From the Annals of Unelected Officials Making our World a Better Place

“Servicers who put struggling families first have nothing to fear from our oversight, but we will hold accountable those who cause harm to homeowners and

“Servicers who put struggling families first have nothing to fear from our oversight, but we will hold accountable those who cause harm to homeowners and

There are lots of things that OWNERS should hate about Exxon, all of which are related to their last decade of capital allocation in their

I was recently asked to share a small cap investment idea with the attendees of the Q2 Virtual Summit hosted by the Investor Summit Group.

The IEA is arguably the key source of global energy issues and math. Summarizing: The aspirations of Green grossly underestimate the capacity of the existing

We don’t know these people and we are not vouching for their work or conclusions, but they are holding the right hot poker that is

Cove Street’s PM, Jeffrey Bronchick, has a daughter in Richmond, Virginia, which coincidentally is the home of Markel Corp and their mini-Berkshire style annual meeting.

If there is something upon which anyone in the world can agree, it’s that there is simply an overwhelming amount of “information” out there that

Some of the benefits of investing in private assets instead of public companies have been well documented. As an investor in a private fund, you

The following is an excerpt from Cove Street’s Small Cap PLUS Q1 2021 letter. It represents a totally fictional, certainly not autobiographical, account of what

No, this is not a spinoff of Tim Ferriss’s The 4-Hour Workweek. There are in fact no shortcuts to great investing. Having said that, it is very

This was culled from the first quarterly conference call for Canoo, which needless to say is a SPAC merger that as far as I can

Let’s just say the graveyard is full of those who think they are “bigger” than the market and “markets” exist to be bent to

This relates to a lot of things in the world outside of Wobegon.

This exchange is lifted from the recent DISH earnings call. DISH is attempting an “interesting/controversial/expensive/risky?’ build of a software-defined 5G network. They don’t promote, they

This week, another look at what value investing is and isn’t. Nothing really new here if you are a thinking investor, which means there

I recently had the privilege of appearing as a guest on one of the first episodes of the DealMakers Podcast. The conversation was a bit

An idea came to me recently that what value investing truly needs is a re-branding. Companies often re-brand and re-name themselves after some sort

This was one of the better pieces in a world of fawning financial journalism. Thank you Bloomberg for writing about something that doesn’t involve

From the Every Investor Will Get a Trophy File: Taper Tantrums Ahead? Financial Times January 2021: “The second support to be removed is expected

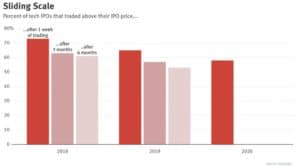

We have always been in the camp of “waves of IPOs are closer to a sign of a market top than a sign of strength

What is the actual float of a company? How many shares are actually tradeable relative to the headline free float share count that major data

Never in the history of the world have more people had more access to information. And yet… On My Mind: They Blinded Us From Science

So imagine you are on one of those innumerable TV cop shows where apparently if you stick a variety of crime scene photos on a

From Charlie Ergen’s Q2 SATS Conference Call: “So it’s an interesting time. I think patience — I hope our patience will be rewarded. It hasn’t

Observation: If something cannot go forever, it won’t. At current performance rates, there will be five stocks comprising 110% of US market cap. That “seems”

Radical Uncertainty: Decision-Making Beyond the Numbers by Mervyn King and John Kay I am fully aware of my ability to convey enthusiasm about seemingly esoteric

While we prefer to spend most of our time on micro analysis, one cannot avoid being dragged into some of the issues of the day.

Epidemic forecasting has a dubious track-record, and its failures became more prominent with COVID-19. Poor data input, wrong modeling assumptions, high sensitivity of estimates, lack

This is emblematic of Dumb Money — courtesy of people who are Smart Sellers: Lemonade IPO

It is almost always a contrary indicator when the sell-side is unanimous, but what happens when they can’t agree at all? In reality, when there