The Difference between an Owner and a Government Employee. Or Consultant. Or General Busybody.

While this is “old” it ties neatly into our previous post on “So What do you Want as a Board Member” from the Berkshire Hathaway

While this is “old” it ties neatly into our previous post on “So What do you Want as a Board Member” from the Berkshire Hathaway

This is a really bad idea that is wrought with constitutional issues, among other things. And does ANYONE really want to check a box on

You know you have made it as an investment manager when someone is willing to create a sketch of you to attach to an interview!

As part of our continuing series of “buy the heck out of it and tell everyone else in the world”, with the additional caveat of

The New Yorker has become almost unreadable for certain political and woke reasons, but from time to time, there is actually a focus on old

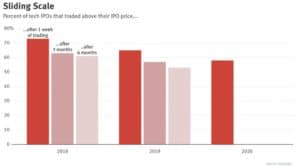

We have always been in the camp of “waves of IPOs are closer to a sign of a market top than a sign of strength

This is a “Letter From the Founders” culled from the S-1 of Lemonade (LMND) – a recent IPO we took a shot at a few

Our lead principal and Portfolio Manager Jeffrey Bronchick, CFA was asked to do an interview with Ross Roggensack of Oak City Consulting. Sartorial choices aside,

What is the actual float of a company? How many shares are actually tradeable relative to the headline free float share count that major data

Musings on Markets: Sounding good or Doing good? A Skeptical Look at ESG.

SEPTEMBER 2020 — It would be correct to say that a number of us have had a little more “alone” time on our hands over

Most of the time when I am espousing the Cove Street gospel in the podcast realm, the audience consists of a bunch of people with

A very long time ago, the author was the first outside columnist for TheStreet.com, which in its early days had a terrific set of people

So imagine you are on one of those innumerable TV cop shows where apparently if you stick a variety of crime scene photos on a

Early in my career, I would saddle up the horse and carriage, go to the office, call a company of interest and ask for them

In a world that loves data and quantification no matter what the source or the possibility of reaching a bewildering machine learned conclusion that makes

This study should either seem obvious and not worth reading past the summary; or it should seem obvious and therefore Elizabeth Warren is the obvious

From Charlie Ergen’s Q2 SATS Conference Call: “So it’s an interesting time. I think patience — I hope our patience will be rewarded. It hasn’t

Did Lockdown Work? An Economist’s Cross-Country Comparison by Christian Bjornskov

Observation: If something cannot go forever, it won’t. At current performance rates, there will be five stocks comprising 110% of US market cap. That “seems”

Cove Street has received a number of inquiries from both existing and potential clients regarding any changes we have made to our investment process due

Cleary Gottlieb’s Memo released on July 24th: Shareholder Complaints Seek To Hold Directors Liable For Lack of Diversity

Radical Uncertainty: Decision-Making Beyond the Numbers by Mervyn King and John Kay I am fully aware of my ability to convey enthusiasm about seemingly esoteric

More fun summer reading. What is relevant are recent rumblings – promoted by “gee, not sure” – to allow 401K funds to offer Private Equity

While we prefer to spend most of our time on micro analysis, one cannot avoid being dragged into some of the issues of the day.

While we hate to generalize or box our thinking into “styles,” we naturally, self-evidently, and painfully—today—consider ourselves value managers. We have had many conversations in

Epidemic forecasting has a dubious track-record, and its failures became more prominent with COVID-19. Poor data input, wrong modeling assumptions, high sensitivity of estimates, lack

I recently had the opportunity to discuss Cove Street’s investment process and a few individual securities in an interview with Hidden Value Stocks. Specifically, in

As Beijing moves swiftly to increase control over Hong Kong citizens this week, the Wall Street Journal warns that their actions highlight a broader ambition

This is emblematic of Dumb Money — courtesy of people who are Smart Sellers: Lemonade IPO