So a few weeks ago, we put out a “bookish” piece on our efforts to effect Board change at a holding, Motorcar Parts of America (ticker: MPAA). And yes, the conclusion was that CSC did a lot of work behind the scenes to successfully replace two Board members with legitimate change candidates that certainly could not be worse than the status quo. They just weren’t our candidates, which we wouldn’t care about if not for the lying. (Read the piece on that here – it’s a CSC classic.)

But these voting results are astounding. How can shareholders vote to continue the 20-year reign of a CEO of a company where not a shareholder alive has made a dollar? Yes, two of the largest shareholders – 325 Capital and Bison Capital — are locked up in shareholder agreements that require them to vote with the company slate. But what in God’s name are the other large shareholders thinking – and you know who you are. WTF? I would at least like some consolation prize to be delivered – perhaps in the form of fine tequila – to our office for listening to you endlessly whine about management and the Board, and yet you didn’t have the gumption to vote with your chatter. In the words of old school Carl Icahn, “Our parents and grandparents died fighting tyranny, the least we can do is vote against it.”

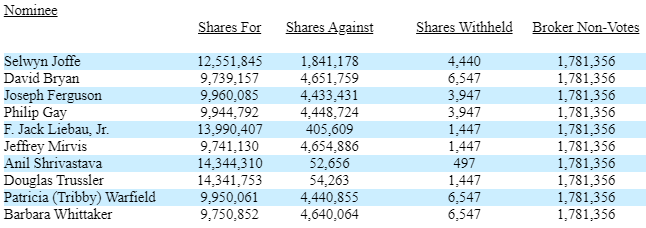

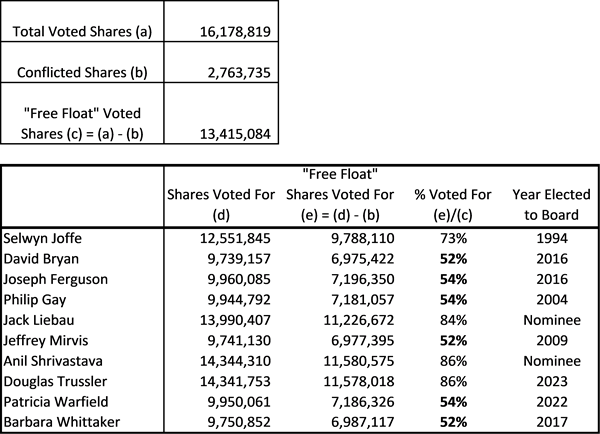

Here is some math. There are 19,753,585 shares outstanding with 16,178,819 shares voted at the latest annual meeting. Insider board members Trussler/Bison and Shrivastava/325 own a combined 2,296,479 shares and are locked up. CEO Selwyn Joffe owns 467,256 shares(after 20 years??), bringing us to 2,763,735 shares owned by conflicted parties. So that leaves 13,415,084 shares as a voting “free float.”

So let’s reconstitute this vote:

Let’s repeat the shame part of the Joffe vote results. Shame.

But then move on to the other candidates who barely cleared 50% “for” votes by unconflicted shareholders.

Should they resign voluntarily? Should the rest of the Board simply ask them to leave? Frankly, a company this size probably doesn’t need a board of more than seven people and could function properly with five motivated directors with skin in the game.

And this is why life generally continues on tomorrow as it did yesterday. Few like to call out what is obvious but personally difficult. And few will resign out of principle vs. taking the money another year. And thus, we have the present state of perverse culture in corporate America, which is particularly dysfunctional in smaller companies because the spotlight beam is tighter and the dollars at stake smaller on a notional basis.

Once again, we encourage you to read our initial piece on what happened here and apply the same concepts in all your holdings. This is not being “activist.” This is being common sense and accepting a sense of responsibility as an owner.

In the meantime, this is a cheap stock with two new material owners on the Board and one new “governance guy.” Our downside appears boredom and there are attractive probabilities attached to positive scenarios. We shall see.