Mean Reversion.

Valuation Matters.

Behavioral Finance- people take a long time to see, admit and react to change.

Dot-Com Redux

How to invest after valuation risk strikes

By: Nick Schmitz

Leading up to the dot-com bubble burst, small value stocks dramatically underperformed large growth stocks for years.

Below are the indexed factor premia for the five years up to year-end 1999 for buying small stocks instead of large stocks and value stocks instead of growth stocks.

Figure 1: Indexed Global Factor Premia (Through Year-End 1999)

Source: Ken French Library

After five years of market exposure, small caps and value stocks compounded dramatically less than large caps and growth stocks across all three developed markets.

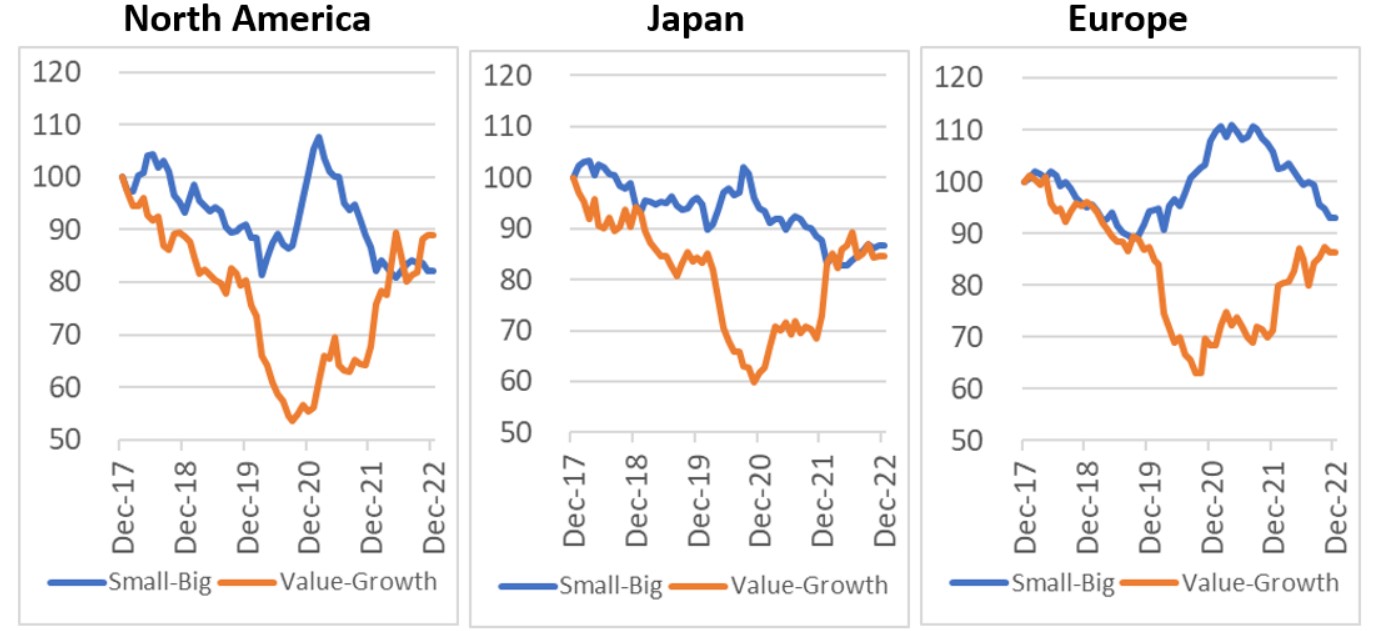

If that looks extreme, it’s eerily similar to what has happened again over the last few years.

Figure 2: Indexed Global Factor Premia (Last Five Years)

Source: Ken French Library

2022 broke the trend, and some have advocated “buying the dip” in large growth. Most of the FANMAGs have experienced almost bankruptcy-level drawdowns of late, so why not wade back into the growth waters now?

But if you’d “partied like it’s 1999” as a growth investor, how long would the hangover have lasted?

We wrote about this in late 2020 in our piece on the “blunt ratio” (critiquing the Sharpe ratio). There we noted how “stable” growth was at staying down for decades at a time (after the Nifty Fifty and dot-com bubbles burst), thereby producing a pretty good Sharpe ratio compared to deep value, with it’s much more volatile bounce backs.

Here, however, we look at the upside small value. We show the same metrics as the charts above for the 22 years following 1999 (even though this period ends in another large growth bubble).

Read the rest of the article here.