I don’t know the Verdad people, but they tend to lean toward what we are thinking, so they are obviously smart and worldly people who should be taken seriously.

Here is the takeaway:

It’s interesting that this increase has coincided with the widespread adoption of passive indexing. My theory would be that the evidence from SPIVA reports has led many investors to be skeptical of active management in long-only equities, but that skepticism has not diminished their desire to seek outperformance. So as assumptions about the alpha generated by active management in liquid markets—where data is clear and transparent—have declined, assumptions about the potential alpha available from alternative investments have increased.

But in an alternatives universe that has quadrupled in size and where every large investor now has an allocation, is there really more alpha available than there was when alternatives were the wild west and their adoption was limited to a small pool of smart and adventurous capital? And is that alpha sufficient to overcome substantially higher fees and compensate for illiquidity?

The Rise of Alternatives

Optimism about returns has driven a rotation into alternatives

(Verdad Weekly Research)

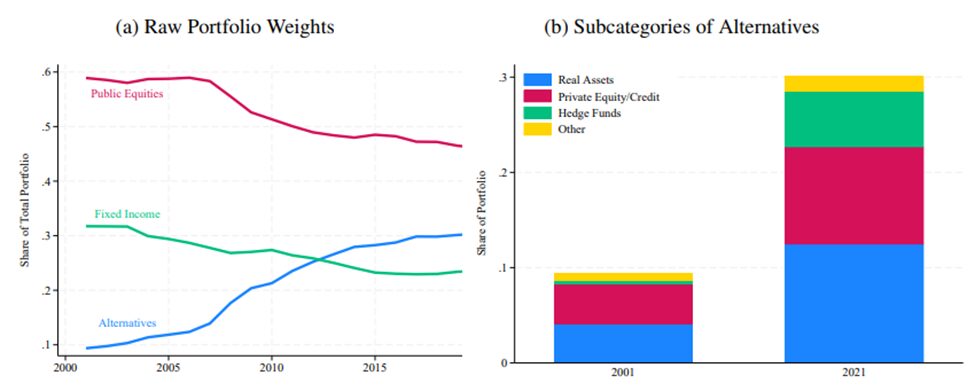

Public pensions have upped their allocations to alternative investments from 14% in 2001 to 39% by 2021.

Figure 1: Pension Portfolio Compositions

Source: Begenau et al.

This shift has not happened solely because pension funds are taking more risk. The risky share of their portfolios has risen only from 68% to 76%. Rather, a recent paper by scholars at Stanford and Harvard explains the reason for this shift: a widespread increase in return expectations for alternatives relative to other types of risky assets.

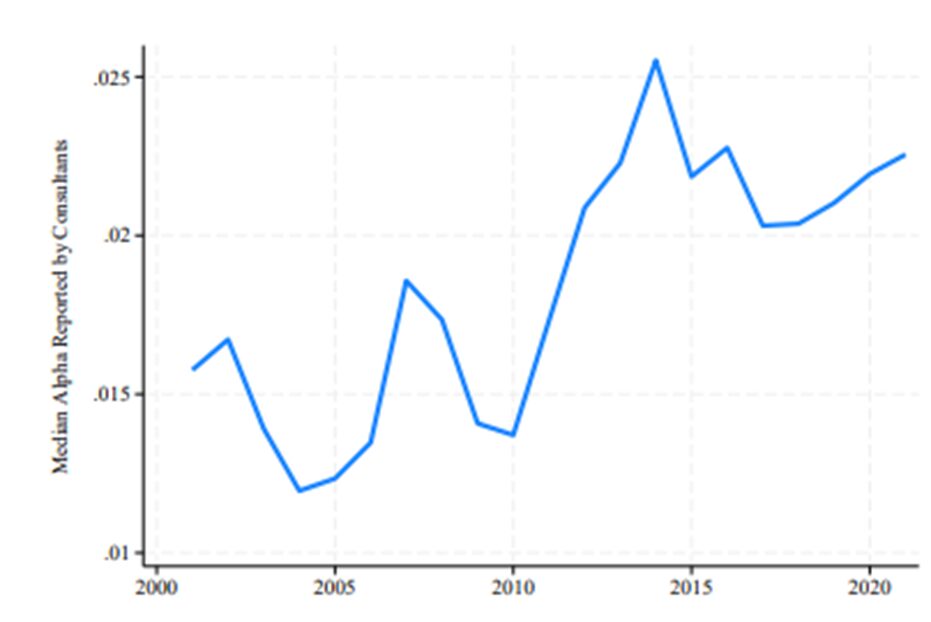

The researchers show that investment consultants have steadily increased their estimation of the alpha of alternatives relative to public markets by 68 basis points since 2001, an increase big enough to justify the entire expansion of alternative allocation.

Figure 2: Consultant-Reported Beliefs about Alpha of Alternatives

Source: Begenau et al.

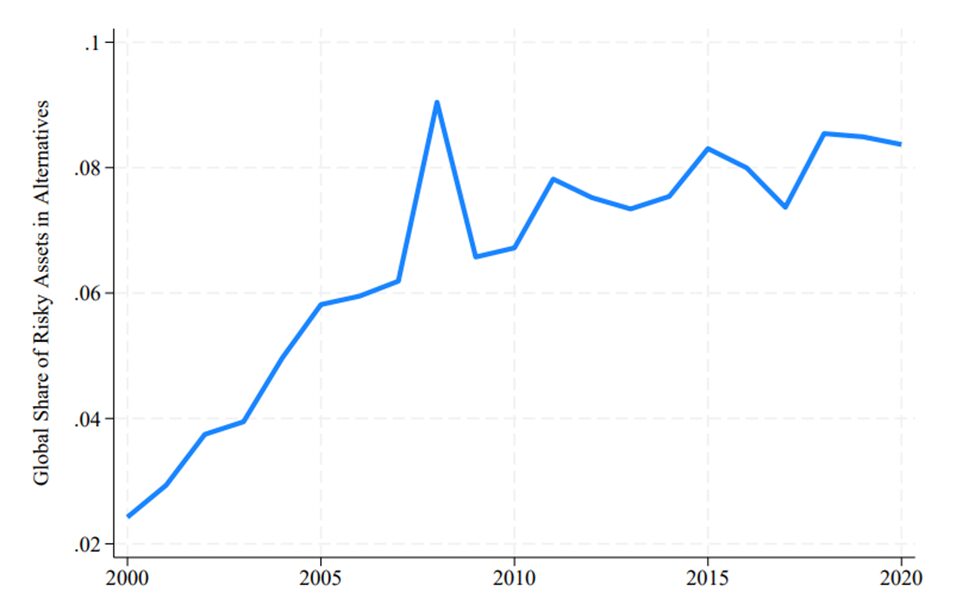

This rise in consultants’ beliefs about the alpha-generating ability of alternatives has coincided with a rise in the supply of alternative investments. The chart below shows that alternatives have gone from about 2% of global risk assets to over 8% of global risk assets from 2001 to 2020.

Figure 3: The Supply of Alternatives

Source: Begenau et al.

Alternatives may be only 8% of global risk assets, but many institutions are allocating about 40% of their portfolios to these strategies—a massive overweight, in our opinion.

It’s interesting that this increase has coincided with the widespread adoption of passive indexing. My theory would be that the evidence from SPIVA reports has led many investors to be skeptical of active management in long-only equities, but that skepticism has not diminished their desire to seek outperformance. So as assumptions about the alpha generated by active management in liquid markets—where data is clear and transparent—have declined, assumptions about the potential alpha available from alternative investments have increased.

But in an alternatives universe that has quadrupled in size and where every large investor now has an allocation, is there really more alpha available than there was when alternatives were the wild west and their adoption was limited to a small pool of smart and adventurous capital? And is that alpha sufficient to overcome substantially higher fees and compensate for illiquidity?

Article sourced from Verdad’s weekly research.