It is no secret that a cadre of mega cap tech stocks have had a spectacular run so far in 2023. And while the “Magnificent Seven” have dominated headlines, they have similarly dominated their indices. So much so that the Nasdaq recently enacted a “special rebalance” to limit the concentration of these companies as a market cap weighting put the top seven companies at an astounding 55% of the index.

The distortion has trickled down into our world – increasingly anything not containing these mega-cap companies constitutes “everything else.” As a recent WSJ article points out, certain asset managers such as Vanguard define company size by share of total market value. So as big tech gets bigger, we increasingly see “large” companies fall into the indices to which we are compared.

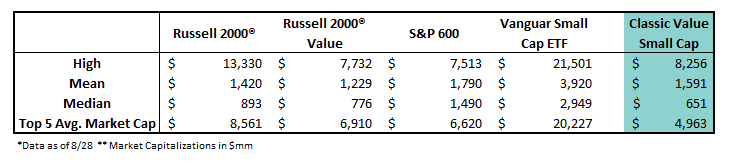

So, what is smallcap? Yes, the intrepid analyst has already googled Linda Evangelista and what dollar amount it takes for her to get out of bed in the morning. So…why is that relevant? When we started, smalllcap was “under 1 billion.” We nose the indices to which we are compared and raised it to $3 billion at the inception of CSC 12 years ago. As noted in the table below, the needle has shifted again…and by a lot.

As of last month end, the weighted average market caps of the Russell 2000 and Russell 2000 Value sat at $3.1B and $2.6B respectively. Compare that to our own portfolio at …$1.6B.

It is self-evident…to us…that as our asset class has become less interesting to most, firms have closed, the sell-side has disappeared, and larger investors with which we compete simply don’t get out of bed for less than…billions and billions of market cap. Which in theory expands the playing field of “small” companies.

Our personal cliche at CSC is that the less people paying attention and the less liquidity, the more the conceptual opportunity. Think US Treasuries at one end of the spectrum and Botswanan Private Equity at the other. Our world of smallcap value remains directionally closer to the latter, even if we increasingly choose to hold on to certain “Buffetts” as they compound into larger entities.

Jeffrey Bronchick and Austin Farris