While the S&P 500 reaches new highs, I’ve taken the opportunity to reread Margin of Safety by Seth Klarman. While rereading, I rediscovered the story of trading sardines. The old story goes that after sardines disappeared from traditional waters in California, commodity traders sent the price of the sardines skyrocketing. One day, a buyer of these sardines decided to indulge, so he opened up and ate a can of them. After doing so, however, he became immediately ill. The man consequently returned to the seller to complain, and was told that the sardines he had consumed were not “eating sardines”, but rather “trading sardines.”

This story goes to show how in the short-term, investors may ignore logic and bid up securities without regard for their intrinsic value; the spoiled sardines in the story should have had no value, yet were bid up anyway. In a similar way, we may now be observing software companies turning into “trading sardines”.

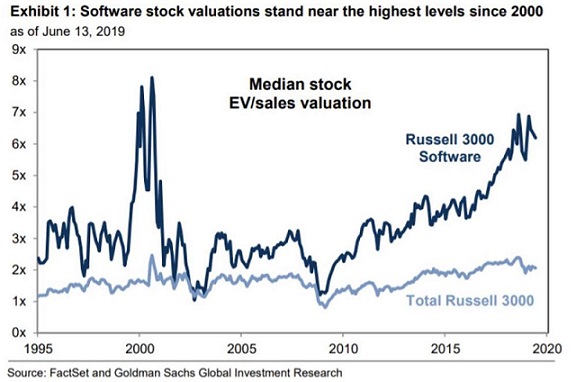

Buying software companies and getting the instant gratification of stock price appreciation in the form of multiple expansion has sent software revenue multiples close to 2000 levels. Short-term investors tend to not weigh the risks of either multiple contraction nor performance not living up to expectations. Similarly, these investors in high revenue multiple software companies continue to add to the flywheel of continual multiple expansion by attracting more capital (which they are able to achieve given that their multiple expansion-reliant strategy has worked well in the last 5 years). Only time and patience will reconcile trading values to intrinsic values.

– Andrew Leaf, Analyst

Information provided on this site is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product. Advice may only be provided by Cove Street Capital’s (“CSC”) advisory persons after entering into an advisory agreement and provided CSC with all requested background and account information.

From time to time on our website we may offer direct access or ‘links’ to other Internet websites. These sites contain information that has been created, published, maintained or otherwise posted by institutions or organizations independent of Cove Street Capital LLC. CSC does not endorse, approve, certify or control these websites and does not assume responsibility for the accuracy, completeness or timeliness of the information located there. Visitors to these websites should not use or rely on the information contained therein until consulting with an independent finance professional. CSC does not necessarily endorse or recommend any products or services described by these websites.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. You should not assume that any of the securities discussed, if any, are or will be profitable, or that references we make will be profitable.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our ADV Part 2A. A copy of CSC’s current written disclosure statement discussing the Company’s business operations, services, and fees is available on our website and also upon written request.

Cove Street Capital requires a modern browser to look and function properly.

Internet Explorer stopped receiving updates in January 2020. Using it may cause display issues on our website, and put your own online security at risk. We highly recommend switching to a secure modern web browser such as Chrome, Edge, Firefox, or Safari.