In addition to expanding the investable universe, using a true free float calculation also removes the dreaded necessity of having to sell stock in a company that performs too well and becomes a mid-cap. Using true float, a high performing small cap that becomes a midcap can then be held longer until it has reached more of its full potential rather than being sold once it crosses the $3B threshold.

Small cap value has been one of the highest returning asset classes over the long term partially because of liquidity risk. Investors in small cap companies cannot easily buy or sell their shares in the same way they can sell a large cap stock such as Microsoft. Historically the absence of liquidity has prevented larger investors from participating in small cap as the sheer scale of their investment would make it difficult to buy and sell a stock without massively moving its price. If one takes into account the aforementioned true free float, then the actual number of shares that are available to trade is even smaller, exacerbating the problem and supporting the longevity and durability of the illiquidity premium we enjoy as small cap investors.

Passive’s Unintended Consequences

Passive investing not only constrains liquidity by removing significant blocks of stock that would otherwise potentially trade freely, but it also has two other negative consequences: price discovery is distorted and boards/management teams can more easily abrogate their fiduciary duties.

A company’s stock price should reflect the market’s collective estimation of intrinsic value or the value of the company’s cash flows discounted to the present. In theory, market participants buy and sell a stock based on differing views of intrinsic value. However, with passive investors this is not the case. The indexation firms simply create and maintain financial products, mechanically buying and selling securities based on index weightings. “Intrinsic Value” is not part of their process. It stands to reason that the share price of a company with high passive ownership will be more disconnected from the company’s fundamentals and intrinsic value.

Passive investors are also less likely to rock the boat against management/boards. Management teams and board of directors can be virtually assured of passive investors votes as long as they do not do anything egregious and attempt to check all the boxes outlined by the proxy voting firms. Passive investors will never pursue a change of management or a board as it is anathema to the very idea of being a passive investment vehicle. Although passive investors may vote with an activist if there is a recommendation by Glass Lewis or ISS (the two large proxy voting), they will never initiate activism themselves. Knowing that at least 20% of your shareholder base will vote with them unless they act terribly provides poor management/boards with the ability to pursue value destructive ends without recourse. As passive investment vehicles continue to increase their ownership management/board accountability will decline further.

The reduction in true float over time as passive investing grows has adverse effects on liquidity, firm behavior, and price discovery. And it begs the question: so what is a Small Cap stock?

– Dean Pagonis, Principal + Research Analyst