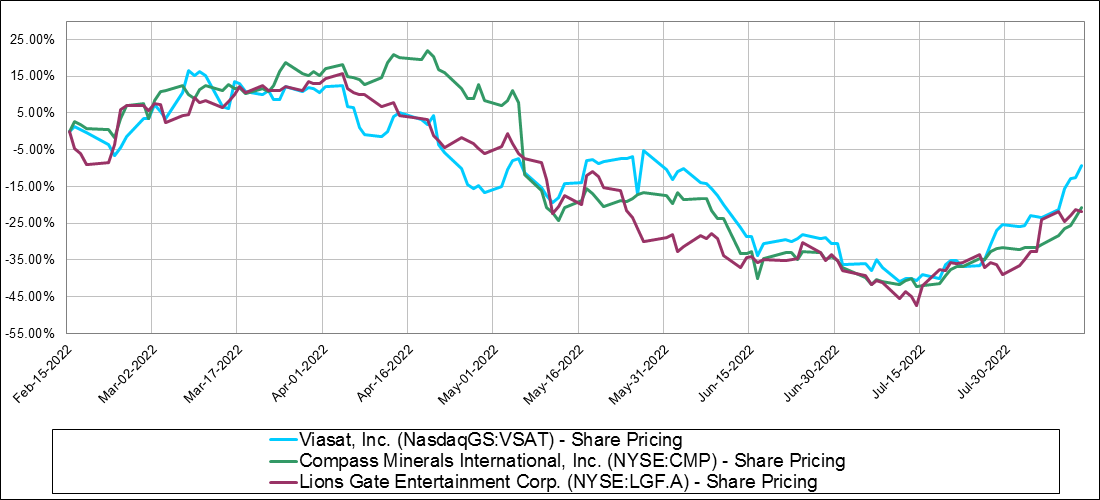

What do a salt miner, a movie/TV studio and a satellite provider of broadband have in common? For Compass (salt miner), Lionsgate (movie/TV studio) and Viasat (satellite provider of broadband) the answer is: very little. However, according to the markets over the past six months, they have traded together. Why? Because they all have leverage.

Net leverage for Compass, Lionsgate and Viasat was 4.4x, 6.6x (or 4.1x excluding their loss in Starz International), and 4.2x LTM Adjusted EBITDA, respectively, in the last quarter. We are not bothered by this amount of leverage for the following individual company reasons:

- Compass will experience a large uptick in earnings once it passes double-digit price increases onto its customers in order to help cover drastically increased logistics costs.

- Viasat will see leverage decrease significantly once it launches its next satellite in the coming months.

- Lionsgate’s studio assets more than cover the value of its debt, and the losses from Starz International, which drags on earnings, could be dialed back if needed.

We believe the fact that these companies traded together over the past six months was a very strange market movement, but it gave us a great buying opportunity to increase our position size in these businesses. Our strong knowledge of these underlying companies, including understanding that their fundamentals did not change, gave us the confidence to buy more of their shares as prices went down.