I am 5 years into a successful marriage, so I am slowly becoming an expert in the field. And like many things my grandmother told me about marriage, this investing piece by NYU Professor Aswath Damodaran is “old but right on the money.”

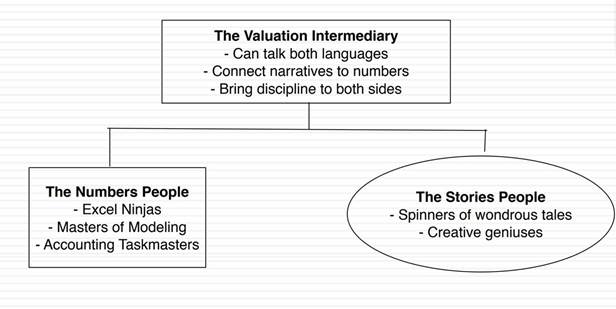

Many people might scoff at the idea that investing requires a fair amount of creativity. Stereotypically, investors are left-brained “excel ninjas” who are devoid of creative juices. But successfully marrying qualitative and quantitative data is as much art as science. It is easy to develop a flowing narrative regarding how a company will be much more valuable in a few years. However, it can be challenging to turn that into a model that is both internally consistent and takes into account the broader industry context.

The idea is to create a firm and an investment process that allows (and encourages) people to use both sides of their brains. Upon looking through the above presentation, Jeff Bronchick, who has long been a connoisseur of the art of investing and who designed Cove Street’s investment process, immediately exclaimed, “I did this presentation 25 years ago!”

-Ben Claremon