At the 2018 Berkshire Annual Meeting, Buffett noted that “multiple times in my life, people have felt the country was more divided than ever….and after every election you’ll have people feeling the world is coming to an end and, you know, ‘How could this happen? Through it all, you know, America — in fits and starts — but America really, really moves ahead.” And somewhere else he noted that “for 240 years, it’s been a terrible mistake to bet against America, and now is no time to start.”

So says the guy with the largest cash position in the world and is selling Apple and Bank of America every week with the enthusiasm of Elon Musk at his first SEC budget meeting.

Getting this out of the way, 2024 has been somewhat of an annoying bummer on an Aaron Judge postseason scale. Here is an example that played out in two remarkably similar episodes. In both cases, we were sitting on long term, five-baggers when the CEOs call us directly and ask WTF is happening in their stocks, as they don’t understand the lofty valuations. In one case, we witnessed $1mm of insider selling following the call. So that seemed like a relevant data point, and it wasn’t as if we didn’t have a half dozen other investments that were trading like paint drying to which we could, in a disciplined fashion, recycle capital. I am sure you know how this is trending. The two in question are up big since we made the sales, and the recycled recipients are unchanged. Disappointing…though we stand by our process and would suggest our recently deployed capital has less to lose and more to gain heading into 2025.

Because we are busy and Jim Grant and Co. do such a great job at this, with publisher permission, we present this page as a pretty decent summary of what we are referring to as “speculative nonsense.” Our favorite is “The Market is Expensive But Don’t Sell Your Stocks.”

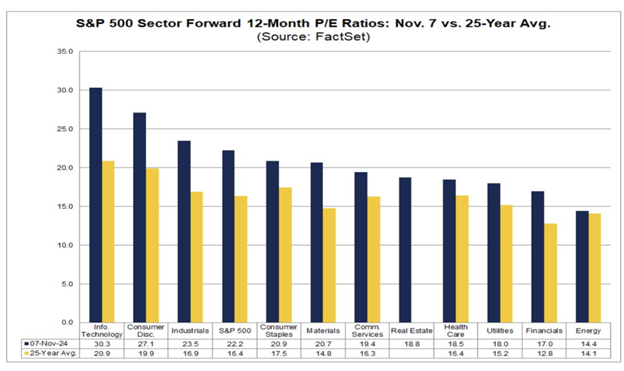

We have little idea of the intermediate future other than some “leans” that are supported by a lot of financial history and some “nose” for what subtly lurks in financial markets. Strong trailing returns tend to steal from the future – by stock, by asset class, by market, by geography. Boom. Yes, in the shorter-run there is the momentum uncertainty designed to make you look stupid for trotting out a series of rational historical arguments, but every annoying “pre-DEI” CFA statistic is suggestive of expensive in almost everything but emerging markets and U.S. small-cap (the over/under was 150 words for that mention). So yes, you should lean into reducing silly valuation and higher than you thought weightings. And re-allocating.

It’s not all 7 stocks. While this page has whined about the idiocy of predictions based upon “forward P/E,” which consistently demonstrates uselessness as a predictive metric (shake up an 8-ball for a higher R2), this chart is directionally correct. The Big 7 drags money into the index and voila – it looks expensive across the board. I am sure you expect me to insert “but small-cap blah blah” here, and you would be right – my fingers are thinking it as that part of my brain is simply fatigued at the thought and too busy contemplating what good wines to hide in the pantry during family Thanksgiving efforts.

But despite the “Trump small-cap rally,” which has been nice as hell, the narrative that all things equity will be good has a long way to go to prove itself out. We would also suggest it is highly likely the “Trump winners” will be more selective than current market movement suggests. Tariffs are not good as a historical rule for any economy older than 30 minutes, and its application will be through the usual messy political sausage grinder. Refreshing the bodies at the top of current and new agencies seems like great fun reading online, but there is a decent argument to be made about any variety of businesses freezing decision-making until they see what is what. And the recent meme craze of “identifying and buying everything that is heavily shorted” seems unlikely to have legs. “In-sourcing” to a U.S. domiciled manufacturing base is not per se a gift to smaller companies, most of whose revenue is selling to larger companies who will be doing the outsourcing reversal.

But yes, saying it out loud: business…and eventually…equity assets…should do better with an administration that at least faces in the right direction and says generally business-friendly things. Big money and leverage like reassurance rather than getting pounded in the face daily with morality threats. These pages don’t particularly care about your feelings, we are being paid to make money.

But it is funny how the future remains uncertain, and in the words of Keynes, reading the faces of the other judges is a lot different and harder than believing your lying eyes and facts.

To wit: small-cap banks, which constitute 20%+ of the Russell 2000 Value index. After the first Trump win, the KBW Regional Banking Index (ticker: KRX) returned a 20% gain in Q4 2016 on the theory of Trump being good for business and a sense of less regulation and FTC interference driving needed industry consolidation. And yet, in Q4 2020, the KRX rose 30% after a Biden victory. And both sets of gains died on the vine over the ensuing 3 years. The SPDR S&P Regional Banking ETF (ticker: KRE) returned 17% under Trump’s first term vs. the 80% 500 S&P return. That same ETF returned 33% under Biden up to election day vs. a 60% S&P 500 return over that same period. What we are hinting at is not just that smaller banks are lousy investments once you start compounding a 7% ROE from any point other than 75% of real book value, but that “betting” on the political yack of the day and how it might affect X industry is not worth your time. The sausage shop hasn’t even moved into the new space yet.

There is all this great stuff in the Yackosphere that would be nice to wake up to in 4 years. But wow, what a solid mess to come and sadly be compressed into the next two years given the ides of mid-cycle elections…and then the gearing up for yet ANOTHER experiment in democracy rearing its fund-raising head. For example, the HHS department is 80,000 unionized and pensioned civil servants sitting below 2,000 political appointees who have two years to decorate new offices and create PowerPoints before going back to normal lives. It really and truly is difficult to see meaningful and long-lasting progress in governmental reform, whether you are talking philosophical change, process change, efficiency change, or dollar change. You really do need two consecutive terms of anyone to really dig deep into the proverbial swamp, and thus making large dollar bets on anything but a trade seems like a difficult investment process to get right because I somehow doubt the decision-making to buy Froot Loops or Twinkies on aisle four is going to be driven by RFK policy.

So we wait and see what falls up or out. And gauge the math of the valuation of a company in relation to the rumors/facts d’jure for the next two years and see what makes sense.

Alan Greenspan, still stalking DC today as a 98-year-old, was famous for this paragraph:

How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy?

Which is another funny ingredient in the witch’s brew. AI yack and a nearly a half trillion dollars of capex running mostly through an NVIDA market cap aside, the Federal Reserve pivoting toward rate cuts has been a huge driver of stock market support in 2024. Almost every single earnings report has somewhat referenced “lower interest rates” since March, and sure rates were cut. But one wonders.

The Federal Reserve has been so eager to lower interest rates that it may wind up having to raise them again? I don’t think that is a concept that is priced into equity valuations – running 20 to 37 times cyclically adjusted earnings for U.S. indices if you buy into that valuation stuff. Changes in inflationary expectations are predictions beyond our paygrade, but stocks, gold, and crypto are rocking, credit spreads are at 2007 lows, and record high yield debt issuance is occurring with crappy terms – “speculative nonsense” is everywhere. Is this an environment for another rate cut? The 10-year Treasury yield is trading in the 4.40’s as of this writing, which is some 81 basis points above its low on September 16…the day before the Fed cut rates by half a percentage point. When might this matter?

Let’s assume Fed honcho Jay Powell stays in his “non-political” seat until mid-2026, which would be a good thing given all the change elsewhere. He channeled his finest Greenspan in a recent speech by trying to make it clear that possible changes in policy under a new Trump administration would not be taken into account by Fed policymakers until those policies were enacted: “We don’t guess, we don’t speculate, and we don’t assume.” Which is obviously very funny. I guess he can leave all that to incoming Treasury Secretary, Scott Bessent who has minted serious coin under Soros and his own fund with occasionally prescient macro bets.

All of which is fancy talk for things that go on around us. Practically speaking, we run money in a concentrated Limited Partnership – “6 to 10 investments” and a select group of separately managed accounts that are somewhat more diversified. We pay close to attention to what we own, blending tight spreadsheet analysis with a very wide net of contacts involving competitors, industry nosiness, current and former C-level executives, Board level relationships, and other investors who occasionally know a crapload more than we do in a specific situation. (OK, rare, but it can happen.)

So yes, we are in the top quartile of periods of speculative nonsense that I have seen in my career. We have been leaning against it. Which doesn’t mean there is “nothing” to do – we remain fully plated with ideas and spring loaded in most of what we own. But if you are running a lot of money, you should be leaning against this wind.

We close with several pivots involving Cove Street and “the industry.” We have made some internal changes. I would naturally point to Michelangelo’s alleged comments on the creation of David, in which he was noted to have said that the process was simple: remove everything that is not David. Over the past two years, we have removed legacy strategies, un-aligned and uneconomic clients (along with 40 page quarterly DEI questionnaires), and somewhat sadly, internal people (all of whom have found great homes) in order to focus on less restrictive, focused investing. Business characteristics, valuation, partnering with people who are aligned with shareholders. The ability to invest around the capital structure, the ability to directly serve on Boards and BE the catalyst. Yes, we are closing our Mutual Fund albatross, which will also enable members of CSC to directly serve on Boards and reduce “people basis risk.”(If you are asking, the PM’s money is going into our LP.)

I grew up professionally at a classic version of Neuberger and Berman, which someone at the time noted was a firm for “old guys and their parents.” On a recent podcast, Stanley Druckenmiller, 71 years old, stated he starts his day at 4 am. “I immediately go to the Bloomberg, I make a cup of coffee…check all the markets… I take a shower, go to work, start all over again.” Well, we don’t have to worry as much about global markets and leveraged currency, so replace 4 with 6.

Druckenmiller is worth $7 billion-ish. Clearly, he no longer does this for the money. He thinks being “overly competitive” is the hallmark of great money managers. His advice? Only enter the game if you love it…there’s too many people in the business like me that just love the game.”

Something like that is in play at Cove Street Capital…and we are very open to like-minded partners.

A very best to friends, family and health.

Jeffrey Bronchick, CFA

Principal, Portfolio Manager

Cove Street Capital, LLC

*The opinions expressed herein are those of Cove Street Capital, LLC (CSC) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. Consider the investment objectives, risks and expenses before investing.

You should not consider the information in this letter as a recommendation to buy or sell any particular security and should not be considered as investment advice of any kind. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this newsletter. Recommendations made for the past year are available upon request. These securities may not be in an account’s portfolio by the time this report is received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage of the account’s portfolio. Partners, employees or their family members may have a position in securities mentioned herein.

CSC was established in 2011 and is registered under the Investment Advisors Act of 1940. Additional information about CSC can be found in our Form ADV Part 2a,