Grinnell College

There is a lot of money in the world and there are often fascinating stories behind it. This is a great story and what also

There is a lot of money in the world and there are often fascinating stories behind it. This is a great story and what also

I will ignore the somewhat silly premise of the book which was to analyze the emotional nature of “money managers” and thus glean some clues

Related: Plus ça Change, Plus C’est La Même Chose.; The Fire is Burning Leading Proxy Advisory Firms ISS and Glass Lewis Recommend OM Group Stockholders

Aside from a mayonnaise issue, one of the largest pet peeves here is the following: focusing one’s time on finding interesting businesses and values first

There is a very real temptation to think someone else is smart based upon the premise that they say things with which you completely agree.

A nice reminder for all of us…since it can seem easy to forget when one lives in a world seemingly full of unicorns.

“I don’t believe any of us have the pretension of believing that by being very good analysts, or by going through very elaborate computations, we

“I came, I saw, I purchased at a low multiple” …from Graham to Asness it still works. CLICK HERE to read more.

Investing other people’s money for a fee is fiendishly simple—just avoid being terribly wrong. This applies to widely diversified or concentrated portfolios. Read on.

Managing $163 billion is not easy. What this piece points out is: It’s generally right. “Private” or “Alternatives” are a good idea only when practiced

From time to time I have embarrassing moments, like admitting I have read L.J. Rittenhouse’s book, “Investing Between the Lines: How to Make Smarter Decisions

This report remains the single most coherent and consistently negative argument against…a lot of things we do.

Mr. Gideon King’s parting notes on his decision to close down his hedge fund business: “Controlling capital and engaging intellectually is good work if one

From time to time we must look in the investment mirror and conclude that we are stinking and we have no one to blame but

A senior member of our investment team read this transcript and couldn’t help but replace the words “investment management” in lieu of the subject being

by Ben Claremon | Research Analyst As long-term-focused investors, we have a certain disdain for the quarterly earnings rigmarole and the associated maniacal focus on

Read this article from the New York Times and replace many of the nouns with “investor,” “stock,” and “investment industry.” Long before social media, Wall Street

There is more to life than increasing its speed. –Mahatma Gandhi by Matthew Weber | Director of Trading + Operations Even though we are “investors,”

Press Release Young Broadcasting, Media General to Merge RICHMOND, Va., June 6, 2013 /PRNewswire/ — Media General, Inc. (NYSE: MEG) and privately held New Young

by Eugene Robin | Research Analyst I’d like to share with you a great book on the basic mathematics of the stock market written by John

by Ben Claremon | Research Analyst BERKSHIRE This past weekend’s trek to Omaha for the Berkshire Hathaway annual meeting represented the fifth consecutive time I

by Ben Claremon | Research Analyst Under normal circumstances, the prospect of leaving sunny Southern California to travel to a place where the day-time temperature

We have embarked on a longer-term project to digitize about 6 yards and 28 years of collected investment “literature.” Because this is the age of

As someone who does not watch CNBC unless I’m away from the office and utterly trapped in a small hotel room that only offers 5

I sometimes have a dim realization that I need the same intellectual lessons pounded into me over different time periods in order to avoid the

“Keynes the Stock Market Investor” is a pretty interesting piece that was partially excerpted in the Wall Street Journal several weeks ago, but being gluttons for

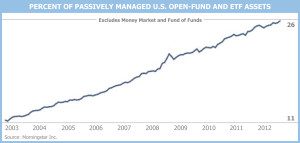

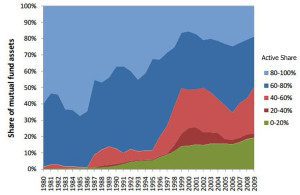

by Eugene Robin | Research Analyst Let us start by saying that this is not an essay on whether or not a large pool of institutional

While this is a wonderfully snarky clip from the Economist, if I were paying “2 and 20,” I am not sure I would think it’s

This report is published for information purposes only. You should not consider the information a recommendation to buy or sell any particular security, and this