The idea of regulation and the establishment of a legitimate exchange is to ensure that phony and fraudulent ideas DON’T go public in the first place. Whining that these “ideas” are now trading at 15 cents and might present risk to investors is the definition of ass-backwards.

The financial crimes committed in the promotion of SPAC deals and the lack of SEC scrutiny was an offense equivalent to Madoff and it disproportionately affected those specifically targeted for protection by SEC charter.

And the world turns.

Hundreds of Stocks Have Fallen Below $1. They’re Still Listed on Nasdaq.

Investor-protection advocates say many belong to risky small companies that should be on the OTC market

By: Alexander Osipovich

Hundreds of stocks have broken the buck this year, following a slump in the once-hot market for buzzy startups seeking rapid growth.

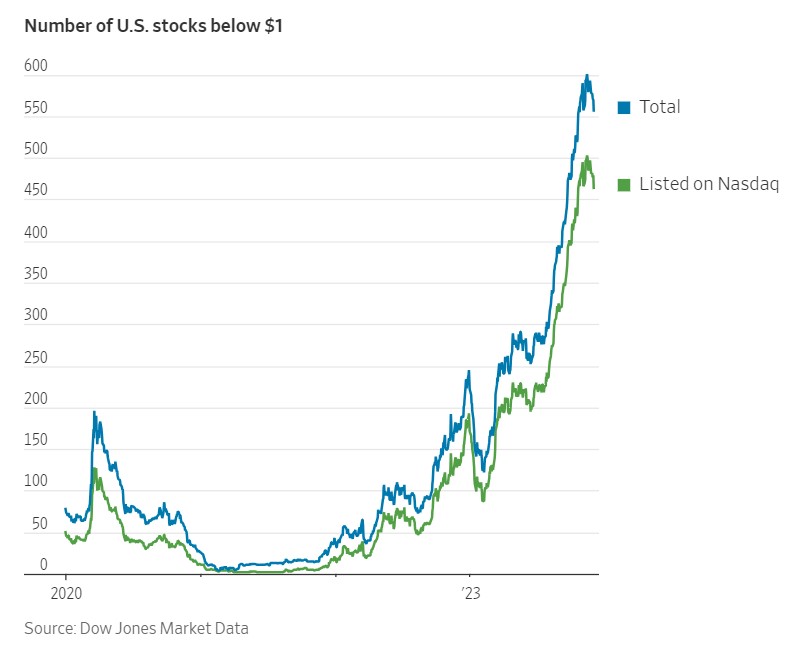

As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data. The majority of these stocks—464 of them—are listed on the Nasdaq Stock Market, whose rules require companies to maintain a minimum share price of $1 or risk being delisted.Investor-protection advocates say many of these sub-$1 stocks belong to risky small companies that should be on the over-the-counter market, the traditional home of “penny stocks” not ready for the prime time of Nasdaq or the New York Stock Exchange.

But instead of being delisted, the companies are maneuvering to maintain their Nasdaq spots—alongside blue chips such as Apple and Microsoft—as long as they can.

“Any company that looks to list and remain listed on Nasdaq must satisfy certain requirements,” a Nasdaq NDAQ 0.47%increase; green up pointing triangle spokesperson said. “Our rules, like any other exchange, are approved by the Securities and Exchange Commission and provide specified periods for companies to regain compliance with the applicable requirements.”

Companies with a share price below $1 can stay listed more than a year before Nasdaq kicks them off. Largely owing to the pileup of stocks below $1, around one in six Nasdaq-listed companies is running afoul of the exchange’s rules, Nasdaq data show.

“Exchanges are supposed to be gatekeepers and list only bona fide companies that have investor interest,” said Rick Fleming, a former SEC investor advocate. “If a bunch of companies aren’t really meeting those standards, it undermines the seal of approval that the exchanges are supposed to be imparting.”

Many of today’s sub-$1 stocks went public in 2020 and 2021 during a boom in initial public offerings and deals with special-purpose acquisition companies. Mergers with SPACs were a popular way for startups to go public until a regulatory crackdown in 2021 slowed the SPAC craze.

Nasdaq’s website lists 583 companies that are “noncompliant” with its own listing rules. Besides falling below $1 a share, common reasons for companies to become noncompliant include failing to meet minimum targets for float, stockholders’ equity or number of shareholders.

Read the full story at wsj.com.