By Andrew Leaf and Austin Farris

As Covid forced us to figure out how to do our jobs with an Acer monitor and kitchen table (some of us at our parents’ house), we’ve had to reacknowledge that real life, economic or otherwise, does not live on the screen. Partially prompted by a resurfaced Stanley Druckenmiller anecdote (he fired a money manager who was shorting Tesla despite never having driven one), some of us here at CSC decided to hit the road and spend the day at one of our local holdings: Six Flags (NYSE: SIX).

A brief recap: Six Flags is the largest regional theme park operator in the world, with 27 regional theme parks and waterparks in North America. CSC Portfolio Manager, Jeff Bronchick, has owned SIX stock several times over the last 20 years and points to the following Buffett-ism: it helps to buy a business that is good enough to be run by an MBA, because eventually, you will have one running it. Regional parks tend to have geographical moats with good returns on capital and excellent free cash flow. Thus far, most economic participants in the industry recognize the near financial suicide of building across the street from an existing player, preserving SIX’s stable business model. It should be noted that there can be a LOT more cyclicality in regional parks than one thinks – like say, when a pandemic hits.

And thus, our latest entry into SIX was around March 2020. But, after almost two years under a struggling CEO, there was another leadership change in the form of new CEO, Selim Bassoul. I think you can find universal agreement in the investment community that this was unexpected and clearly led by the largest shareholder, H Partners, which owned nearly 19% of the stock at the time. So while they didn’t have control, they were clearly swinging the largest stick.

We also think you can find a mixed bag of opinions on the wisdom of this leadership change, which to be fair is often the case when an industry outsider like Bassoul is brought in. As has happened time and again at Six Flags, it takes 100 people to maximize results – 1 guy to lead it and 99 industry insiders, ex-employees, and sell-side analysts to say how stupid the new plan is. When Bassoul came in, he was hanging his hat on, say, a 300 bagger during his 23-year reign as CEO of Middleby, a 20-year roll-up of the food equipment industry.

So, Mr. New Guy enters the company in late 2021 and moves fast, centering on cost savings at corporate and a “premiumization” strategy seeking to offer an improved park experience at a higher price point. The latter meant initially accepting lower attendance, but charging more and generating higher spend per attendee, which was intended to create a nice fly-wheel of better experience begetting better attendance. This enhanced experience strategy was to be implemented over the course of 3-4 years.

Let’s just say the summer of 2022 was a mixed bag reworking the fly-wheel. Bassoul experienced great initial success in driving per capita spending from $42.37 in 2019 (pre-Covid) to an estimated $62.81 in 2022, yielding a ~50% increase. But he generally whiffed on attendance math, causing attendance to drop substantially. Note to self, customer attitudes on spending don’t change overnight – when you increase the price, many of them won’t come back. This was the takeaway from year one of the multi-year plan.

So, was the food better? Did the place look directionally toward Disney or more so like a tired regional drive-in movie theater? Were there shorter ride wait times? Did the park app work? Were the bathrooms cleaner? (When a CEO talks about bathroom quality on an earnings call, he better deliver.) And so, with these questions in mind, off we went.

What we found at Six Flags Magic Mountain was largely in line with what Bassoul has telegraphed to investors. Certain bathrooms have been upgraded (yes we actually explored restrooms, plural), digital signage throughout the park displays real-time ride wait estimates and advertisements, and benches and other seating have been added to create rest areas (some outfitted with TVs and a bar, which we found to be packed during a certain AFC divisional playoff game). The parks have gone cashless to increase the speed of transactions, and a forward-thinking thrill-seeker can even order food for pick up via the mobile app (4.6 rating on the App Store) to avoid waiting in line.

We don’t see why the investment world is up in arms about the introduction of dynamic pricing – changing the cost of a ticket based on the day of the week, season, and weather. Why the heck wouldn’t people pay more for a Saturday during the summer vs. a Tuesday in January? SIX has introduced tiered pricing for parking, and has become more strategic about how it charges for various season passes relative to a day pass. Various levels of “flash passes” for dodging the lines command different rates, and improved cost management means outsourcing some carnival games to a third party. The significant additions to the seasonal events calendar and various “pay an extra $25 for these pop-up experiences” did not go unnoticed as additional revenue opportunities.

But the improvements are only “in the 4th or 5th inning”, according to a certain park president. We can attest to that. The bathrooms tucked away in the back of the park still remind one of a Mojave Desert gas station pit stop. And seriously, the pizza is still bad enough to make one consider snatching a chicken finger from an unsuspecting 7 year old. Gauntlet thrown back to Bassoul, who has been raving about the new pizza at the park.

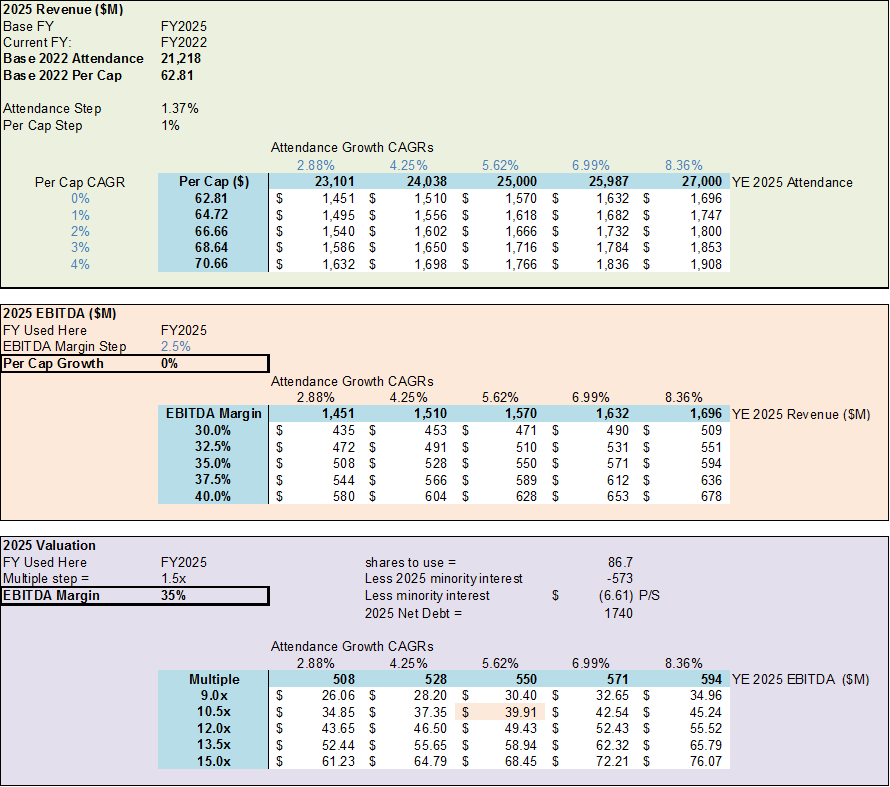

Our view is simple: we like the business. We think Bassoul’s changes seem obvious and doable. There is simple math here, assisted by a handful of public competitors that make benchmarking reasonably doable. Management’s plan is to take current attendance levels of 21m to 25m by 2025 at current (or higher) per-capita spending. Our analysis below shows that if management hits its 2025 target of 25m attendees (~25% below 2019 levels of 32.8m) and maintains: (1) near current EBITDA margins, (2) a 20% discount to historical EBITDA multiples, and (3) current per-capita spending, you should get a stock 50% higher from today, or $40 a share (which is a very conservative base case – the PM thinks it could even be 50% higher than that).

Risks include weather (a summer “Pineapple Express” atmospheric river event?), a deep recession, higher gas prices, increased labor pricing, sheer incompetence or a bone-headed capital allocation move by management – all of which are non-zero probability.