Today’s topic is the proxy advisor industry and the real abandonment of responsibility by the investment management/passive management industry despite what nonsense they espouse. My “outrage” was pinged by a simple thing last week.

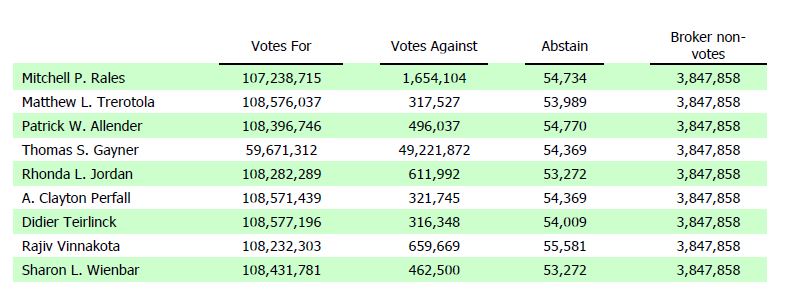

There was an SEC filing by Colfax Corp (ticker: CFX) which displayed the results of the recent Proxy voting for Directors. All Directors received the usual 98% AYE (the logic of which escapes me given awful performance) except for one Tom Gayner, who had nearly a 50% no vote.

Now, I have “known” Tom for 20 years as an investment “acquaintance” in his role as CIO and now co-CEO of Markel Corp. We probably talk once a year. I have met him twice. Point being, he is not my brother -in-law.

My opinions aside, if you do the briefest of scrounging on his history and reputation, you could not produce a more successful and pristine reputation. And both are important. In fact, I would bet his “60th Birthday Roast” would be an impressively sedate affair.

So, why negative 48%? Because he sits on “one board too many” in the eyes of the self-anointed governance police. He sits on his own, two from the split of Washington Post into Graham Holdings and Cable One, and that of the aforementioned Colfax.

The issue is that the proxy advisors arbitrarily submitted a hard rule (two good, three bad) and what is truly scary is that subscribers so OBVIOUSLY blindly follow it without an individual thought about the specific situation. ANYONE who was not taking the ISS/Glass Lewis narcotic and thinking about it for 60 seconds would realize who Tom was, who he is surrounded by and with whom he surrounds himself with on these Boards. Jealousy might be the natural first thought (how do I get to swim in that pool?!), but then you would vote for him.

Any yack that comes from the mouths of Blackrock, State Street, Fidelity, Vanguard and the like on the hundreds of people they have hired to properly engage their fiduciary responsibilities as “owners” of public companies is completely exposed as BS through votes like this. They simply have a nice computer system linked to the custodian and tied to the proxy advisors and their only task is to press ENTER, if they even have to do that.

A simply embarrassing state of affairs.

Cove Street Capital requires a modern browser to look and function properly.

Internet Explorer stopped receiving updates in January 2020. Using it may cause display issues on our website, and put your own online security at risk. We highly recommend switching to a secure modern web browser such as Chrome, Edge, Firefox, or Safari.