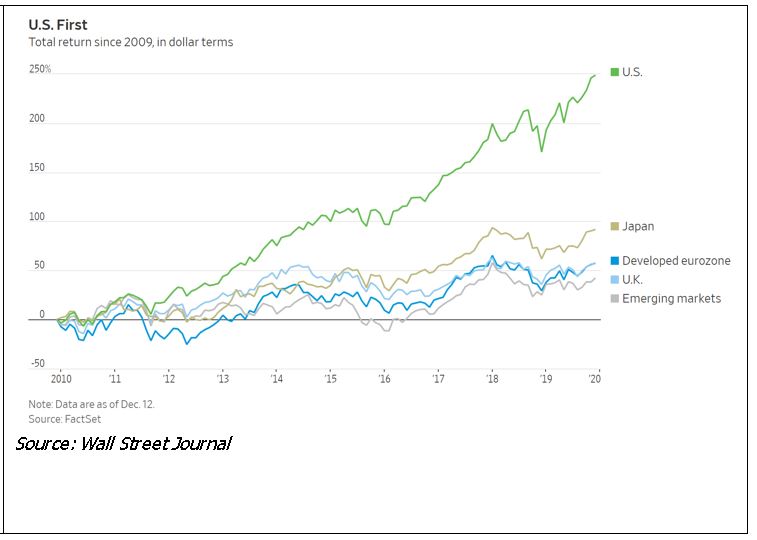

Our favorite new acronym (within an industry that has far too many) is “TINA”. TINA is not the name of a person or object. It is a concept. TINA stands for “There Is No Alternative”, and in the case of financial markets in 2020, it specifically refers to the idea that there currently is no alternative to buying stocks, particularly U.S. stocks (please see the above chart to understand why). To provide a brief illustration of the how we believe TINA is distorting asset markets, we will focus on the S&P 500. But, a lot of the foregoing is true for all of the U.S. stock indexes. We think it is safe to assume that, in general, investors prefer to stick with what is working. As the aforementioned chart indicates, that has been U.S. stocks over the last decade. As an asset allocator, if you have the choice of investing in E.U. sovereign debt that has no yield (or even a negative one) or Eurozone stocks that have underperformed since 2010, why wouldn’t you instead invest in U.S. stocks and bonds? On top of that, the dividend yield on the S&P 500 is about 1.8% right now. So, if you invest for a pension fund that requires a 6% return just to maintain its funding levels, a rising S&P 500 with a decent yield looks like a great place to park money.

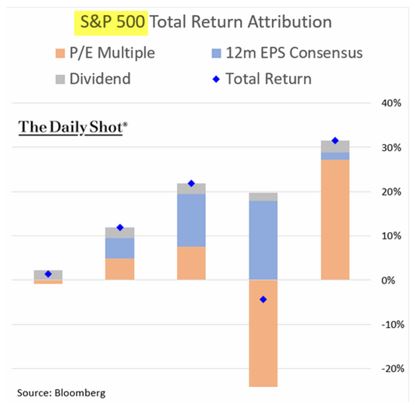

The issue is that corporate earnings growth is very tepid—if not negative . What that means is that the S&P’s rapid ascent in 2019—up close to 30%—was driven almost entirely by multiple expansion. The chart above from Bloomberg highlights the degree of multiple expansion. 2019 is represented by the far right bar—the one that is mostly orange. (If it feels like we are always talking about valuation, in fact, we are. Valuation—not Tweets, political machinations, GDP growth or global trade flows—is our north star.) In order to measure historical valuations, the Yale economist Robert Shiller maintains a database of the cyclically adjusted price-to-earnings (CAPE) ratio for the S&P 500. CAPE is a metric that is calculated by dividing the current S&P’s price by the last 10 years’ average earnings. It can be used, not as a market timing instrument, but as a barometer of where valuations stand relative to recent and distant history. The current ratio is around 30x versus the long-term average around 17x . While the current multiple is down a bit from recent peak in Q3 2018, it is still almost as high as it was during the latter stages of the late 90’s tech bubble—the only period within the last 30 years that had higher CAPE ratios than today’s. All of this brings us back to our friend TINA and the impact on an index’s valuation that money flows can have. In the short run, stocks are no different from any other commodity. An increase in demand without a coincident increase in supply of the same magnitude leads to rising prices. While the full impact of TINA on U.S. stocks is hard to quantify, there is no question that the S&P’s 2019 performance was bolstered to some degree by people seeing no better alternative to investing in U.S. stocks. Like we have said many times, investors need to be aware of the often hidden distortions caused by very ow global interest rates—with TINA being the latest example and the most obvious symptom being historically high valuation multiples. The point we are making—to really drive it home—is that stocks went up a lot in 2019; but our sense is that some portion of that is not being driven by company fundamentals.

Should we expect U.S. markets to continue to rise at the current pace? Maybe, but probably not. The long-term average return for the S&P since 1950 (excluding dividend reinvestment) is less than 8%. We are not going to argue with the fact that stocks generally rise over time. That is the history of the U.S. market. But, our sense is that we should expect lower than average future returns given the current valuations discussed at length above. We might be wrong about that in any given year but we will take the bet that today’s valuations will be an anchor that is stronger than anything that TINA can muster—over the long run.

That being said our concentrated portfolio of eclectic securities does not require multiple expansion or heroic growth to be a good investment over the next few years. Each holding has internal improvements and/or secular tailwinds that should drive growth in earnings and most importantly, free cash flow. Further, even within difficult end market conditions that include all kinds of uncertainties that invariably flash across the news screen each day, generally speaking our companies continue to plow forward at a surprisingly robust pace. Despite that, none of them trade at excessive valuations. Irrespective of the overall market valuation, we continue to find new (at least to us) unloved, unappreciated and under-followed securities that fit our investment criteria and that trade a material discount to our estimate of intrinsic value. Sadly, just not quite enough of them…to date. We are hopeful that 2020 brings myriad opportunity to deploy cash in securities for which we see a suitable margin of safety.

Ben Claremon

Principal and Portfolio Manager1. https://www.wsj.com/market-data/stocks/peyields

2. https://www.barrons.com/articles/slowing-corporate-profit-growth-isnt-the-recession-signal-some-investors-fear-51573242301

3. https://www.gurufocus.com/shiller-PE.php

4. https://dqydj.com/sp-500-return-calculator/Information provided on this site is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product. Advice may only be provided by Cove Street Capital’s (“CSC”) advisory persons after entering into an advisory agreement and provided CSC with all requested background and account information.

From time to time on our website we may offer direct access or ‘links’ to other Internet websites. These sites contain information that has been created, published, maintained or otherwise posted by institutions or organizations independent of Cove Street Capital LLC. CSC does not endorse, approve, certify or control these websites and does not assume responsibility for the accuracy, completeness or timeliness of the information located there. Visitors to these websites should not use or rely on the information contained therein until consulting with an independent finance professional. CSC does not necessarily endorse or recommend any products or services described by these websites.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. You should not assume that any of the securities discussed, if any, are or will be profitable, or that references we make will be profitable.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our ADV Part 2A. A copy of CSC’s current written disclosure statement discussing the Company’s business operations, services, and fees is available on our website and also upon written request.

Cove Street Capital requires a modern browser to look and function properly.

Internet Explorer stopped receiving updates in January 2020. Using it may cause display issues on our website, and put your own online security at risk. We highly recommend switching to a secure modern web browser such as Chrome, Edge, Firefox, or Safari.