Some of the benefits of investing in private assets instead of public companies have been well documented. As an investor in a private fund, you don’t have to worry about pesky things such as market prices going down and impacting your returns. You also don’t even have the option of selling so you are in essence protected from your worst behavioral biases kicking in at the wrong time. As a fund manager, you get to smooth your returns, use an amount of leverage to juice your returns that the public markets would shudder at, and get paid fees that mutual fund managers would salivate at. What is not to like? Sounds like a win-win for the asset allocator and the manager.

The issue with the above is that an enormous amount of money has flown into private assets, and especially private equity. According to some great work by our friends at Acuitas, at end of 2019 private equity firms had $2.5 trillion (yes, that is a T) in uncalled capital/dry powder.

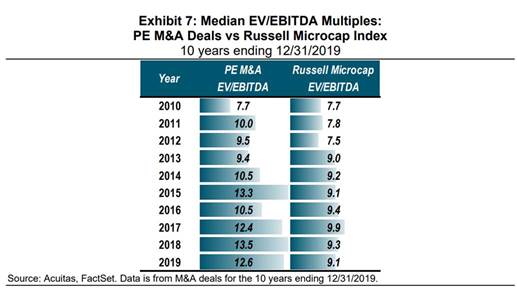

With all of this money chasing deals, there is likely going to be a ton of competition for the best assets. When you add the fact that SPACs (Special Purpose Acquisition Companies) have also raised billions of dollars to buy some of the same companies, it is easy to imagine that multiples paid are going to creep higher and higher. We are value investors so we don’t think we have to explain why the higher the price, the more risk of poor future returns. On that note, Acuitas has a chart in the above-linked piece that highlights the multiple expansion we have seen in private equity buyouts since 2010:

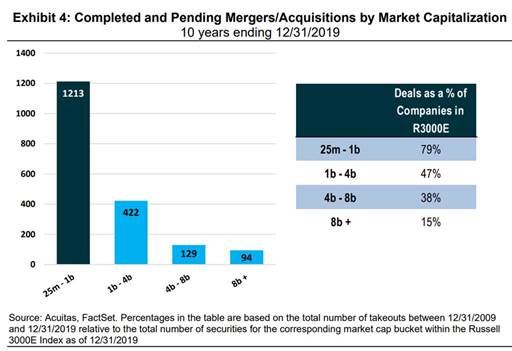

Assuming bidding wars only inflate these multiples higher, is it crazy to assume that the much-vaunted, world-beating private equity returns won’t be quite as good going forward? We think lower returns than those generated (partially through survivorship bias by the way) historically are baked in the cake. Accordingly, like Acuitas and the guys from Verdad Capital, we think there are better returns to be had investing in small and microcap public companies in the U.S. Aside from trading at lower multiples than what buyouts go for, another reason is that those companies are likely to be CANDIDATES to be bought out. In fact, the majority of deals that happen in the public market space occur below $1 billion in target company market cap:

And the premiums paid are higher than are with the deals over $8 billion:

What is not to like? An allocator who chooses to invest with a public equity manager as opposed to a private equity buyout fund gets: liquidity, lower fees, likely higher prospective returns, better valuations, and a group of companies that can sell to the buyout funds at ever higher multiples. There are no free lunches in investing and of course, there are risks associated with microcap and small cap investing. But, on a relative basis, it would appear to us that the odds are stacked in favor of concentrated public investors who invest with a long time horizon. We know a few good ones if you need recommendations.

P.S. Cove Street’s experience in small/micro land over the past decade has taught us that there is a compelling opportunity for a hybrid fund that mainly invests in public equities but also has the ability to buy orphaned companies that aren’t getting love from the public markets. That kind of fund sits outside of most institutional allocator box-checking and therefore there are only a handful of firms that have the latitude to get the benefit of playing in both worlds. We much prefer to operate in less crowded spaces and would be open to speaking with like-minded, out of the box style thinkers.