From a Mystery Q4 Earnings Call: I would also like to spend some time this morning reiterating and elaborating on XXX capital allocation priorities. First, our

Yes, it is easy to see how “older and crankier” develops when the nouveau twitter gushes over a Buffet aphorism that was seemingly revelatory in…1986?

Stop and Buy This Book: The Counting House by Gary Sernovitz

Liberty Trip filed to both “delist” to the pink sheets and move incorporation from Delaware to Nevada.

Except from IAC’s Q4 earnings call:

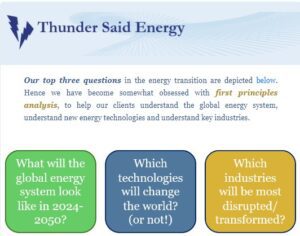

If your goal is to “pay attention to detail” and try to put some meat next to the headline potatoes, then Rob consistently presents logical

Yes, I broke my “Don’t do Podcast” rule from the enlightened height of our own self-interest. And it’s a classic example of the world in

We plucked this from a recent RFP we have seen for Smallcap Investing. First off, all hail the idea that someone is actually allocating money

The coast seems a little clear, Monster Truck Rain excepted. Since I dread writing this time of year from the standpoint of “predictions for any

Almost a year ago to date, financial markets had a mini freeze over some high profile examples of “liquidity issues” in the banking sector. Our

Last week the US Securities and Exchange Commission issued final rules for special purpose acquisition companies (Spacs). IN 2024! Final Rule Special Purpose Acquisition Companies,