The Tower of ESG Babble?

Original article appeared in Harvard Business School’s Working Knowledge What Does an ESG Score Really Say About a Company? 21 JUL 2021|by Kristen Senz A

Original article appeared in Harvard Business School’s Working Knowledge What Does an ESG Score Really Say About a Company? 21 JUL 2021|by Kristen Senz A

This is a “Letter From the Founders” culled from the S-1 of Lemonade (LMND) – a recent IPO we took a shot at a few

It is popular in some circles to suggest that in a passive world, “no one will care about Small Cap stocks and thus a value

Our lead principal and Portfolio Manager Jeffrey Bronchick, CFA was asked to do an interview with Ross Roggensack of Oak City Consulting. Sartorial choices aside,

The following is an excerpt from our Q3 2020 Small Cap Plus letter. If you have ever found yourself struggling to explain why, in the

From Billion Dollar Loser, the new book chronicling the WeWork disaster: As one member of WeWork’s finance team put it: “The nature of private markets

What is the actual float of a company? How many shares are actually tradeable relative to the headline free float share count that major data

As we have noted in this space in the past, “these dudes” have been more than mostly right for a really long time on what

Value Losses Lead $10 Billion Quant Trader AJO Partners to Shut: AJO Partners, a $10 billion quantitative fund manager, will shut by the end of

Musings on Markets: Sounding good or Doing good? A Skeptical Look at ESG.

Most of the time when I am espousing the Cove Street gospel in the podcast realm, the audience consists of a bunch of people with

Never in the history of the world have more people had more access to information. And yet… On My Mind: They Blinded Us From Science

One of the more difficult parts of my job is to essentially say the same thing in novel ways in order to keep clients, listeners,

A very long time ago, the author was the first outside columnist for TheStreet.com, which in its early days had a terrific set of people

So imagine you are on one of those innumerable TV cop shows where apparently if you stick a variety of crime scene photos on a

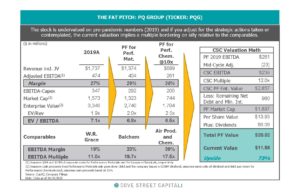

An extraordinarily cogent narrative of why this is our largest position. He almost had us until the Buffett and Graham part. Worth reading twice end

Early in my career, I would saddle up the horse and carriage, go to the office, call a company of interest and ask for them

In a world that loves data and quantification no matter what the source or the possibility of reaching a bewildering machine learned conclusion that makes

This study should either seem obvious and not worth reading past the summary; or it should seem obvious and therefore Elizabeth Warren is the obvious

Swimming against the prevailing investment tide is often fairly difficult. Humans by their nature feel safer in the crowd and standing out from said crowd

From Charlie Ergen’s Q2 SATS Conference Call: “So it’s an interesting time. I think patience — I hope our patience will be rewarded. It hasn’t

Did Lockdown Work? An Economist’s Cross-Country Comparison by Christian Bjornskov

Observation: If something cannot go forever, it won’t. At current performance rates, there will be five stocks comprising 110% of US market cap. That “seems”

SEC Proposes a Significant Change in Reporting by Institutional Investors It is truly amazing how much time and effort and dollars are spent tracking what

Cove Street has received a number of inquiries from both existing and potential clients regarding any changes we have made to our investment process due

Cleary Gottlieb’s Memo released on July 24th: Shareholder Complaints Seek To Hold Directors Liable For Lack of Diversity

Radical Uncertainty: Decision-Making Beyond the Numbers by Mervyn King and John Kay I am fully aware of my ability to convey enthusiasm about seemingly esoteric

More fun summer reading. What is relevant are recent rumblings – promoted by “gee, not sure” – to allow 401K funds to offer Private Equity

While we prefer to spend most of our time on micro analysis, one cannot avoid being dragged into some of the issues of the day.

While we hate to generalize or box our thinking into “styles,” we naturally, self-evidently, and painfully—today—consider ourselves value managers. We have had many conversations in