by Eugene Robin | Research Analyst

I’d like to share with you a great book on the basic mathematics of the stock market written by John Allen Paulos that has a section on the efficient market. Briefly, if investors believe in the Efficient Market Hypothesis (EMT) then they believe that the market efficiently incorporates all old and new pieces of information and thus the quest to beat the market is a losing proposition and thus everyone should just buy index funds. But, if enough people believe that the market is efficient then no one will engage in active management, thereby decreasing the overall efficacy of the now not-so-efficient market by slowing the diffusion of information into market prices. Therefore, if enough people actually believe that the market is efficient then that belief actually ensures the falsity of the theory itself, ergo, a paradox forms.

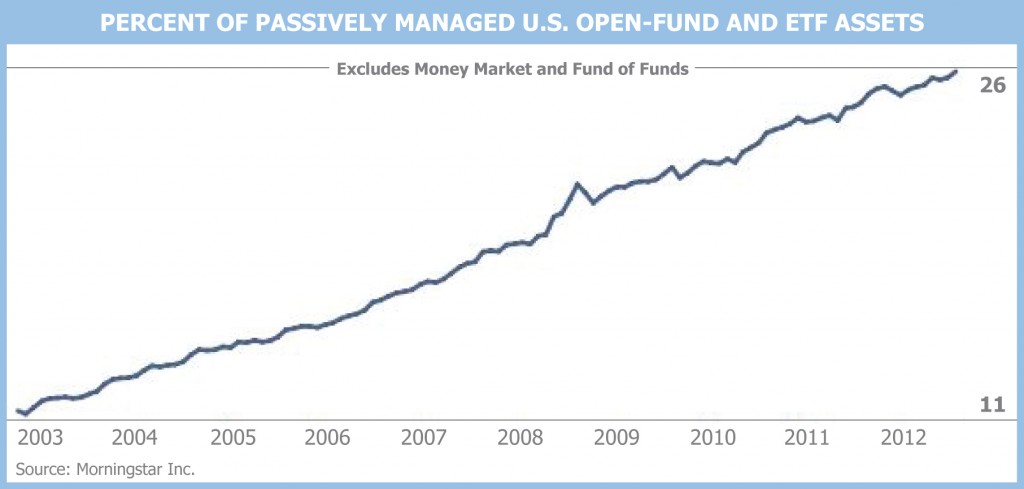

Why am I mentioning this? After recently watching a PBS documentary where Vanguard’s John Bogle espoused the glories of the ETF revolution, I began to think about the actual effects of ETFs on active managers. It’s hard to argue that Bogle is entirely wrong in his assault against the traditional active management industry. Retail investors have in fact voted in favor of Bogle over the past decade, moving industry assets to be 26% passively managed versus 11% in 2003 (Morningstar Annual Report – 2012). Institutional investors have also started to look more into different variations of indexing such as the “core-satellite” approach. Yet, if the rotation into passive investment strategies heralds in an era in which the majority of retail and institutional investors believe that the EMT is correct, wouldn’t that indicate that the paradox is in full effect? Yes, I believe it would. While I don’t know where the tipping point is, if the following trend continues I believe we’ll see much less efficiency in the future and thus a better investment environment for infidels such as Cove Street:

So to Bogle and the rest of the indexers I say: Please continue to spread your beliefs across the asset allocation world and we wish you sincere luck in destroying your own gospel.

—

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this should not be considered as investment advice of any kind. The report is based on data obtained from sources believed to be reliable, but is not guaranteed as being accurate and does not purport to be a complete summary of the data. Partners, employees, or their family members may have a position in securities mentioned herein.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. These securities may not be in an account’s portfolio by the time this report has been received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this report. Recommendations made for the past year are available upon request.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our Form ADV Part 2a.