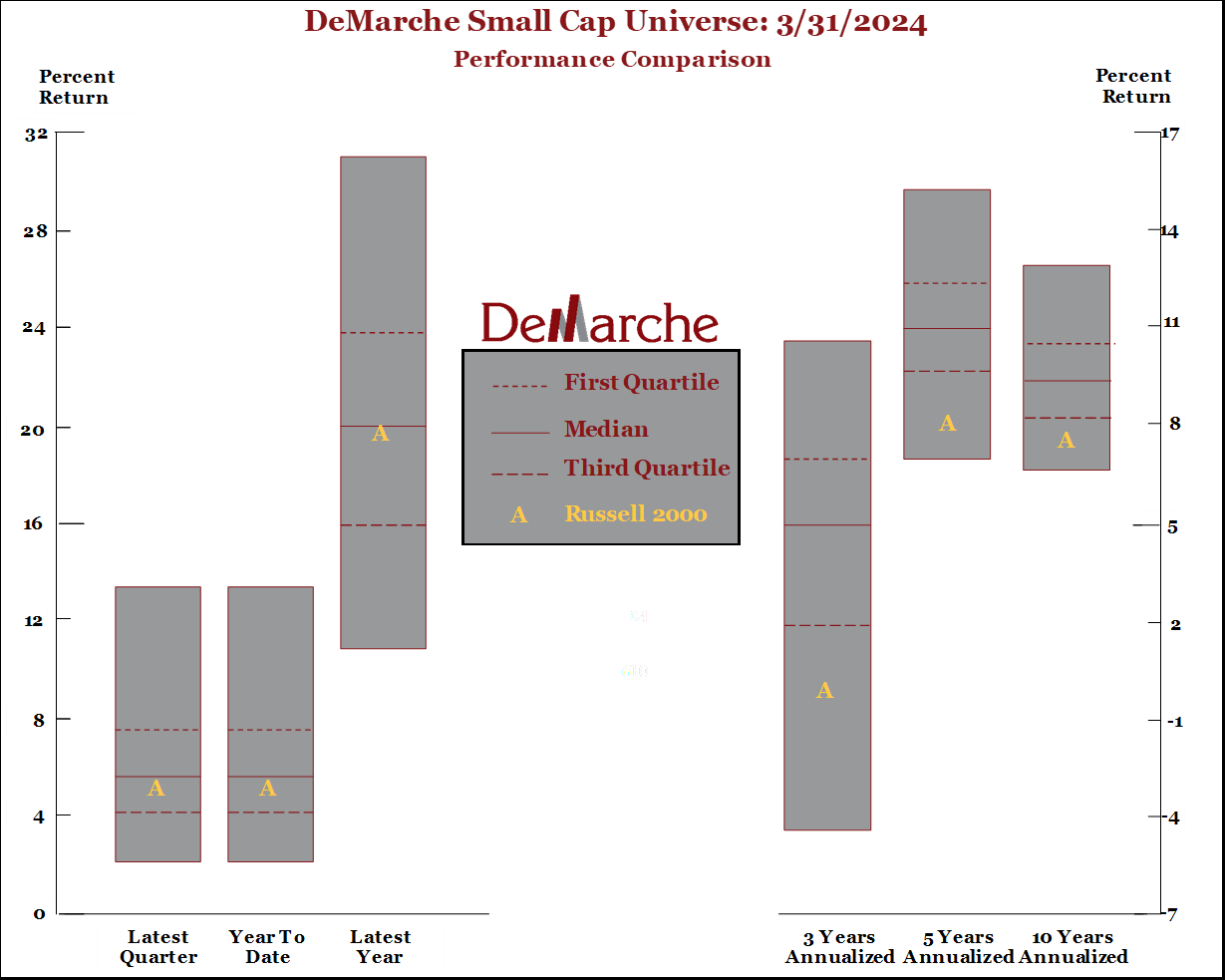

It is no secret that the Russell 2000 contains some crappy companies – some 40% of the R2000 constituents are unprofitable. This is a common refrain from prospective LPs or SMAs who are deciding whether to avoid the small cap category altogether…100 years of Fama/French factor data aside. So, how should investors looking to get small cap exposure go about it? Our friends at DeMarche, an institutional investment advisor, have assembled the following from their internal database of 100+ small cap strategies.

Ultimately, DeMarche finds that index hugging the Russell 2000 would perform as a fourth quartile manager on a 3-, 5-, and 10-year basis in the world of active small cap. Implication? Active managers have added value as a class in the wild west of small cap.

We would recommend having a look at the full DeMarche white paper on investing in small cap, from which we pulled this, here.