Here we are in June, and things mostly continue on in a Newtonian fashion: “A stock at rest will remain at rest, and a stock in motion will remain in motion, seemingly at constant velocity and in a straight line, unless acted upon by a net force.” Or Elon swiping your Nvidia chips.

So yes, a number of big boy stocks continue to rip, a number of smaller cap stocks continue to meander and any variety of silliness, which as noted in our last Strategy Letter, seems impervious to “whatever.” As noted…again: in May, four technology stocks added more market value than the rest of the S&P 500 put together. Daily zigs and zags continue to be driven by useless predictions of whether the Fed will cut rates in 2024.(We will take the no vote)

Said another way by another thoughtful member of the prestigious “CSC Non-Partner” Club: “Regardless, keep up the good work, different views and perspectives are refreshing. Still a tough fit for us – structurally we are playing a different game, no dedicated small cap exposure, beholden to outperforming large cap-oriented benchmarks etc.”

Said one more way, because I have been just dying to use this somewhere and will credit FT Alphaville for exposing it:

The General Response to Raising Capital in the SmallCap Space

I am sure you have read plenty about the return of the Meme nonsense, so I will be content to leave the Bruce line hanging from the Title with one minor, “Ooh, ooh, ooh, what can I do?” Does it mean anything at large or is it just a perpetually ridiculous corner of our world that can now be enabled 24 hours a day with small handheld devices? This being America, we are torn between letting idiots be idiots in a caveat emptor fashion vs. paying a lot of money for a Securities and Exchange Commission whose alleged mission is not DEI and Climate Change theory but the protection of small investors, and somewhere in this field of manure, it seems likely there is a fraud pony. However, it is oddly a contentious set of legal issues beyond our scope here.

But where there is silly, and the perception of money being made by someone else, other money will look for a hook. Per Bloomberg, their U.S. equity momentum factor model (composed of names which have outperformed the broader benchmark over the past year) accounted for roughly two-thirds of the S&P 500’s year-to-date gains through last Wednesday. According to Bianco Research data, this is the best such performance of said model since 2000-ish. The piece goes on to note Wall Street professionals are positioned accordingly, as net exposure to the strategy within hedge fund U.S. equity portfolios stands at its highest in at least two decades.

Yes, “momentum” as an equity factor is not an awful addition as a screening device as in, “give us a list of cheap stocks with decent underlying businesses whose price momentum ‘suggests’ that a bottom has been reached.” A lot of people have raised a lot of tens of billions of dollars on this basis. And NOT buying a stock at 16 on its way down from 50 to 9 is a desirable set of affairs if you are asking.

But most of this “stuff” doesn’t move our critical variable needle, and we don’t spend a lot of daylight hours mulling the implications – but can’t we dream of waking up in a kitty dreamworld to our small handful of heavily shorted stocks (with much more legitimate business models) and selling the hell out of an 80% one day move? The alarm goes off in ten minutes.

Back online, the general updates from US corporate earnings with Q1+ behind us are the usual mixed bag, but we would note a shade toward the “not better” if you are measuring by anything but press release references to an AI project. And we reference fundamentals with valuation, which, to note the formerly obvious, are inextricably linked. A stock can go up on crap earnings if they are merely less crappy than the prior period, and “what’s wrong with those earnings and my stock is down” is usually the simple case of “priced in already.” We would also note a legitimate dichotomy of companies based on exposure to customers making less than $100k. We see this in obvious and odd places like retail and getting your 12 year old car fixed, a relevant issue to note as we have recent positions in Advanced Auto Parts and Motorcar Parts of America.

And here we insert some newish twists on some older thoughts. A key characteristic of “Private Assets” in whatever form – Buyouts/Credit/Real Estate – seems to be a latent realization of “a lot easier to get into than get out of” as judged by both common sense, the pile-up in fund exits, the explosion in “secondary” funds, the use of new and improved fund leverage to create liquidity and some gating behavior in all said relevant and aforementioned funds, all of which never cease to amaze me when countering questions on our own strategies: “well, I am interested, but I am concerned that smaller cap has liquidity issues.” Having a small handful of public equities that were purchased from someone else’s liquidity issues as part of a portfolio remains a lot more liquid than a ten year lockup with extension rights. Very few people seem to be trying to raise money to take out stub public positions in zombie PE funds. I should note that WE are.

And on the running topic of credit and rates and “why hasn’t the move from zero interest rates resulted in any consequential movement in financials – absolute or relative?” Large companies are net cash vs. small ones are highly levered? There is a large population of net savers who are partying hard with the ability to earn 5% plus? The credit world is so covenant lite that there is presently a paucity of actual failures and instead there is a Game of Thrones arena of intra-credit warfare between users of Natural Intelligence who are re-carving pumpkins of leverage for what are likely very similar client pools who seem oblivious to the carving? Or is this simply the Hemingway world – leverage goes bad gradually…and then suddenly. We file under Slow Moving Things to Continue to Watch.

When we have “little current performance,” we tend to keep our heads down as a lack of stock price movement partially produces self-reflection and a re-underwriting of current positions to evaluate simply wrong vs. uncomfortably early. And a re-thinking of position sizing, as being concentrated tends to focus the mind. And a continuing looksee of what else is around us that may be of relative better interest. But the bar always remains high – portfolio gin rummy tends to be one of the truly self-defeating tendencies of investment management.

We continue to see selective “awesome” opportunities in the smaller-cap world, which we offer both on a portfolio basis and through a focused LP where we combine our research efforts with the ability and experience to effect governance and outcomes via Board representation. We would drop said and related hints on Clarivate in the former and Research Solutions in the latter. We are happy to discuss things of interest with interesting people.

I have noted that “The DIFF” blog is something worth reading in the sea of annoying opinions of our world. A fascinating mind, widely read…and we like reading about things in which we don’t have expertise or an opinion. Mr. Hobart usually delivers. Occasionally, he hits our investing world (public equities, smaller cap) on the head, and to wit:

Investing, and business generally, is a game of relative advantage. There are two ways to get that: one is to try to maximize some kind of absolute advantage—design the fastest GPU, build the most comprehensive distribution network, estimate the intrinsic value of an investment with maximum accuracy, etc. But sometimes the right move is to just find a place where your median competitor is not as bright or hardworking as you are.

This may be worth it! In fact, the general path of starting in a competitive and scalable field, applying the gains to a less competitive and less scalable field, and then growing back to where you were before (or past it!) with a lot more of your own capital is well-established. That’s basically what Buffett did; he worked for Benjamin Graham for a while, then raised his own fund with an order of magnitude less capital, and put his personal money into even smaller opportunities than that. Looking for the poker table full of patsies is a good way to optimize for percentage returns over dollar returns, but if it works well enough, the only tables with meaningful stakes will be the one where other players know what they’re doing.

That smells like us to us.

We close out where we started this piece. The only thing one really learns about “markets” over history is that things seem to change…once the current momentum stops. The why and the when are always obvious in retrospect and there are multiple contradictory signposts along the way that pass through your line of sight. We attempt not to lose sight of a small group of North Stars: persistent research into business models, paying attention to valuation of said model, understand incentives and governance. Rinse repeat.

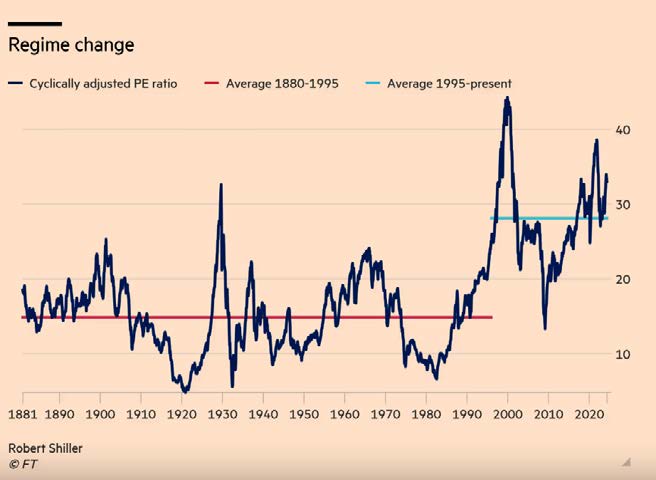

We grew up thinking the below was a real signpost. It seems to have lost predictive value within the arc of most current investment careers. But with the French Open in the background, at these levels of valuation and a widespread callousness toward risk, we note “le petit quelque chose qui fout tout par terre.”

Jeffrey Bronchick, CFA

Principal, Portfolio Manager

Cove Street Capital, LLC

*The opinions expressed herein are those of Cove Street Capital, LLC (CSC) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. Consider the investment objectives, risks and expenses before investing.

You should not consider the information in this letter as a recommendation to buy or sell any particular security and should not be considered as investment advice of any kind. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this newsletter. Recommendations made for the past year are available upon request. These securities may not be in an account’s portfolio by the time this report is received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage of the account’s portfolio. Partners, employees or their family members may have a position in securities mentioned herein.

CSC was established in 2011 and is registered under the Investment Advisors Act of 1940. Additional information about CSC can be found in our Form ADV Part 2a,