Yes, Another Genius Paper on Smallcap With Which We Agree

From Research Affiliates: Small Caps, Big Opportunities: Investing Beyond Large-Cap Stocks By Que Nguyen, Xi Liu, and Mario Albuquerque In today’s market, the historically wide

From Research Affiliates: Small Caps, Big Opportunities: Investing Beyond Large-Cap Stocks By Que Nguyen, Xi Liu, and Mario Albuquerque In today’s market, the historically wide

I will admit to a man-crush on Fernando. This is on the money if I feel like expressing an opinion on the last week. Spoiler

While we think “client communications” are for clients – this is a clip in the absence of spouting any well-articulated nonsense on the topic of

First off, subscription to the Free Press is mandatory. And I simply second the motion. A sovereign wealth fund for a country that is 30

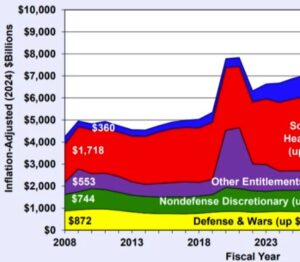

DOGE is fun, but it is unlikely to make a real dent in Fed spending. Cutting 25 per cent of federal employees would save only

Unlike most of the rest of the world, I will attempt to minimize all there is to say about the beginning of the next 4 years, as the persistent yack and what to make of it reverberates in all corners of the financial globe.

Despite the usual breathless fawning, let’s face it, Buffett’s latest letter reads as if it’s the last one and he duly notes it. And it’s

One can correctly argue that what comes out of a politician’s mouth is some combination of what someone told him to say, the last thing

Charles Skorina is an interesting “old hand” – CharlesSkorina.com – who runs an executive search firm for the endowment world. And I like his letter.

we started an LP 3 years ago to capture and execute on opportunities that were outside the box of many institutional clients in terms

A few hundred years ago, shortly after beginning Phase II of life as Cove Street Capital, I was “summoned” to a very large allocator organization, after 10 years of annual treks and pitches to zero avail.

I like writing about investing. I wrote a quarterly investment letter for the fund when semi-annual was all that was required. But the nonsense that

The Federal Reserve’s decision to cut short-term interest rates by 50 basis points in September 2024. The management of the LA Fires in 2025. Arguably

Statement from David B. Burritt, U. S. Steel President and CEO, on Today’s Order by President Biden January 3, 2025 – President Biden’s action today

Cliff Asness of AQR Continues to Write From the FU Money Standpoint for Our Benefit Private Equity Public equity performance hurt, particularly in the U.S.

A Federal Court struck down the rules that have required thousands of public companies that trade on Nasdaq Inc. exchanges to have at least one

At the 2018 Berkshire Annual Meeting, Buffett noted that “multiple times in my life, people have felt the country was more divided than ever….and after

On Friday after the close, ISSC filed an 8-K giving the CEO of a $134mm market cap company a stock package that could have been

Yes, you are the CFO of a public company in the Great Era of Degradation in the quality of reported earnings. And yes, because “all

“Buy these X stocks because Y will be elected.” Using the KBW Regional Banking Index (KRX), there was a 20% gain in Q4 2016 on

We own this with roughly a $12 cost basis. We have always liked smallcap aerospace and defense. They can have oddball, profitable niches in an

Byrne Hobart thinks..not always correctly but that isn’t the point. He makes you think. “And it’s an elite school story: it opens with an anecdote

If a Soft Landing Is in the Cards, Why Aren’t Small-Cap Stocks Rallying?

From WSJ.com Wall Street Races to Bring Private Credit to the Masses Investing titans are jostling to launch funds made up of hard-to-trade private loans

While the beach version of SoCal has had an epic, non-marine layer summer, it seems to have been enjoyed by few locals who instead violate

So a few weeks ago, we put out a “bookish” piece on our efforts to effect Board change at a holding, Motorcar Parts of America

We have referenced Byrne Hobart’s The Diff newsletter any number of times as well worth reading. He thinks and writes as well as anything I

FTI Consulting August 2024 Newsletter Given the explosive growth of leveraged credit markets over the last decade, the ascendance of private credit, the extreme lengths