The 2035 New York Rangers of Finance?

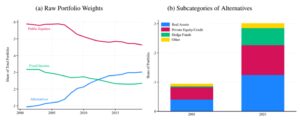

Cliff Asness of AQR Continues to Write From the FU Money Standpoint for Our Benefit Private Equity Public equity performance hurt, particularly in the U.S.

Cliff Asness of AQR Continues to Write From the FU Money Standpoint for Our Benefit Private Equity Public equity performance hurt, particularly in the U.S.

At the 2018 Berkshire Annual Meeting, Buffett noted that “multiple times in my life, people have felt the country was more divided than ever….and after

On Friday after the close, ISSC filed an 8-K giving the CEO of a $134mm market cap company a stock package that could have been

Yes, you are the CFO of a public company in the Great Era of Degradation in the quality of reported earnings. And yes, because “all

“Buy these X stocks because Y will be elected.” Using the KBW Regional Banking Index (KRX), there was a 20% gain in Q4 2016 on

We own this with roughly a $12 cost basis. We have always liked smallcap aerospace and defense. They can have oddball, profitable niches in an

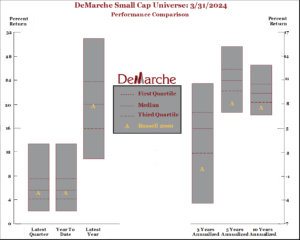

If a Soft Landing Is in the Cards, Why Aren’t Small-Cap Stocks Rallying?

From WSJ.com Wall Street Races to Bring Private Credit to the Masses Investing titans are jostling to launch funds made up of hard-to-trade private loans

We have referenced Byrne Hobart’s The Diff newsletter any number of times as well worth reading. He thinks and writes as well as anything I

FTI Consulting August 2024 Newsletter Given the explosive growth of leveraged credit markets over the last decade, the ascendance of private credit, the extreme lengths

This gentleman does interesting work which can be summarized as follows: Most equity investments are not good: the “mean” for equity investments is much higher

Securities can go down as well as up. Over-owned and hyped securities will be pummeled more. The world in which we live is heavily indexed

this makes CNBC and Bloomberg out to have the credibility of BBC reporting on Gaza.

As a follow-up to this and this blog post, I received this 9 times today in my inbox. I can tell you one thing with

As a follow-up to partner Austin Farris’s recent piece on our blog regarding small-cap index performance, we present weird scenes inside the stock market goldmine in July.

I don’t know the Verdad people, but they tend to lean toward what we are thinking, so they are obviously smart and worldly people who

Why does the SEC want this? Who really wants it? “Only 4 hours of work” is BS. Another reason to run concentrated portfolios.

Private market assets under management totalled $13.1tn on June 30 last year, having grown at nearly 20 per cent a year since 2018. Most of

It is no secret that the Russell 2000 contains some crappy companies – some 40% of the R2000 constituents are unprofitable. This is a common

“I am open to the idea that the market is getting less efficient and that this has something to do with indexing. But if so,

I have clocked a lot of Smil on different topics. Thoughtful and obvious math on the carbon world. This is not political, it’s reality.

We do keep an eye out on all things roaming around the world, although a lot of them don’t turn up in portfolios. That said,

It might simply be wrong to infer any “corporate conduct” hurdles from someone who was simply born to be the grandson of Warren Buffet’s sister,

This is subtly very interesting when attempting to understand just how screwed up our healthcare system is. Investment and policy relevant. Like the Middle East

We will credit the Financial Times for this tidbit. Let’s assume a Chairman with a Forbes estimate of net worth north of $4 billion works

In a March 8th interview in the FT (which is behind the paywall, so I will summarize), Cliff Asness of AQR continues to lead the charge for why seven stocks won’t rule the world forever. And a few other non-original thoughts that are still worth repeating.

Even if one assumes this makes any sense, it will take a really long time to kill off the carbon transportation business.(Cars and Trucks) The

We “usually” hate corporate governance structures where there is unequal voting rights accorded to different share classes. And we are wary of “control” situations where