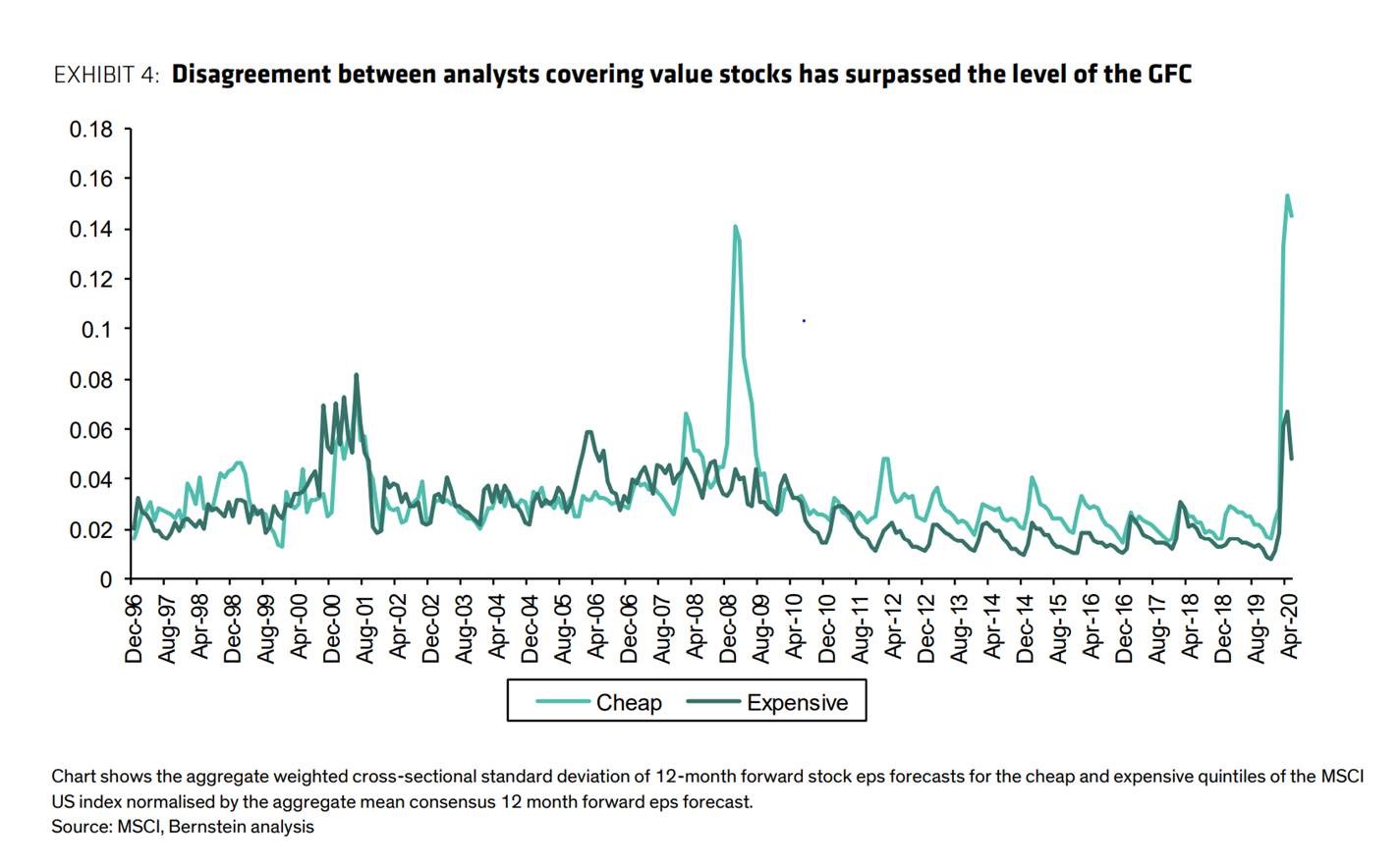

It is almost always a contrary indicator when the sell-side is unanimous, but what happens when they can’t agree at all? In reality, when there is a large dispersion in terms of earnings forecasts among sell-side analysts, it suggests that the market has no idea what earnings and cash flows will look like in the near future. Our history in navigating market cycles has shown us that the more analysts disagree, the higher the likelihood that a security could be undervalued. According to a recent piece from Bernstein entitled Portfolio Strategy: Credit outflows all unwound, and peak disagreement? (see excerpt below), the disagreement surrounding value stocks is now higher than it was even during the Financial Crisis. Therefore, this might be a REALLY interesting time to be a value investor.

Not all stocks face equal amounts of disagreement. We can show that the cheapest stocks have a level of disagreement between analysts which now already exceeds that seen in the global financial crisis, Exhibit 4. The more expensive stocks face a level of increase in disagreement that is not far above their long run average level. An uncertainty on the outlook is at the heart of what it means to be a value stock, so to see a jump in disagreement for value companies such as this is, we think, incrementally more supportive.