We really wanted to like what we read in the recently-released proxy statement for Acuity Brands (AYI). In response to an awful say-on-pay result from the last proxy, AYI made some optically attractive changes. The company got rid of EPS as a metric for short-term and long-term comp. It even added an ROIC component to both short-term and long-term comp. However, the issue is that, when crafting the thresholds, AYI created a bar so low the company can literally not improve ROIC at all and still award its executives the maximum shares and fund 100% of the bonus pool.

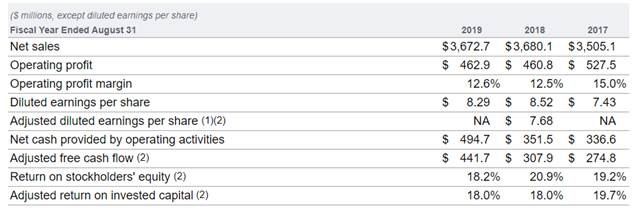

To better understand our disappointment with the comp plan, let’s start with the below chart that highlights the company’s recent results:

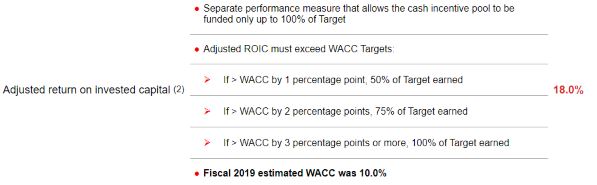

As you can see, Adjusted ROIC over the last 3 years has been 18%+ and elsewhere within the proxy statement AYI identifies that its Weighted Average Cost of Capital (WACC) is 10%. Unfortunately, as the next chart shows, all the company has to do is generate an ROIC that beats the WACC by 3% to get the total bonus pool funded at target. If your starting point is 18%+ and your hurdle rate is now 13%, what is the point of using ROIC as a metric?!?!

This is an example of a comp plan that checks a lot of our boxes. AYI’s structure rightly focuses on ROIC and free cash flow. The issue is that unless a company sets targets and hurdle rates that are aggressive but achievable, there is a risk of compensating for mediocrity. We scrutinize the proxy statement precisely to find discrepancies and inconsistencies like this—and we are not bashful in respectfully voicing our concerns when we engage with company management.

– Ben Claremon, Principal + Portfolio Manger

(Source: AYI Company Filings)

Information provided on this site is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product. Advice may only be provided by Cove Street Capital’s (“CSC”) advisory persons after entering into an advisory agreement and provided CSC with all requested background and account information.

From time to time on our website we may offer direct access or ‘links’ to other Internet websites. These sites contain information that has been created, published, maintained or otherwise posted by institutions or organizations independent of Cove Street Capital LLC. CSC does not endorse, approve, certify or control these websites and does not assume responsibility for the accuracy, completeness or timeliness of the information located there. Visitors to these websites should not use or rely on the information contained therein until consulting with an independent finance professional. CSC does not necessarily endorse or recommend any products or services described by these websites.

Past performance is not a guarantee or indicator of future results. The opinions expressed herein are those of Cove Street Capital and are subject to change without notice. Consider the investment objectives, risks, and expenses before investing. You should not assume that any of the securities discussed, if any, are or will be profitable, or that references we make will be profitable.

CSC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. Additional information about CSC can be found in our ADV Part 2A. A copy of CSC’s current written disclosure statement discussing the Company’s business operations, services, and fees is available on our website and also upon written request.

Cove Street Capital requires a modern browser to look and function properly.

Internet Explorer stopped receiving updates in January 2020. Using it may cause display issues on our website, and put your own online security at risk. We highly recommend switching to a secure modern web browser such as Chrome, Edge, Firefox, or Safari.