Unlike most of the rest of the world, I will attempt to minimize all there is to say about the beginning of the next 4 years, as the persistent yack and what to make of it reverberates in all corners of the financial globe. And then violate this statement over 3400 words. To paraphrase the great words of master geo-politician Phillip Henslowe in Shakespeare in Love once again:

The natural condition of democracy is one of insurmountable obstacles on the road to imminent disaster.

FENNYMAN: So, what do we do?

HENSLOWE: Nothing. Strangely enough, it all turns out well.

FENNYMAN: How?

HENSLOWE: I don’t know. It’s a mystery.

The practical element of the new administration other than some rational sense of caution is reminiscent of the Bronchick Family tactic in relation to the late family matriarch entering a restaurant. One simply waited at the host station until at least three tables were reviewed, one pauses again to ensure that #3 was truly the final seating, and then and only then one commits to the table. And turn your head and pretend not to look when every breadstick and sugar packet disappears into a pocketbook. Are we clear on that application to the investment world?

We all should be aware that with the benefit of 24/7 technology, it is entirely possible to obliterate the differences between speaking/tweeting the first thing that comes to mind, repeating the last thing that someone said, using bluster as a negotiating tactic, or actually operating from a coherent set of principles that can possibly be implemented in a rational and hopefully legal set of actions. Or just use an AI Bot.

I will wholly admit to a “go DOGE and go harder bias” but that doesn’t factor much into the day job. There is not a single large American corporate entity that I have witnessed in 40 years that has not gone through at least one exercise that seems to effortlessly cut 10% of its workforce and 10% of its off-piste activities and not budge the corporate mission. And I would argue that before one goes off the deep end on the “latest” missive asking all Federal employees to document what they did last week, one should self-employ that technique. It could eliminate 40% of all professional investment jobs. And there is still no crying in baseball.

But there are some interesting stock movements that may be opportunities in things related to government spending – government/defense/space service provider and lots of other things, KBR Inc. being something of particular interest. We more than halved positions near highs in the 60s with a $20 cost. A DOGE fear 20% off trade ensued. There is an active relook. Government contractor DLH Corp on the other hand has been gone for some time as their relative position with leverage signaled a potential problem in the middle of 2024. The stock is down some 70% from its highs, which suggests that they and the largest shareholder might have listened to our admonitions to sell the entire company. Look at the stock price of Target Hospitality (TH), as another example of how things are/might change from changing relationships with government spending. The point here is to be more “reactionary.” If you are not in the immediate crosshairs — like a 2x revenue uptick since 2020 from building border migrant camps — then the practical bet is to “invert” and evaluate stock movement within the frame of likelihood probability of the worst case coming to fruition. Like a variety of things in healthcare and food. Fiendishly simple.

The real thought is to consider the idea that we are in a big cloud of “not sure” which is only relevant in that US financial markets continue to mostly trade at historically high valuations in almost every asset class. Uncertainty bought cheaply is an investment process and “don’t know” issues are the stock in trade as an investor. There just seems to be an extravagantly poor risk/reward in wasting time to bet on any number of conceivable or formerly inconceivable outcomes based upon political or personality whims. Time after time one sees an “interesting” investment outcome derived from what seemed to be an obvious set of circumstances — US tariffs and the terrific performance of international stock markets being just one fun fact. And “this is going to be great for business, but the Treasury rally is crushing the MAG 7.” A week recently spent in NY with any number of well-connected or massive pools of assets confirms a high “intelligent chat” to “what to do” ratio that makes for a nice lunch, but not necessarily practical investment wisdom. And if you put on a large “long Euro defense business, short Euro bond trade with leverage,” just enjoy that and leave the rest of us alone.

One logical interpretation that we are seeing live in recent quarterly earnings reports is an economic slowdown. If you don’t know, then doing nothing seems to be becoming a plan of action rather than words on a screen. This follows some Q4 “increased activity from manufacturers ahead of potential tariffs.” That’s what we see on the ground on top of valuations that remain head-scratching in many of the “good things” that we would like to own. This brings an investor to a Shakespearean question to which he must alone answer: “whisper in thine own ear… sell when you can..for you are not for all markets?” Do you, or as importantly, the client for which you are running money, capable of handling severe markdowns in x investments or portfolios in what should be a long-term viewpoint? Lake Wobegon’s conclusion in this writer’s opinion.

Moving forward to Wilde, who noted that there are two great tragedies in life. One is not getting what you want, and the other is getting it. We have built a world of devices and networking that seemingly needs constant feeding and now we have an administration that is perfect for it. We also now have a world-class money manager in charge of the Treasury – Scott Bessent. Naturally, he would presume to do the rational thing which would be to finance the ye olde public debt of $36 trillion( double ten years ago and 120% + of GDP) with a healthy mixture of laddered maturities vs say what his academic predecessor did which was hugely favor short term debt issuance at then near-zero rates, a lovingly expedient way to hide the build of longer-term liabilities. And which to weigh if one watches scales: the possibility of a real decline in government spend vs tariff havoc on pricing? Good ideas facing potentially hostile timing environments are always an interesting game to watch – currencies and interest rates. Round 1 to the DOGE: the Ten-Year Treasury is down 50bps in 2025, 3%-ish inflation remains “unch.”

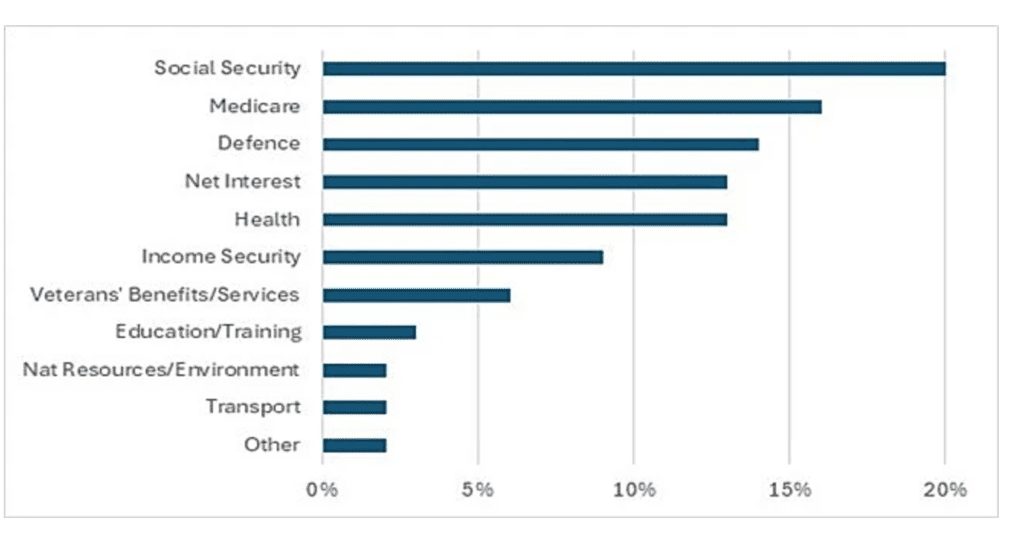

But why worry? “The U.S. government has spent $2.44 trillion in fiscal year 2025 to ensure the well-being of the people of the United States” per this link and the accompanying chart. Note to DOGE self: it is fun and easy money to pick off tens of billions of dollars of the merely wasteful stupidity our government has collected over decades and multiple administrations across party lines. The top few buckets on this list might be a tougher nut to crack. And could it REALLY be enough to offset the possibility of stagflation issues from the actual implementation of tariffs on whomever for whatever? Oh, and not to waste space, but there has simply been zero correlation between the budget deficit and almost any important financial market statistic since WWII. Look it up.

Here we insert the usual “what the hell in the credit world” which remains a world unto its own with Liability Management Exercises, monster-sized new and presently uncalled distressed debt funds, and default passive vehicles for private debt, all seemingly in the hands of the same 12 dominant financial players, passing assets back and forth among each other outside of the glare of BK courts for what are apparently the same institutional clients. It is clearly more difficult to parse at large the ramifications of what is over-levered, who is over-levered and how it plays out on a macro basis given the sheer size of funds committed to distressed investing, but it is always clear that there is an outcome that is highly problematic for equity. Maybe not a complete zero given the ability to can-kick what historically might seem a hopelessly over-levered situation, but we have been increasingly careful. There has been a long financial history that demonstrates that the lure of the upside of leveraged equity can take a dystopian pummeling despite the liability demonstrated over much of the last ten years. We have some, but less. And another data point of what margin of safety you are receiving for an uncertain future – non-investment grade spreads at roughly 285 basis points at this writing and is half-ish the 25-year average of 545 basis points.

You can also insert here the standard plug for smaller cap investing, which remains mostly bereft of new funding, with the occasional absolutely insane stock move of which we can only claim two year-to-date. This remains an area with enormous absolute and relative opportunity for intelligently sized amounts of capital. It remains odd to hate the world but have a pile of current and interesting ideas mostly due to years of inattention. And as we have noted in the past, we spend a lot more time being “active” with our investments as opposed to a highly diversified value-esque portfolio that is dependent on the return of Godot.

A nice version of this involved what was eventually named Logility Inc., a software/consultant focused on supply chain management. While there was good statistical math in terms of margins, returns, and balance sheet, the company was mired for years losing growth opportunities to any variety of entities. (Re-note to self: if a smaller company is still on the Sidoti micro/small cap conference list after 5 years, there is a bigger problem than you presently understand.) We sensed that the A/B voting structure that enabled an aging founder whose economic interest was 20% of his control voting interest to be a hindrance, a nice off-sheet intangible variable that cannot be podded, AI’ed, or screened for. You simply had to spend time with the competitive set, customers, and the company itself. Letters were written and conversations were had with the company regarding examples of previous entities that converted into one voting class and produced subsequent value for shareholders in a variety of different ways from a higher valuation, the ability to attract new people, or in this case, a sale of the company. We were not the only voice, but a persuasive one. The company converted B to A, and frankly to our surprise, sold itself at a 50% premium to our cost. We thought this would take more elbows and time, but happy to be sitting on a small patch of beach looking good, feeling good with Billy Ray.

There are plenty more where this came from. We have found that very few companies benefit from years of stagnant relative performance and a dormant stock price. The trick is to find the underlying business that is capable of much more, and a group of people that are game for new ideas. This process takes time, paying attention to off spreadsheet ownership, incentive and governance issues, and the willingness to speak to human beings and develop relationships. Crazy stuff.

And now a word on AI. I have had a note on my desk for years: What am I doing? How long would it take to train a smart college graduate with no specialized training to complete this task? BOOM, the world seems to be coming around to solve for my needs.

In no way is there an “expert” claim here, but I have personally wasted a lot of time watching LA Kings hockey games experimenting. I have demoed a dozen “AI First” investment tools, I have wasted time on every piece of software we use and their AI “improvements” and have read a few thousand pages of whatever on the topic. (I still can’t change my oil.)

And I was a sentient investor in 1999. So let’s start with “I call bullshit” on much of the investment world sense of what is happening as expressed via money flow and valuation and critical “change.”

The investment/tech/media/PR industry is now jacked on Adderall and ubiquitous electronic communications. It can make anything in the world seem impossibly air-sucking in any room in the pursuit of raising money and “you” dear reader are impossibly so five minutes ago. From the annals of Nigel Tufnel, here are 11 things that bug me:

1. Massive amounts of money being thrown at a shiny new toy with uncertain economics in small periods of time is usually not a good bet. William Blake: “You never know what is enough unless you know what is more than enough.”

2. Aren’t the people throwing money at this the worst of the worst crowd chasers? Venture/oligopolistic tech/Media?

3. Is this spending really going to be different than steel, shipbuilding, and fiber superhighways at cycle tops? Isn’t this an asset-heavy business model with lousy returns on capital with likelihood of sunk cost price wars to zero?

4. Softbank in for $500billion. Mic Drop.

5. AI email pitches now exceed private credit opportunities in my inbox.

6. Deepseek: is it possible that there are other roads to a reasonable service that aren’t started with the word trillion?

7. Is there any sense of Moat here? I have tried ten of them. If every 5 minutes there is another Unicorn, then…what? “Everything in tech becomes a toaster in time.”

8. There is a distinct lack of definitive math by anyone because losing craploads of money is usually not the winning gambit, but it seems difficult to equate the capex being tossed about with exactly how many users will be paying what for what? (See also Satellite to Cellphone.) And, I have read some interesting tech porn that suggests a Spotify model, which if you recall was premised around a royalty structure that enabled Spotify to lose money on every song streamed and volume didn’t make up for it. This isn’t “search,” it doesn’t seem to model like software and it does not scale?

9. So is this really revolutionary or a monster PR exercise? A usable product, Teams–as part of the Microsoft bundle–has roughly 320mm active users. Their AI product CoPilot, has “20mm-ish” as of this writing. Ok, Co-Pilot might be terrible vs competitive products, but are GLP-1 antagonists the more important development? ChatGPT claims 400mm “active” users and then a variety of others putting on Apple TV like numbers–we know you are there, but you don’t matter? Converting this to “paid?” Licensing dollars for being embedded into third-party software? Advertising? Massive uptick in paid access to content? Even “adjusted” profitability? A big fat unclear on this return on investment.

10. Any company that includes the phrase “Megatrends” is bound to be wasting money. Today’s pinatas are “the global energy transition,” the electrification of Everything” and “AI and digitalization.”

11. While the MAG companies can revel in wasting a few hundred billion on their latest thing, and maybe take a whack at their margins and returns and multiple for an X time period, it’s the food chain seems particularly silly and vulnerable–data center supply chain, /utilities proposing to building monstrous amounts of capacity, really crappy industrial sites repurposed as power sources and NIMBY ok here?

That’s a quick 11 on investment relevancy as of this writing and thank you for enabling two 2-bags in Hallador Energy, which…has a coal mine and an adjacent utility. Cheap power, owned it before I had any idea this could be a “thing.”

As a practitioner, what are my needs? Can I replace myself or just everyone else? Is there some magic here, or just another iteration of helpful? To repeat what we started with, how long would it take to train a smart college graduate with no specialized training to complete this task?

The answer is now, less. So more time for bigger thoughts? Covering more research ground? Over 40 years, I have obviously seen a steady progression from colored pencils, graph paper, physical libraries, landline phones and horses to a fusillade of tech-ish things that obviously enable more efficient workflow. “Search,” the ability to quickly compare documents and note changes, general screening for numerical or qualitative changes, the ability to search and peer into all sorts of whacky human-to-human interactions on whatever topics, button push spreadsheets that are a good 80% start, etc. All good things. And yes, one can assume the big Quant investment firms have been on this for years, so the odds of this being a huge new variable in better decision-making seems unlikely. And reiterates something that has become self-evident, the return on focusing on things that are difficult to quantify, scrape and code seems higher.

But under the heading of converting free trials screwing around with GPT to taking money from sticky users – assuming this is a standalone service and not just something that everyone is bundling into what they already have – one issue is that what one really wants is really not available to most people under a free model. What is wanted is a complete dataset, and a complete data set is not just ANOTHER offering to mine SEC docs and general web scraping of corporate sites. A dozen a day come to my inbox with the same exact “summarization” of public data. What is interesting is to pay $20k to program and $200 a user a month to scrape my entire 40 years of Word and Excel and OneNote and enable me to ask questions of my former self. And if you are asking, the result is that I am predictably not as interesting as I thought I was. And I am sure that any large investment organization has done much of the same and I see few signs of better decision-making, given that humans are still in charge of the algos. I think. Again, a nice toy to have, but the world hasn’t changed.

Anyone who has played in this space or read one of Bill Ackman’s 180 page PowerPoints can be impressed by how convincing something can be that will be proven to be so wrong. After all, probability-weighted answers or guesses about the future are still digitally filling in the blanks here, albeit better than in the past. You can also see how answers can be shaped behind the scenes ala “Covid Research” in 2020. And FYI, I submitted this to the GPT for comment and naturally it told me I was a genius. Another thing to note is becoming an expert in “prompting” to tease out a more practical narrative is a skillset every “I want to be your intern” should be thinking about.

Let’s talk hallucinations. I think the history of investing suggests the lack of need for machine-generated nonsense when our species seems to do just fine. And think of what is left of Network Television. Can not one assume that algo-driven answers sculpted by human-driven forces of large technology companies will tend to converge around the “safe, predictable and what is most popular?” Versus a search for the novel, the offbeat, and the non-consensus, which in theory might be more helpful in understanding what information might not be presently reflected in the price of a stock? Once you are past the data and basic understanding stage, might an investor need more hallucinating than spitting out the management PR/sell-side/tweet of the day? And one should assume that every cool AI tool perceived as helpful for the investor will be countered by an AI tool employed by those selling to you.

Yes, I am sure that AI and machine learning will make the world a slightly better place at large, and create more time for the white-collar workers of the world to stream more Netflix, either employed or unemployed. Once they are done torturing us with breathless BS announcements about their AI enhancements, the business world will continue to quietly embed machine learning to improve themselves and improve the products and services they charge for. For the rest of the world? Interesting thinker Bjorn Lomborg (https://lomborg.com/best-things-first) notes that fixing tuberculosis, malaria, and chronic disease, tackling malnutrition, improving education, increasing trade, implementing e-procurement, and securing land tenure will cost some $35 billion a year and potentially save 4.2 million lives each year and generating $1.1 trillion more for the world’s poor. That is math that would barely dent any major tech company’s proposed data center capex and private jet carbon offset spend. Feel good or do good?

So, we chug along. 2025 starts with the opposite of 2024, our broader micro/small SMA strategy doing better, our more focused LP doing slightly worse. Unless we really want to publicly plug a large investment for the enlightened height of our own self-interest, I tend to think detailed specific thoughts on what we are investing in are for the people who are paying for our efforts. Come be one!

Jeffrey Bronchick, CFA

Principal, Portfolio Manager

Cove Street Capital, LLC

*The opinions expressed herein are those of Cove Street Capital, LLC (CSC) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. Consider the investment objectives, risks and expenses before investing.

You should not consider the information in this letter as a recommendation to buy or sell any particular security and should not be considered as investment advice of any kind. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this newsletter. Recommendations made for the past year are available upon request. These securities may not be in an account’s portfolio by the time this report is received, or may have been repurchased for an account’s portfolio. These securities do not represent an entire account’s portfolio and may represent only a small percentage of the account’s portfolio. Partners, employees or their family members may have a position in securities mentioned herein.

CSC was established in 2011 and is registered under the Investment Advisors Act of 1940. Additional information about CSC can be found in our Form ADV Part 2a,