Very few things trigger CSC as a collective as the idea of the ‘adjusted’ quarterly/annual performance metric. While it has become very common and an arrow within the quiver of management jargon to adjust performance for supposed “one time” costs, we have found that this perverse alternative reality has spread beyond the typical culprit of Income Statement adjustments into the realm of the truly fantastic: cash flow.

Anyone with even a rudimentary knowledge of GAAP financials statements will tell you that the Cash Flow statement, with its hard rules of measuring actual dollars flowing in the business as opposed to the accounting profits (which can be manipulated thanks to accruals) of an Income Statement, can better elucidate the health of a business. This remains the case, yet a greater number of serial adjusters are now aiming their sights at the hard and fixed world of cash flows with the idea that there exists an almighty adjusted cash flow. The adjusted cash flow springs from their imagination as easily as the Grimm brothers’ tales. Thus, here is the message Cove Street just sent to the great cash flow adjusters named GTT Communications currently located in some of our portfolios:

Dear Brian and Rick:

We have the utmost respect for you when it comes to your operational bent and the immensely successful entity that you have crafted into the current form of GTT. But we are writing to you in regard to a gripe which we’ve shared with you on the phone and in person –that being the continued peddling of “adjusted” versus “real” free cash flow.

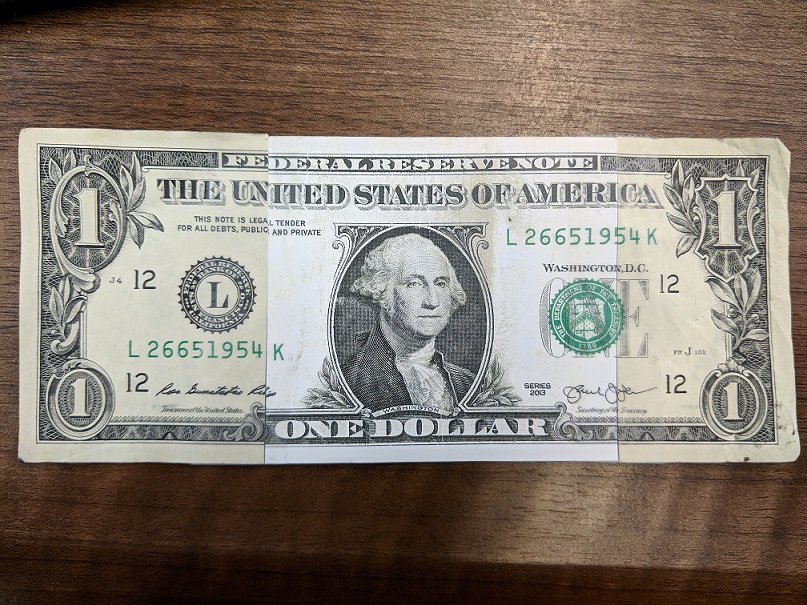

In the investment management business we do not report our returns in an “adjusted” basis regardless of how much we want to adjust out all of our mistakes. If we came to a perspective investor with a presentation listing our adjusted returns we would be thrown out of their offices and reported to the SEC for securities fraud. Adjusted returns are no more real or relevant as are the adjusted free cash flow reported by the Company. We barely accept the usage of “adjusted” numbers up and down the income statement. To suggest that “Free Cash Flow” is adjusted is, once again, complete BS. You either have more or less money in the bank than you did prior to the start of the quarter. Period. We have enclosed a prop to illustrate this point. Let us know how it works in the real world.

Brian bemoans on calls why the investment community gives no credence to the results GTT puts up. Our counter is that the investment community is perfectly aware of your results but they are even more attuned to the notion that “cash is king” and that for your roll up strategy to be legitimate, real un-adjusted cash flows need to start showing up in a meaningful way on your GAAP cash flow statements. Until that time occurs, your stock will continue to trade as a penny stock and a proxy for the risk-on/risk-off leverage trade. This cannot be more fiendishly simple: generate cash, pay down debt, show operational improvement via margin expansion, rinse and repeat. If those steps are accomplished, shareholder returns will follow.

(OUR ENCLOSED ADJUSTED DOLLAR)

The opinions expressed herein and relative to the information provided are those of Cove Street Capital, LLC (CSC) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. Consider the investment objectives, risks and expenses before investing. You should not consider the information in this comparison data as a recommendation to buy or sell any particular security and should not be considered as investment advice of any kind. You should not assume that any of the securities discussed in this report are or will be profitable, or that recommendations we make in the future will be profitable or equal the performance of the securities listed in this letter. Each portfolio’s holdings may vary. please contact Cove street capital if you have any concerns or questions 424-221-5897.

Cove Street Capital requires a modern browser to look and function properly.

Internet Explorer stopped receiving updates in January 2020. Using it may cause display issues on our website, and put your own online security at risk. We highly recommend switching to a secure modern web browser such as Chrome, Edge, Firefox, or Safari.