We have always been in the camp of “waves of IPOs are closer to a sign of a market top than a sign of strength for equity markets.” And, as is always the case, the intrepid first few deals are usually the better businesses that are (naturally) better received. Then investment banks start trolling in dumpsters behind restaurants for anything that might be edible. We will also note that the statistics are going to be a lot worse when you factor into SPACs, which are effectively reverse mergers with zero third party due diligence.

Investment banks have a long history of dishing garbage for a fee if there is appetite. But there is at least some modicum of perfunctory due diligence stemming from fear of being sued. Not so much in a SPAC deal, where the world is in a two year race to get ANY deal done.

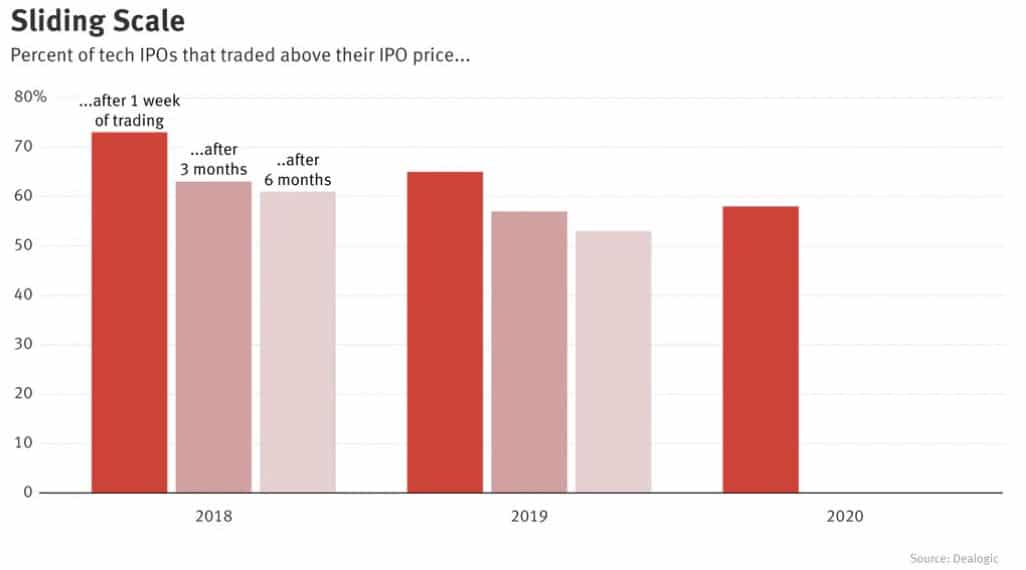

Source: The Information

Source: The Information