We have mostly been in Viasat, albeit with some big trades…for a long time. Click here for a longer narrative on why.

Let’s just say yesterday wasn’t a good day.

There are some events that prove you entirely wrong, regardless of how “off spreadsheet” they are. Was this one of them?

Our investment process embeds a “this is why we will be wrong” line of thinking, known as “the short.” The key variable here has always been, “Viasat will not earn an appropriate return on a huge investment in the VSAT-3 constellation due to a large increase in capacity by the industry at large and a movement toward LEO-based services which offer lower latency and are funded by mega-billionaires with a callous disregard for a lengthy duration of no profitability.”

Any number of investment variables can only be answered with the passage of time. In this case, what we didn’t anticipate is how damn long it would be to test the narrative, as Covid supply chain issues and an industry lack of launch capacity pushed out the hypothesis test 3 years. And with this week’s news, that test has been pushed out..again. So nothing we talk about or discuss changes that because we haven’t proven wrong yet. However as this delay plays out, on a present-value basis, we have wasted a lot of time and time-weighted upside.

So, here is an updated short thesis:

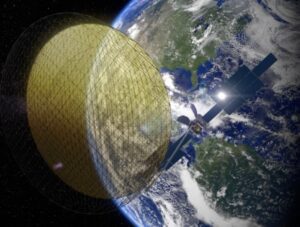

The first satellite of the VSAT-3 constellation is a bust. Let’s not forget that this is the second launch in a row that did not deploy correctly. Who says this technology can work in space? This event is will cause a cascade of future events, including a delay in the launch of the other satellites (potentially losing launch slots), deterioration of relationships with domestic airlines, multi-year delay as it relates to having a global constellation for in-flight connectivity (IFC), panicked selling by the Private Equity firms who got stock in the merger with Inmarsat guys, a hole in the balance sheet caused by the event not being fully insured, which leads to covenant waivers and debt issues. Even if the worst case doesn’t play out, it is likely to take 2+ years to see anything resembling positive free cash flow. We have been totally wrong for years and it is time to move on.

Well, there is a non-zero probability that some of this narrative is true. Our job is to attach probabilities in relation to the current stock price and determine risk/reward from here and ignore what HAS happened. Summing up, if we were analysing this for 5 years with no position, we would be buying the hell out of it today, as bizarrely a new investor would be in the same position today as we were 2 years ago: X hundreds of millions of dollars are sitting in a warehouse not far from our office waiting for launch to generate economics. If our return assumptions are reasonable, you will make a crapload of money from $30 per share. But you will wait.

There is a LOT up in the air now, and there are 3.5 weeks before the earnings call in which the company will define the current situation and update forecasts.

- We assume a complete zero. The situation with the reflector and the satellite as a whole is a work in progress. You can bet that VSAT, Boeing (Ticker: BA), and suspected antenna murderer Northrup are on this 24/7. The antenna is obviously “stuck” and there seems a low probability of a fix.

- The satellite is fully insured…$420m (+/-). That beats a sharp stick in the eye, but delays and fixes clearly move all math out.12 to 24 months. Painful. Oh, and the second satellite is insured under the same terms, which means there isn’t a freakshow re-pricing of insurance. But, it is fair to say ALL satellite insurance is going to go way up.

- Nothing VSAT did – “didn’t work.” There are 12 other satellites in space with exactly the same antenna. “This technology doesn’t work” makes little sense. Oddly, L3 Harris built the VSAT-2 antenna, which also had an issue, killing roughly 20% of that capacity. And they are the contractor on the 3rd satellite in the constellation which is designated for Asia. Yes, launching $450mm satellites has low occurrence, high materiality issues.

- We bitched and moaned at the time of the Inmarsat deal. We argued that management was sucking the life out of a stock move from VSAT-3 being launched and deployed and that capacity being sold. Well, we are glad we have them! The combined business is better positioned to withstand this with scale and the ability to repurpose connectivity capacity to satisfy demand. A year from now marshalling the forces in response would be a lot easier…but if this happened a year ago, we would not have as many options. It also reduced the exposure to the biggest fallout from the satellite failure, the ability to restart growth in US Rural internet. It is 14% of the combined revenue of the company, vs 35% prior to the deal. We have persistently questioned why the investment community equates Viasat to a rural internet provider, vs a global provider of bandwidth capacity that has basically run the table on the industry for a decade.

- The next VSAT-3 satellite is essentially the same as this one, including the antenna. Half that sentence is legitimately scary in theory, as it still is not clear as to exactly what happened and what will happen. The good news is this satellite, plus capacity from Inmarsat, can be redirected to satisfy customer demand, particularly in the IFC space. Yes, there will be compromises, and if you contracted with Viasat to equip 1300 planes and you are only halfway through and promising free in-flight Wifi, you can’t help but be in WTF mode. TBD.

- The next launch is with ULA which is far less crowded than a SpaceX program…so if VSAT wants to keep the schedule for the second bird, it can. There is also less of an issue if Viasat decides to delay as this will actually be the last flight of the legacy ULA rocket. It is fair to note here that the new generation of ULA launch capacity, which Amazon has hung its LEO hat on, has been a complete delayed mess including a big fat test blow-up this week.

- This is a monstrous gift to the LEO world, particularly Starlink, as I am sure their marketing efforts will be touting the “risk” of one big fat satellite vs thousands of smaller ones. To date, customers are not “out” anything. This is an event endured by shareholders. The multi-year delay to date, with more going forward, just provides marketing air cover for the LEO people to sell capacity and service in the absence of VSAT capacity.

- The balance sheet? Not in any way an existential issue, but it is correct to say this pushed out the free cash flow date, and the investment community in general doesn’t like more debt for longer. A dilutive rights offering or secondary at some point? Non-zero probability as we write.

Private equity? They came in through the Inmarsat merger, took $70 stock and have a 180-day lockup into the 4th quarter. We have never failed to be surprised by dumb moves by smart people, but moving pieces around doesn’t change values, it just causes some short-term indigestion. The least of our worries.

In retrospect, one issue we fault ourselves is position sizing. We made this our largest position at $30 and we are back to scratch. Better recognition of the inherent risks in “space stuff?” Yes. We also erroneously employed an experience we had in Avid Technology. We sat for 4 years with a mid-single digit cost as the company’s management change, resolution of accounting issues, and conversion to a SAAS model took..forever. We were 100% correct in our analysis of value, but we frankly were mentally burnt and rejoiced at selling the stock at $10 and $15. It went to $30 as..we were right. So yes, the exact conversation was had in regard to Viasat and we saw the successful “launch” of VSAT-3 as the beginning of a long run of upside. Woulda, coulda, and didn’t sell anything on the 50% move in the first half of 2023.

So, as we speak, we own it in size. There are many ways to be proven foolish in investing and there is very little glory in good process that results in poor outcomes, but in our opinion there simply isn’t an alternative method. Sometimes, you just get it wrong and we have been wrong to date. Proper investment discipline necessitates an analysis from here, and not being captured by the current moment of shame and aggravation, which is..large. Dead money for how long? Value diminution? The work always continues.

In the meantime, despite the seeming lack of air in the room, we have other investments which have solidly contributed to an outperforming year to date. Just less so.