Private Credit Update: AI Not Saving the Day

Tricolor, the third-largest used auto retailer in Texas and California, has more than $1 billion in assets and over $1 billion in liabilities, with more

Tricolor, the third-largest used auto retailer in Texas and California, has more than $1 billion in assets and over $1 billion in liabilities, with more

Regulation can be viewed as the Full-Time Employment Act for Lawyers. Some things are complicated both in their nature and the way change can morph

Doomscrolling in financial market journalism and commentary was so “way before” the current cellphone doomscrolling phenomena. And I am sure it was popular on stone

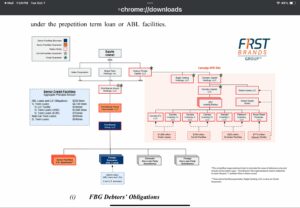

The mind can wander. This is a big corporate bankruptcy, and you haven’t seen many of them, given the sheer tidal wave of dollars that

“Based on analysts’ LinkedIn profiles, we identify a robust negative correlation between the expressive tone conveyed in their self-presentations and forecast accuracy, particularly among male

This has become a recent new, large position. We buried the Lede in our Strategy Letter, so here it is unvarnished for those afraid of

The very long cycle of ridiculousness continues in financial markets as judged by investor behavior in the usual suspects of “meme, crypto, return of the Spacs, credit recycling vs Chapter 11’s, the blind acceptance of Continuation Fund pitches and Washington DC output.”

Process. Interesting. Re-read annually. Deleted half the lists and ideas in the “get to it later” email folder. Reading outside the obvious. Hacking the CSC

Thanks for Re-Tip from the Byrne at the Diff for something I have read periodically since 1983. Translation? The world’s a big place and you cannot

Murray Stahl has been referenced here before. Google away on him and Horizon Kinetics and sit down for some long reads. A great writer he

I lifted this from a recent Financial Times piece. What I will add for the intrepid reader is a longer time horizon. It is correct