Stealing with You or Stealing from You?

I would think the general institutional investor that is in Private Equity funds understands that they are buying into a pool of investments, each of

I would think the general institutional investor that is in Private Equity funds understands that they are buying into a pool of investments, each of

The world turns. New people are born and eventually move off the couch and into something resembling employment. And thus new generations of nonsense about

From Bloomberg article Rogers Wins as Court Blasts ‘Unreasonable’ Antitrust Czar August 30th, 2023 (Bloomberg) — A court ordered Canada’s competition body to pay millions

It is no secret that a cadre of mega cap tech stocks have had a spectacular run so far in 2023. And while the “Magnificent

From Berkshire Annual Meeting 2023: What gives you opportunities is other people doing dumb things. And it’s — and I would say that — well,

From industry rag FundFire: Janus Henderson CEO Ali Dibadj is making no secret of his goal to buy private credit capabilities, saying in an earnings

Less stocks, less trimming, less taxes. Less indexation? Not really, as one of these mega-winners finds you rather than vice versa. The other practical issue

I will categorically deny that I have ever hired anyone for the simple reason that I did not want take a turn at voting CSC

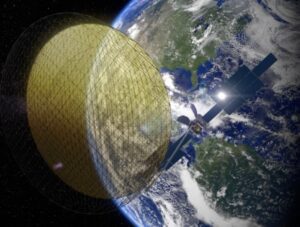

Yet Another Value Podcast: Jeff Bronchick and Andrew Leaf talk $ECVT Ecovyst+ $VSAT Update

There are some events that prove you entirely wrong, regardless of how “off spreadsheet” they are. Was this one of them?

From time to time, there are some decent questions raised about investing that emanate from the academic world of investment research. You should always dig

As the designated proxy analyst this spring, I had the recent pleasure of pouring over nearly 100 proxies – between both companies we do and

Click the image to download a PDF version. We return after a slightly longer than usual gap between writings as…we were busy. Yes, it is

Clipped from a recent and almost always good The Diff/Bryne Hobart blog: First, there are some traits good investors need that are fairly stable over

When poor governance and shareholder idiocy happens and we do or say nothing, isn’t that lying down in front of a misattribution of Sir Edmund

This “may” be a version of me admitting in 2023 that cat videos exist and are very cute, but since it is a long essay

You can run your PA as you see fit. We would suggest this is your second largest position as is ours. This recent presentation does

Yes, that is the Principal at the far end as the moderator for an investment panel at the Markel Annual Meeting (Yes – please come

There is a relatively new top 5 Position. What is the value of the privately held portfolio? We paid for zero. The future remains uncertain

Verdad Research puts forth these boxes. It sums up to old school CFA stuff: you tend to get paid well in statistically cheap and you

This is from an X shareholder in CNX Resources we mentioned in a previous blog. “I was recently reading or listening to something – I

Get sucked into this “crazy” mentality which works for every industry but oil and gas. Own assets near the largest “users” of natural gas in

WB is running around Japan meeting his “Big 5” Japanese investments and raising nearly free capital to fund it, which is another neat way of

We were not remotely involved in this as an FYI. But if we were simply repaid for every dollar lost in a situation where it

Said another way – bank blow-ups are garden variety stupid. The collective “we” rarely change. Said at least one other way, Man is a deterministic

We have written numerous times about the degradation of what constitutes “earnings.” We are talking decades. But excluding compensation issued via stock vs cash is

…if you are thinking about spending literally trillions of dollars on a new policy imperative. A Recent conference clip from Seifollah Ghasemi, Chairman, President &

Our experience says no. This is math behind it.