BREAKING: We interrupt this regularly scheduled letter for a brief and likely useless take on “the virus.” The first issue is that when a market is on its tippy-toes on a stool reaching for a lightbulb, there is a material probability of a fall, one is just not sure exactly what is the precipitating event. This is one of those events that are not on the spreadsheet. Issue two is our sense that this is what defines a “transitory” experience, which does not mean it will not be painful for an uncertain duration. It means that for much of what we own, this is a “mark to market” exercise rather than a permanent impairment of capital. Thirdly, we have leaned into a few new ideas: Six Flags and Cinemark are examples of being horribly early, that represent this viewpoint. And now back to the program.

MARCH 2020 — We spend a lot of time in these pages endeavoring to wax poetically about the world at large and our investment place within it, even though that is not really what we do for a living. We get it. Some people just want to know our thoughts about the investment world…and yes, we do have opinions on that subject. But we are just not sure that ours are any more relevant than others—however well said—and industry compliance is always more annoying when we address specific ideas. We also suspect that investment success is distinctly uncorrelated in the short-run with an increasingly public stance and the amount of ink and PowerPoint which one devotes to it In other words, if you can be embarrassed by unforeseen events in the stock market, you probably will be.

The reality is that we mostly do a lot of reading and talking about businesses and the people who operate them on behalf of shareholders, and try to limit our activity in the marginally dumb things available to us on a daily basis in the search for:

The Really Good One. Paraphrasing the words of someone a lot older than us, a lot wealthier than us, and who has spent much more time in Omaha than us: “the reality is that good investing is work, work, work, and then be ready from time to time when a great opportunity appears, and then step up to the plate with all you prudently have.” (Oh, and be right.)

nd now we get the specific subject at hand. Here we are with ViaSat (Ticker: VSAT) stuffed in every allowable portfolio corner we can muster, including the personal account of your writer. Another takeaway from the aforementioned investor: take your position first, and then—from the enlightened height of your own self-interest—LET OTHERS KNOW. This is particularly relevant since a key weakness and annoyance at ViaSat is that they do not have a single PR bone in their collective body. This doesn’t have to be a corporate problem, but from time to time it is. The reader is now forewarned.

So what is a Really Good One? It tends to be a pretty decent business, with a pretty decent balance sheet, led by pretty decent people whose stock is being badly punished in the short-run by a “low probability / high severity” narrative with intellectual backing that can be crushed through some reasonable “System Two” cognitive processes and the passage of time. That process is usually the outcome of some unusually differentiated set of experiences and/or its own passage of time at the trough which enables one to take advantage of the “System One” thinking on display at the equity market voting booth. (We sent many of you the Kahneman book as a Holiday Gift several years ago—don’t tell us you just ate the chocolate and are not following this train of thought!)

Back to ViaSat. Let’s start at the beginning and state that our firm and its predecessor have followed the company since 2001. The writer was one of the largest shareholders at the time with a single digit entry cost per share. Partner Eugene Robin and, oddly enough, his father are former employees. We think we have a pretty good network in the satellite communications world—which is complicated, opaque, and far away from New York. And Wuhan. So we may well turn out to be very wrong, but it will be a well-thought out and off-Wall-Street-derived wrong. And while in real life, results—not process—win, good process tends to create long-term success and we are sticking with it.

ViaSat’s value proposition started in its core strengths—encryption and connectivity for the defense world. Massive IP and intellect spawned out of the Qualcomm/San Diego intellectual hub. The company was founded by, and is still run by, one Mark Dankberg, who is truly a “once in a generation” guy in an engineering/space/satellite sense. That was the attraction when we first owned the stock, but they had a fault, and one that happens to be relevant to today’s argument: they were—and to some degree still are—tone deaf to the idea of being a public company.

“Winning” in a technological sense is crucial, but not necessarily sufficient as a public company. Things like collecting cash from your defense receivables so your balance sheet doesn’t strain and risk equity dilution are somewhat important to the mere shareholders. And we were still somewhat unclear on the math behind “we are now going to take our expertise and shareholders over to the commercial side of the world, build our own satellite, and run a retail internet business.” These investor questions enabled entry at a very reasonable valuation. We whined at the company about the propellerhead-to-finance ratio and were grudgingly accommodated. I think they might have had other words to describe the process.

But, in Dankberg we trust. Besides growing the defense/Government Systems business terrifically (we will go into this in some detail shortly), they have been enormously successful in internalizing their IP and building, launching, and running commercial satellites and services via Satellites ViaSat 1 and ViaSat 2. So much for our opinion. The stock went from $5 to $45 over some years. But the portfolio manager was NOT along for entire ride, having sold in the mid-teens. It then went to $90. Let’s label this “intellectual flexibility”.

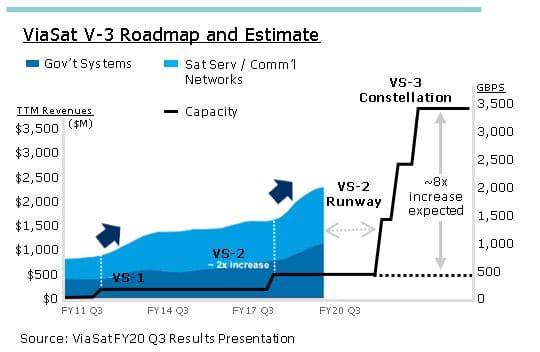

Where ViaSat has essentially been able to improbably run the technology table for years is building geostationary (“GEO” for short), High Throughput Satellites with quantum leap upgrades in bandwidth delivery at the lowest cost per bit relative to anything that can be considered remotely competitive. The company’s efforts are focused on geographic areas and users that are simply not going to be near a fiber optic cable or a 5G build anytime in the next decade. It is not just John the Rural Farmer, but a varied mix of military and commercial users, whose hunger for connectivity has been expanding by the day. ViaSat 2 enabled more and geographically diverse bandwidth, the first legitimate unlimited in-flight Wi-Fi (look at the stocks Gogo (Ticker: GOGO) and Global Eagle (Ticker: ENT)), a variety of military applications for which someone would have to kill you to reveal, and “community Wi-Fi” projects in places like Mexico and Brazil. The name of the game is the following: ~$900 million dollars to build satellites and their ground infrastructure, and then fill the bandwidth capacity by delivering to the user the lowest cost per bit of bandwidth. They have crushed this game.

But one recurring problem as an equity investor in ViaSat is that the return on capital and “terminal cashflow” numbers are difficult to tease out. Firstly, the disclosures from the company have been lousy on this front, a subject on which we are pounding them by the day. The second is that they are pursuing what we think is a logical business strategy: if you are earning “north of 20%” pre-tax returns on new satellite and base station spend, then you should continue to be pedal to the metal on capital spend to take advantage of excellent economics and a technological lead. The assumption requires some faith in management’s judgement, because it is not 100% clear that is the case from reported financials. (Pause and see CSC blog post Satellite Potshots.) If that is a correct assumption, then the problem for an outside investor is that you aren’t seeing the free cash flow because it is immediately reinvested into the next generation satellite(s). If that is a correct assumption, then it is the right thing to do. Ask John Malone if he stopped at a 3-state cable cluster.

In the meantime, the process creates what looks like a great short: “Hey, I can’t easily see the underlying economics on what they are spending and it looks like they are not stopping the spending to show me.” It has been an issue for the stock, which tends to go up x months after a spend cycle is over and you get a glimpse of what the “we are done” economics look like, and then the stock retreats or goes nowhere for y period of time when the next gen spending begins or is announced.

Once again, IF the assumption is correct, then each down period has been the opportunity to make money outside of what we think is an upward trajectory in intrinsic value. More services, higher value. We have successfully leaned into these movements in the market on both the buy and the sell-side.

But something is a little different today, and the stock going from $90 to $55 is a little more painful than the normal “just taking a break” deflating. On one hand—and our money says this is the hand to play— 2021 will be the year they launch the first satellite of the ViaSat 3 constellation, a series of three “badass” satellites. This will expand bandwidth at lower costs per bit to new users and new geographies, in a very big way. And again, if you are looking at “north of 20%+” returns on spend…do it big. ViaSat 3 uses a lot of existing ground infrastructure (huge when we get to the next part) and is simply a massive upside for the stock if it plays out reasonably—as we see it.

What is “new” is that we seem to own the only company in today’s world that is not being rewarded for sacrificing near-term profitability and cash flow for long-term growth and value. That is the result of the billions that have been raised in an attempt to launch theoretical ViaSat competitors utilizing LEO (Low Earth Orbit) constellations that deliver ultra-fast, low latency internet to the uncovered masses. And the internet of things. While lofty in their goals and interesting in their design (and who doesn’t love celebrity influencers/backers like Jeff Bezos, Elon Musk, and Softbank?), the history of LEO is not good and the future remains unproven. With 71% of the Earth’s area covered by water, the typical LEO satellite spends most of its orbit beaming “ultra-fast internet” to various ocean mammals, who at last market check are high churn subscribers that are difficult to properly bill.

Underserved populations are plenty but the price points at which those populations would start to throw their pesos, dinars, rupees, and pulas at the LEOs makes system economics difficult to comprehend. While wealthier underserved communities exist in the West, those communities have the opposite problem: with increased bandwidth availability comes increased usage, which is a problem for small satellites with fixed capacities. As such, LEOs will be grossly uncompetitive with terrestrial offerings in reasonably populated areas.

Other issues that don’t seem to get much press regarding LEOs is their massive maintenance capital needs. While geosynchronous satellites stay functional for 15-25 years, the typical LEO is done in 3-5 years, albeit at cheaper and cheaper prices for rebuild and relaunch. The space press seems to only focus on “spend in the sky” when in fact the build-out of ground stations and “system stitching” is hugely expensive as well. It requires a massive global effort to place both assets and sell service across innumerable country jurisdictions, a process that requires a very long political time horizon absent bribery and joining a communist party. None of this has been “done” in the history of gender-neutral-kind. In the meantime, your asset and cash-burn clock is ticking, a definitive factor that may conceivably matter in the future. We recognize that the promise of LEO is “low latency” which all else being equal, is a superior offering for some services versus a geostationary satellite. But all services do not necessarily require low latency, and cost per bit is as relevant a concept as latency in an awful lot of use cases.

Since ViaSat’ s assets are either 22,000 miles in the sky or housed in Arizona/El Segundo, both of which at the present time are Covid-19 remote, this “debate” seems to account for the relentless drubbing of the stock of ViaSat as we speak. This problem just delights those who seem to have nothing to do but faun about the future with endless supplies of digital ink, while ViaSat remains deadly quiet. And in fact, the competitors have entered recent “debates” by making insanely large promises that are distantly and remotely actionable. Yes, there is a distinct non-zero probability that things change and LEO is now entirely doable. Satellites are cheap, and launch costs are plummeting. And it is also possible that even if we are right on the technology and economic issues, it doesn’t matter to “these people.” Money is being spent, assets are going up, and these factors will simply crush the economics of the ViaSat 3 constellation, making it a $900mm spend with subpar economics. Competing with completely uneconomic business models backed by nearly free money is a problem for a number of industries and it can be painfully real.

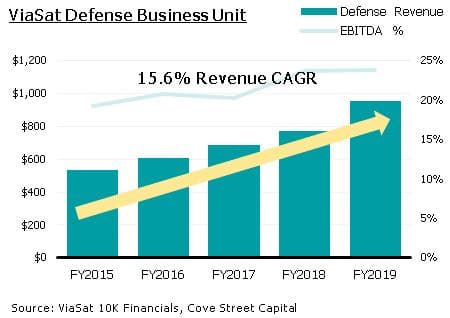

And thus we return to the value of which few seem to speak: ViaSat’s Government Systems segment—the defense business. Here are the 5-year trailing numbers:

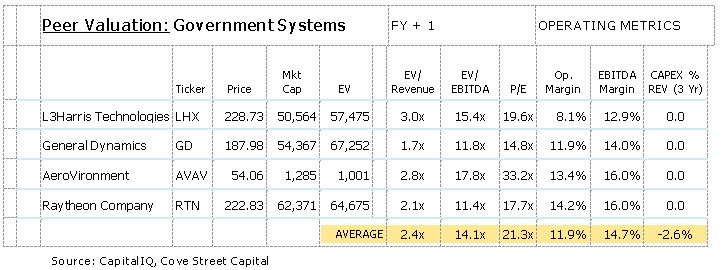

Here is the valuation of some peers:

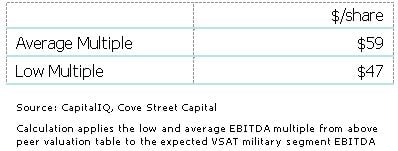

Here is what that means for just the Defense Segment of ViaSat on a per share basis:

We go back and forth on just how theoretical this is, but in industry conversations over the past 19 years, we would suggest that multiple indications of interest in the business may be telling. (“If they would, we certainly would.”) For an equity investor trying to “weigh” things, this matters a lot. The outcome of the GEO vs. LEO battle will only be revealed with the passage of time. But if your downside is boredom over the next 3 years because of the often overlooked defense segment, the risk/reward starts going asymmetrical and that is what we live for. An unpopular asymmetric bet with fat upside.

And what if something good happens? What if the dismal history of LEO continues and this whole debate falls into the “yack of the day” dustbin of financial history? What if it turns out that offering “bandwidth in the sky” is actually best accomplished through a combination of GEO/LEO infrastructure, a solution that is actually envisioned by any number of technical papers filed with regulatory bodies by many of the same names noted above? What if ViaSat, an acknowledged leader in ground station hardware and software, actually benefits from an explosion of complexity offered by multiple and competing LEO systems? What if VSAT actually puts up its own LEO system, like the one it was chosen for by the DoD recently?

There are other risks, like satellites becoming fireballs upon launch while you live-stream, or launch windows interminably delayed. Or the possibility that we have an unhealthy crush on ViaSat management and overweight what comes out of their mouths, however infrequently? Or ViaSat management pursues technological accomplishment at the expense of value per share? Or some other Stone Cold Stunner.

All possible. We have a LOT more analysis and thought behind this summary. But we are not paid by the PowerPoint page; we are paid for results. As noted above, we try hard not to be swayed by the nonsense du jour. We tend to “lean” into things on both the buy and sell-side, as probabilities about the future are weighted in our process. But, from time to time, there is an alignment with our work and the ability to take a bigger swing. This is that moment.

Jeffrey Bronchick, CFA

Principal, Portfolio Manager