There are some things that are different in managing assets invested in smaller companies than larger ones. Energy is one such thing.

Two years ago, investing in Chevron, EOG, or Pioneer because of the terribly false Green Premise that renewable energy can easily, affordably, efficiently, and quickly replace carbon-based energy sources was very doable. These are large diversified companies that even Elizabeth Warren couldn’t kill overnight. In the smallcap world, the choices were a lot gamier and in many cases binary – either energy prices were moving up quickly or equity value would be dissolving in mostly undiversified groups of assets.

“The most money is made in highly cyclical stocks the day before they don’t go bankrupt” is I believe an original line coined at Cove Street..but then again maybe I simply can’t remember where I heard it first. We usually choose NOT to do that, particularly as an equity investor in the cap structure, and particularly when the critical variable for success is “tell me the price of the commodity and when.” So we chose the opposite: an investment in CNX Resources, an Appalachian natural gas company that invented the “shareholder value” pattern and structure that pours out of the energy world today. Drill within your means, hedge up the forward curve, generate free cash, live to see another day.

A big fat giant relative mistake, as OBVIOUSLY that is not the way to make 500% if you OBVIOUSLY knew what was going to ensue in energy pricing. These issues haven’t gone away except that “no one” is going to go bankrupt at $100 oil and $4 + gas. We have made money in CNX, but…we might have done better.

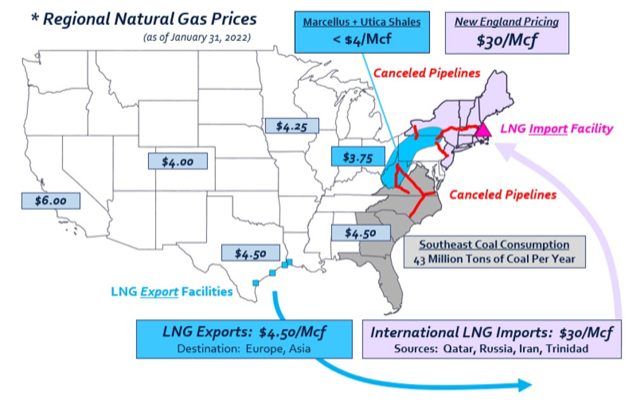

Oh and this chart in a recent EQT presentation bemoaning a common problem with CNX and EQT. There is a definitive shortage of “takeaway capacity” to get gas out of Appalachia, which means that the realized price for producers in that region is much less than the realized price for other people selling $4 natural gas. You also might notice that the price of gas in the cold regions RIGHT NEXT to CNX assets is a lot higher than $4. And you might notice the “canceled pipelines” in Red.

Let’s just say the following – things that cannot go on forever..won’t. People will either enjoy freezing and lower standards of living in the Northeast or there will be political change that eliminates the red portions of the chart. Just is.