As the designated proxy analyst this spring, I had the recent pleasure of pouring over nearly 100 proxies – between both companies we do and don’t own – to then vote our shares. Notwithstanding the pervasive use of FW Cook as a consultant, there is a clear divergence between being “big boy” and playing “scooby doos” as far as corporate governance is concerned.

Some of our best opportunities are investing with a company at the inflection point of “growing up.” One of the things every small company struggles with is a well-thought out comp plan. Tying said plan to targets that when hit generate value for shareholders and then properly communicating those targets to investors – that is adulting.

So what drives us crazy? For starters, a founder/CEO loading the board with friends whose unofficial mandate is to enable and not challenge management. Seldom does this scenario “work out” for shareholders. Another version of this is the A/B stock with a two-tiered board where the founder/family places confidants or cousin Gregs into the board slots they control. This is surely less sinister than the CEO friend-enablers, considering the well-documented agency problems with A/B companies and related governance red flags that can be spotted from a mile away. And while we’re on this topic, a non-founder/family controlled company should not have a staggered board. Staggering is the bane to accountability.

We definitely do not like LTIPs that are entirely time-vested. Shareholders need long-term performance based comp that is multi-year with specific and public numerical targets. We are not a fan of “discretionary” comp – and tying long term incentives to a metric like EBITDA, but not publicly conveying to shareholders what that target level of EBITDA is…well that might as well be discretionary. The 10% of long-term comp tied to “personal objectives” or some other non-financial, non-measurable metric is DEFINITELY discretionary…but get that other 90% right and we can live.

Moderately annoying is the comp tied to “Adjusted” EBITDA…particularly for the companies that get creative with their add-backs. There are the abusers of adjustments who are serial acquirers or are otherwise semi-legitimately attempting to compensate management on the true earnings power of the business. The abusers who don’t deserve such an exemption…well they’re stealing from their shareholders.

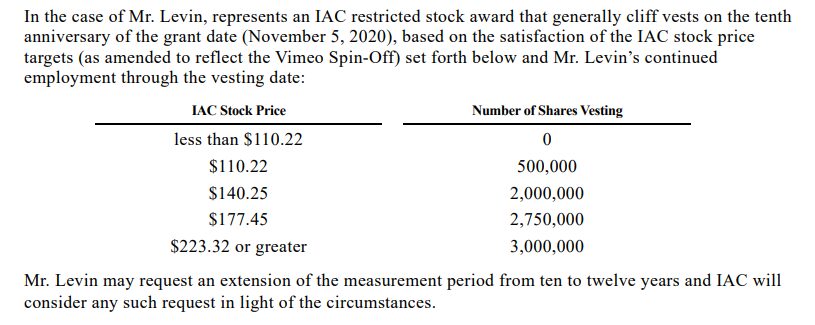

There is plenty room for nuance. We don’t thumb our noses at something like the big RSU grant post-transformation for the sake of “job well done” and retention. And being an A/B stock or controlled company doesn’t inherently make you a corporate governance disaster class. Look at the below comp plan for IAC’s (Ticker: IAC) CEO Joey Levin.

Do some math and tell me if you think he is motivated and aligned with his shareholders. And yes, IAC is one of our largest holdings.

You don’t need to be Barry Diller to put together an amazing comp plan. Other portfolio holdings that deserve mention with similarly structured awards based on escalating stock targets include Tiptree (Ticker: TIPT) and Heritage Crystal Clear (Ticker: HCCI). White Mountains Insurance Group (Ticker: WTM) deserves a call out for paying under-market on base and bonus and pairing that with massive long-term incentives tied to their north star metric: after-tax annual growth in compensation value per share. Management only wins when we win.

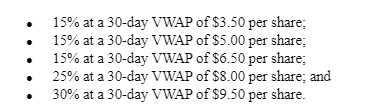

Micro-caps can do this too. I would be remised if I didn’t mention our work with portfolio holding Research Solutions (Ticker: RSSS). We helped the board implement a long-term equity bonus program with vesting based on staggered stock targets as shown below.

On the way to $9.50, management will be awarded nearly 10% of the company’s shares outstanding. That is “big boy.”

We will close with one more star example: Six Flags (Ticker: SIX). The company is valued by much of the investment community on a multiple of its Adjusted EBITDA. Selim Bassoul came into the company as CEO in 2021 on a comp plan tied to a baseline AEBITDA of $560m with a target of $710m over three years. He references these targets in communications with investors and gives yearly guidance to the public in AEBITDA so that we can track his progress.

Ultimately we are looking for proper alignment of incentives between management and shareholders. The best way to do this, in our mind, is to tie the comp plan to targets – whether that be staggered stock prices or value-generating metric X – and then properly communicating those targets to investors. Adulting.