In the article below, “The Size Factor,” the authors come to the logical conclusion, “small caps are trading at the steepest discount to large caps in decades.” We couldn’t agree more.

We hate to classify people or stocks as “classes,” but clearly the absence of a giant momentum headwind is good for us. We would also note the perceptive counter to this: everything good is being taken private and thus what is left deserves to be left, is a lot less relevant given the storm of IPO’s over the past few years. And we would also note that we do not run an index fund, so we arguably could have “basis risk” to this argument. We could also do a lot better through curation if you are asking. Either way, we remain a long way from mean reversion. Operators are standing by.

The Size Factor

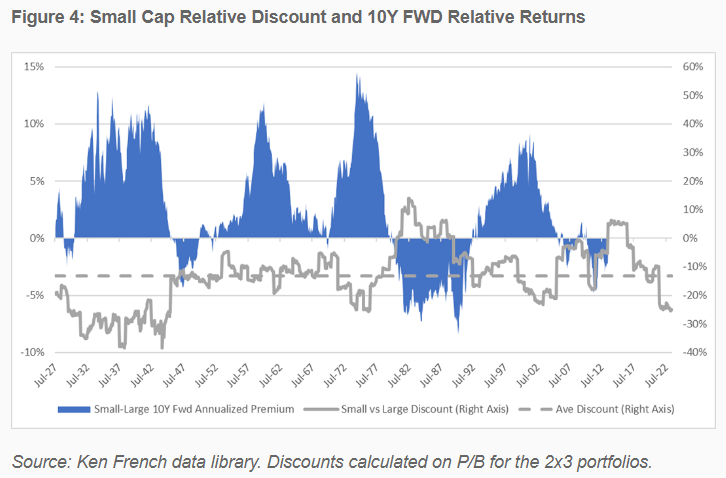

Small caps are trading at the steepest discount to large caps in decades

By: Dan Rasmussen, Brian Chingono, & Nick Schmitt

Over the past 50 years, small-cap stocks have returned, on average, about 2% per year more than large-cap stocks, according to Ken French’s data. The inclusion of the small-cap factor to help better explain stock movements was one of Nobel Prize–winner Eugene Fama’s biggest early breakthroughs.

This higher return, though, came with higher volatility. Over the past 50 years, large-cap stocks have had an annualized monthly volatility of 15% versus 21% for small caps, according to Ken French’s data.

Smaller companies have had higher bankruptcy risk (about 18% higher). They also tend to be more sensitive to economic conditions and, as a result of lower trading liquidity, experience bigger price swings. In theory, investors should be compensated for taking on these incremental risks.

Read the full article here.