Riddle Me this Batman

“Buy these X stocks because Y will be elected.” Using the KBW Regional Banking Index (KRX), there was a 20% gain in Q4 2016 on

“Buy these X stocks because Y will be elected.” Using the KBW Regional Banking Index (KRX), there was a 20% gain in Q4 2016 on

We have referenced Byrne Hobart’s The Diff newsletter any number of times as well worth reading. He thinks and writes as well as anything I

FTI Consulting August 2024 Newsletter Given the explosive growth of leveraged credit markets over the last decade, the ascendance of private credit, the extreme lengths

this makes CNBC and Bloomberg out to have the credibility of BBC reporting on Gaza.

I don’t know the Verdad people, but they tend to lean toward what we are thinking, so they are obviously smart and worldly people who

Even if one assumes this makes any sense, it will take a really long time to kill off the carbon transportation business.(Cars and Trucks) The

Alex Karp, CEO of Palantir on CNBC this week: “I love burning the short sellers. Almost nothing makes a human happier than taking the lines

Statement Dissenting from Approval of Proposed Rule Changes to List and Trade Spot Bitcoin Exchange-Traded Products

It doesn’t matter whether company size is measured as assets, market value, sales, revenue, or number of employees — bigger firms pay more … way more.

”But what if you found out that key data underlying that breakthrough were actually wrong?” Academic research is fun-ish. A problem with making money from

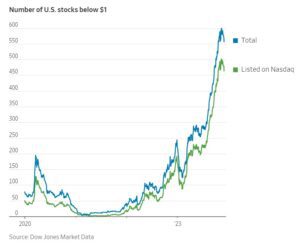

The idea of regulation and the establishment of a legitimate exchange is to ensure that phony and fraudulent ideas DON’T go public in the first place.

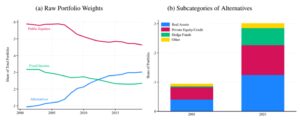

Let’s be clear. Investing money is really about one of at least three things: structuring a pool of capital to meet stated goals, simply making

The International Energy Agency has forecasted that demand for fossil fuels will peak before 2030. “I don’t think they’re remotely right . . . You can build scenarios, but

By Dawn Lim, Layan Odeh and Linly Lin (Bloomberg Businessweek) — In its heyday, Fenway Partners snapped up a fleet of companies from outposts overlooking

I would think the general institutional investor that is in Private Equity funds understands that they are buying into a pool of investments, each of

The world turns. New people are born and eventually move off the couch and into something resembling employment. And thus new generations of nonsense about

As the designated proxy analyst this spring, I had the recent pleasure of pouring over nearly 100 proxies – between both companies we do and

Clipped from a recent and almost always good The Diff/Bryne Hobart blog: First, there are some traits good investors need that are fairly stable over

This is from an X shareholder in CNX Resources we mentioned in a previous blog. “I was recently reading or listening to something – I

Said another way – bank blow-ups are garden variety stupid. The collective “we” rarely change. Said at least one other way, Man is a deterministic

Our experience says no. This is math behind it.

We don’t “do” a lot of macro – see last Berkshire annual for the 11,000th repetition why. But we like contrary thinking. And this remains

TYB is not a crime and we are in favor of it as much as the next person with a full position. But rarely do

Many institutional clients judge us on relative results vs the Russell 2000 Value. 25% of the index is in Financials which are mostly banks. Reason

Mean Reversion. Valuation Matters. Behavioral Finance- people take a long time to see, admit and react to change. Dot-Com Redux How to invest after valuation