It is popular in some circles to suggest that in a passive world, “no one will care about Small Cap stocks and thus a value will languish for nearly forever, why bother or we must be an activist and make our own catalyst.” The simple counter argument is that the world is somewhat efficient and there is still a world of people staring at screens. A decent growing business with shareholder focused management attracts attention – it always does. “Picking better” is the relevant critical variable. Or do a test with 84 people and declare a vaccine is 90% effective and we are ready to ship.

That said, I have a distinct memory of a prior employer who pulled me aside, got two inches from my face and loudly noted: “Buy the crap out of it…and then tell everyone we know when we are done.” So, this is the first piece of 29 in which we highlight a specific position and our rationale. For educational purposes only.

Also on note, we have been involved with the “activist” community for a long time. I would note there is a crucial difference between starting with a fundamentally decent investment and then deciding that remedial action is required vs “everything has to be activisted because that’s what we were hired to do.” The latter has produced poor results in our opinion. We have done everything from quietly last year getting 9 of ten 10 companies we own with staggered boards to de-stagger; to actively placing Board members to signing NDA’s to advise on IR programs to full throated public roar. It has been our experience that a small group of people with skin in the game working privately and together is a superior return beast…and frankly a better way to wake up in the morning.

The next time someone rants on about how smart Private Equity is, run PQG by them. The short-ish story is that this was a mash-up of two tangentially related companies that are tangentially in the “specialty chemical” industry. They were quickly cobbled together and thrown out the IPO door in 2017. A few botched presentations and completely missed quarters necessitated a change in management that could actually make sense of what looked good –really good – on paper and determine whether to run it or not. We track “CEO Changes” and “Failed IPO’s” for potential ideas and this was a double box-check. We did the math work, and flew to Philly to meet the new CEO Belgacem Chariag and the operating team. We flew back and waited a year. We were nervous about close to 5x leverage, we wanted to see Chariag “walk some walk,” and we wanted to have 20 third party conversations about the industry and management. What we saw and heard was an intense operating focus, an implied skepticism that this collection of businesses made any sense together, and a deeply ignored equity that was still 69% owned by private equity. People hate that, we don’t as a smaller firm. (But we invite you make us haters.)

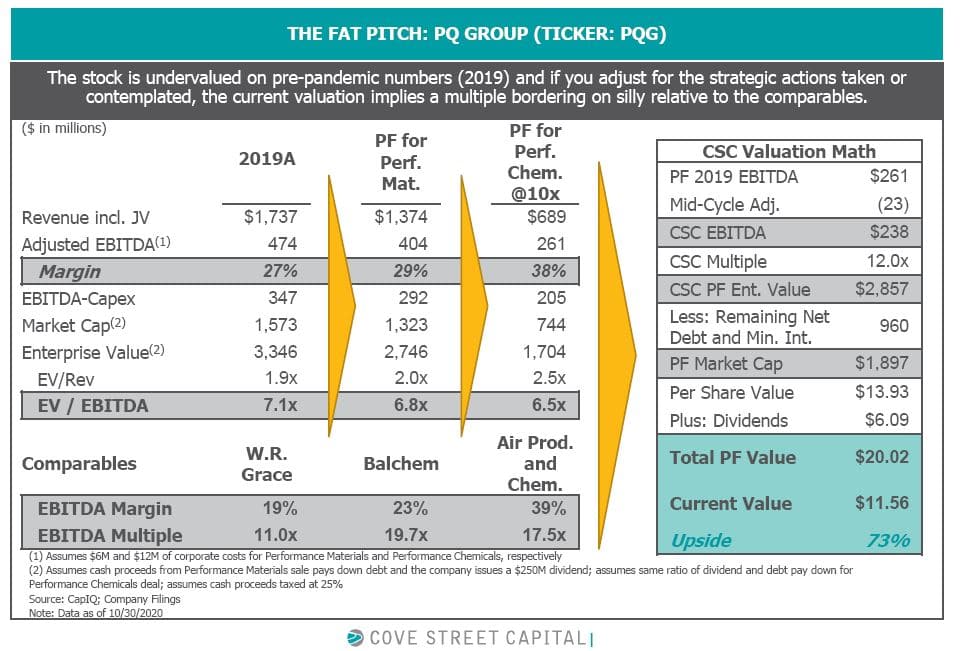

Along comes Covid and our $11 price. Then the first announcement of the sale of the Performance Materials business, which would go 2/3 towards debt repayment and 1/3 as a special dividend to shareholders. And they are also going to sell the Performance Chemicals business, whose proceeds will also be split on a similar basis. And that leaves a 35% margin business, with high returns on capital and solid free cashflow on what will be a nearly debt free entity. If you are asking, this is premise based “Sulphuric Acid Recycling” and “Silica and Zeolite Catalysts.” One argue what the future multiple might be, but it’s not 8.5 times “EBITDA.” And in classic behavioral finance style, “market participants” have been slow to recognize the changes.

This is now a top 5 position. And yes, this is a catalyst for our catalyst stock.

– JB