The Good News Is We Are on The “Public” Side

Managing $163 billion is not easy. What this piece points out is: It’s generally right. “Private” or “Alternatives” are a good idea only when practiced

Managing $163 billion is not easy. What this piece points out is: It’s generally right. “Private” or “Alternatives” are a good idea only when practiced

“Logic and experience indicate that barring investments in a major, integral sector of the global economy would—especially for a large endowment reliant on sophisticated economic

I have been an on-again, off-again subscriber of the Journal of Applied Corporate Finance (and a predecessor) for more than 20 years. It is worth

Download a recent speech by noted Soros “sidekick” Stanley Druckenmiller

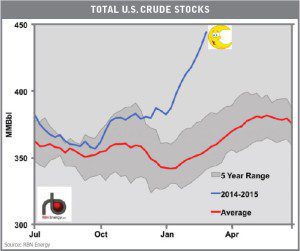

by Eugene Robin | Research Analyst The magnitude of the recent price decline caught many of “us” off guard and caused many (including Cove Street)

From time to time I have embarrassing moments, like admitting I have read L.J. Rittenhouse’s book, “Investing Between the Lines: How to Make Smarter Decisions

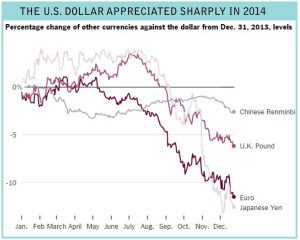

by Dean Pagonis | Research Analyst We think you might have noticed the dollar has been appreciating versus most currencies. (Have you heard the one

This report remains the single most coherent and consistently negative argument against…a lot of things we do.

Mr. Gideon King’s parting notes on his decision to close down his hedge fund business: “Controlling capital and engaging intellectually is good work if one

From time to time we must look in the investment mirror and conclude that we are stinking and we have no one to blame but

Download Cove Street Capital’s January 2015 Strategy Letter Number 19, “The Great Complacency…Continued”

A friend of ours who works for a well-known activist firm summed it up perfectly when he said, “We are living in the era of

A senior member of our investment team read this transcript and couldn’t help but replace the words “investment management” in lieu of the subject being

Read Part I: “The Worst Piece of Corporate BS,” 02/11/2013 A recent article in the Wall Street Journal penned by Michael Dell is so full of

“The hipster effect: When anticonformists all look the same” by Jonathan Touboul

This is a very nicely done and thoughtful piece about a topic that every serious, long-term shareholder eventually faces, despite best intentions.

Download Cove Street Capital’s September 2014 Strategy Letter Number 18, “Metastability”

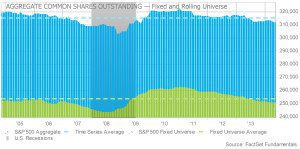

Of the myriad of reasons proffered daily as to why we are the verge of stock market doom, a “decline in share repurchase” has come

Politics aside, we are regularly asked by large institutional clients, “How is Climate Change affecting the way you invest?” Our short and practical answer is

In regard to Tesla… Having defended our more cautious stance for over a year, we find ourselves torn in upgrading as it is clear substantial

by Ben Claremon | Research Analyst As long-term-focused investors, we have a certain disdain for the quarterly earnings rigmarole and the associated maniacal focus on

Download Cove Street Capital’s July 2014 Strategy Letter Number 17, “Hockey is Nothing Like Investing”

Our takeaway on Janet Yellen’s speech is three-fold: We paraphrase: “Wise regulation, which is mostly now in place globally, will ensure that future financial crises

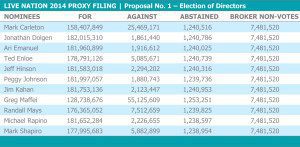

The “Entertainment Business” is well known for having a callous disregard for other people’s money. The origins of Live Nation (LYV) and some of the

by Jeffrey Bronchick | Chief Investment Officer Fender tried to go public in 2012. It failed and here is why. In how the world should

Read this article from the New York Times and replace many of the nouns with “investor,” “stock,” and “investment industry.” Long before social media, Wall Street

RECENTLY ADDED: Conservative Investors Sleep Well – Philip A. Fisher Good Strategy Bad Strategy: The Difference and Why It Matters – Richard Rumelt Organizational Intelligence:

by Jeffrey Bronchick and Ben Claremon We have been thinking about this issue for a few weeks, tempering our urge to dash out some heated

Alleghany Corp’s 14A — This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any